Pennsylvania Claim For Exemption (19.4 KiB) is a form that can be used by residents of Pennsylvania to exempt themselves from certain taxes and payments. This form is used to claim exemptions from state personal income taxes, resident property taxes, and certain other taxes and fees. It can also be used to claim credits for contributions made to the Pennsylvania State Treasury, such as the Earned Income Tax Credit (ETC). The form includes sections to provide information such as the taxpayer's name, address, Social Security number, and income. There are two types of Pennsylvania Claim For Exemption (19.4 KiB): the standard claim and the direct deposit claim. The standard claim is the most common and is used to claim exemptions from state personal income taxes, resident property taxes, and certain other taxes and fees. The direct deposit claim is used to claim credits for contributions made to the Pennsylvania State Treasury, such as the Earned Income Tax Credit (ETC).

Pennsylvania Claim For Exemption (19.4 KiB)

Description

How to fill out Pennsylvania Claim For Exemption (19.4 KiB)?

US Legal Forms is the most straightforward and affordable way to find appropriate legal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with national and local laws - just like your Pennsylvania Claim For Exemption (19.4 KiB).

Obtaining your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Pennsylvania Claim For Exemption (19.4 KiB) if you are using US Legal Forms for the first time:

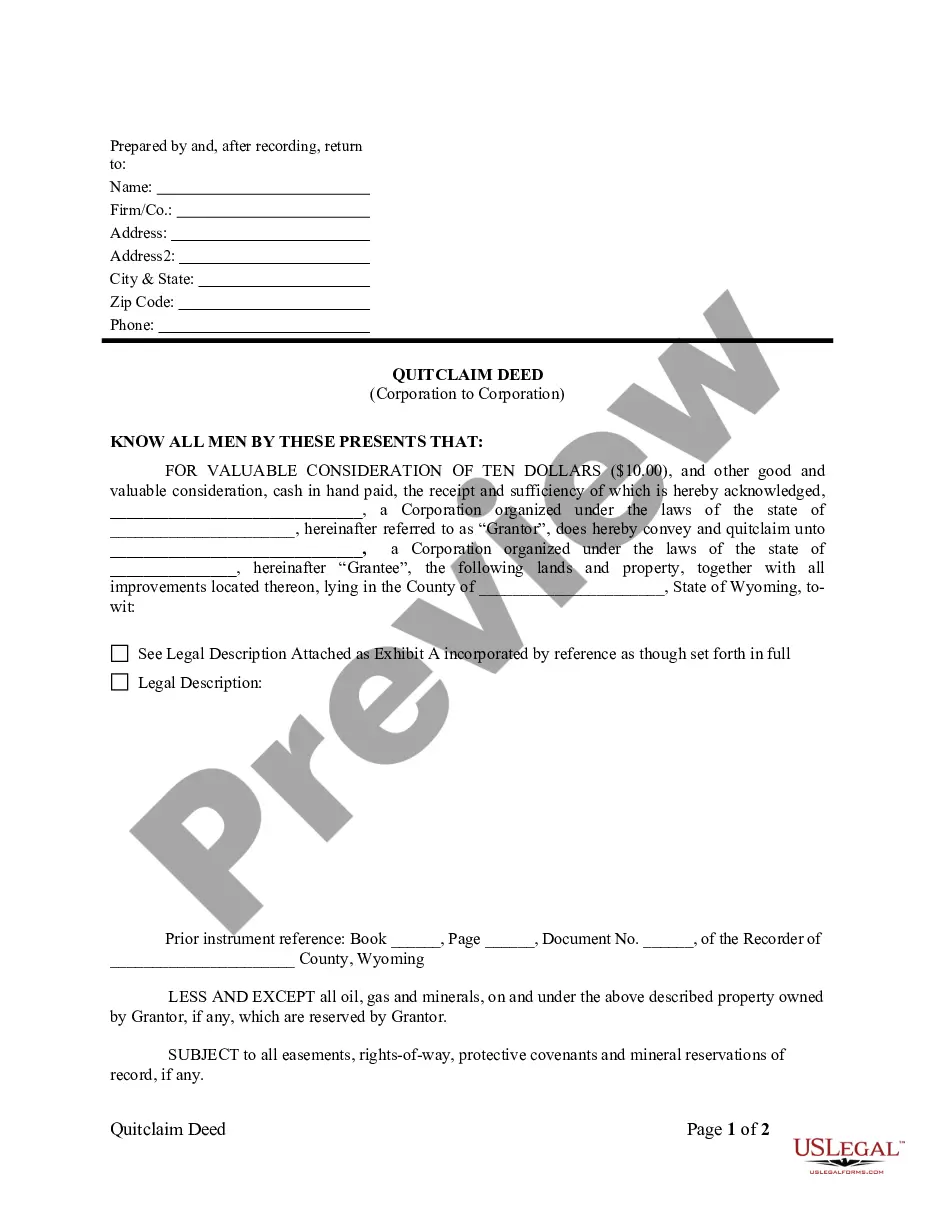

- Look at the form description or preview the document to make certain you’ve found the one meeting your needs, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Pennsylvania Claim For Exemption (19.4 KiB) and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your reliable assistant in obtaining the required formal documentation. Give it a try!

Form popularity

FAQ

There is a long and detailed list of items that are not taxable, but generally, the following are tax exempt: Food for human consumption. Manufacturing machinery. Raw materials for manufacturing. Utilities and fuel used in manufacturing. Medical devices and services.

Rule 506 provides an exemption from federal and state registration for sales of unlimited amounts of securities to ? accredited investors? (e.g., individuals with net worth of at least $1 million or annual income of $200,000-excluding one's primary residence), and no more than 35 non-accredited, but sophisticated

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

You may register for a Sales Tax License online at .pa100.state.pa.us or you can order a Combines Enterprise Registration Application from our forms ordering service by dialing toll-free, 24 hours a day, 1-800-362-2050.

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood. The Pennsylvania sales tax rate is 6 percent.

Pennsylvania. Pennsylvania tax on clothing tax are fairly generous. The state exempts all clothing sales from sales tax except for formal wear, sporting equipment, and anything made with or in imitation of fur.

¶60-590, Occasional Sales, Including Mergers An exemption applies to isolated sales of tangible personal property or services by a person who is not a vendor, or who is a vendor but is not a vendor with respect to the tangible personal property or services sold.

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood. The Pennsylvania sales tax rate is 6 percent.