The Pennsylvania First-Time-Homebuyer-Assistance-Program (234.7 KiB) is a program designed to help first-time homebuyers in the state of Pennsylvania purchase a new home. The program provides financial assistance in the form of grants, loans, and down payment assistance to eligible applicants. The program is open to all first-time homebuyers who meet the eligibility requirements, regardless of their income or credit score. The program offers three types of assistance: grants, loans, and down payment assistance. Grants are awarded on a competitive basis and can be used for closing costs, down payment assistance, and other expenses associated with the home purchase. Loans are available in low-interest rates and deferred repayment options. Down payment assistance is available as a lump sum or a deferred loan. In addition to financial assistance, the program also provides education and counseling services to help first-time homebuyers understand the home buying process and make informed decisions. The program also offers educational seminars and homebuyer workshops to help first-time homebuyers understand their options. The Pennsylvania First-Time-Homebuyer-Assistance-Program (234.7 KiB) is administered by the Pennsylvania Housing Finance Agency.

Pennsylvania First-Time-Homebuyer-Assistance-Program (234.7 KiB)

Description

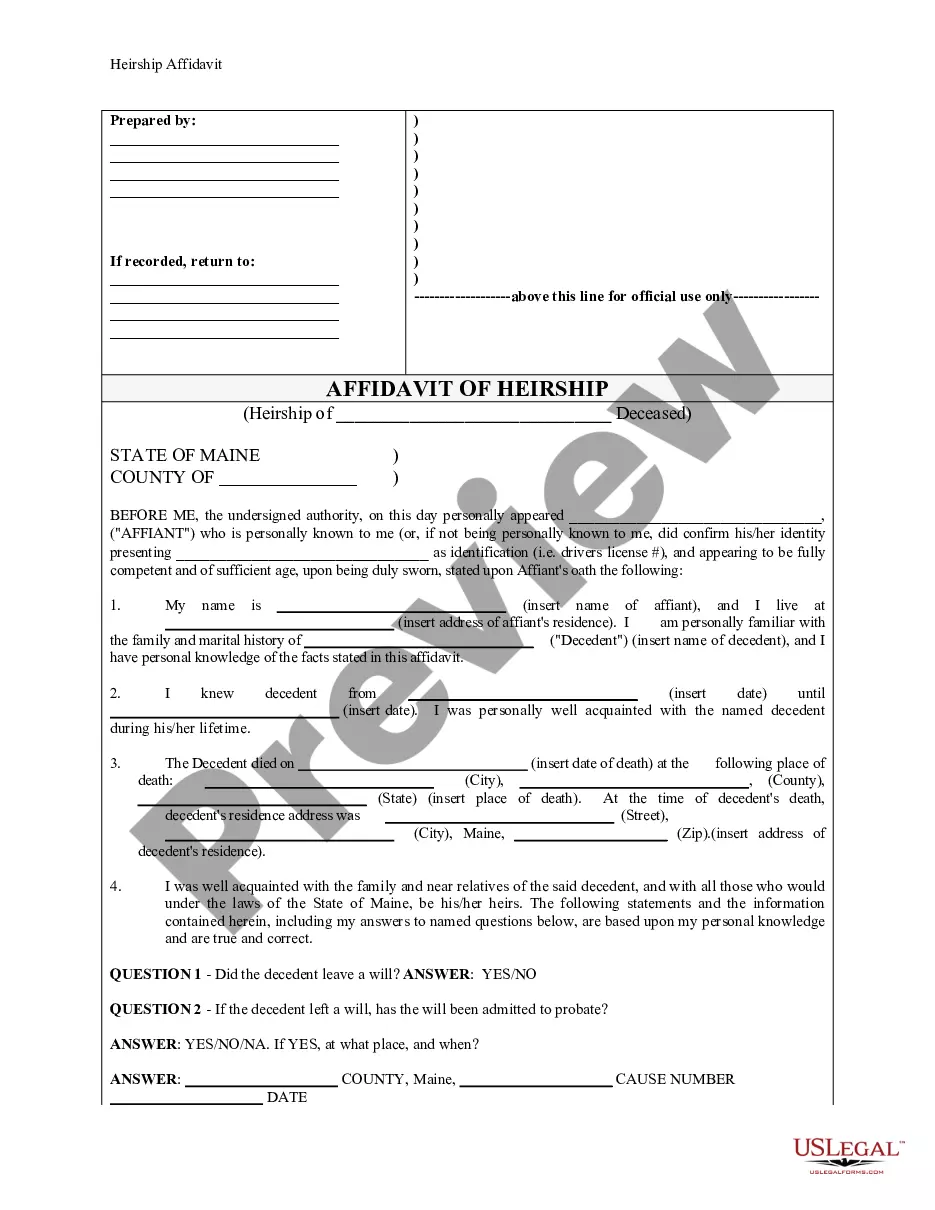

How to fill out Pennsylvania First-Time-Homebuyer-Assistance-Program (234.7 KiB)?

US Legal Forms is the most straightforward and profitable way to find suitable legal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and checked by legal professionals. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your Pennsylvania First-Time-Homebuyer-Assistance-Program (234.7 KiB).

Obtaining your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Pennsylvania First-Time-Homebuyer-Assistance-Program (234.7 KiB) if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one meeting your needs, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you prefer most.

- Create an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your Pennsylvania First-Time-Homebuyer-Assistance-Program (234.7 KiB) and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more proficiently.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the required formal paperwork. Give it a try!

Form popularity

FAQ

The City of Philadelphia's Division of Housing and Community Development (DHCD) supports the City of Philadelphia's Philly First Home program. This program offers a home buyer assistance grant of up to $10,000 (or 6% of the purchase price, whichever is less) to help first-time home buyers.

Often, a down payment for a home is expressed as a percentage of the purchase price. As an example, for a $250,000 home, a down payment of 3.5% is $8,750, while 20% is $50,000.

To be considered a first-time home buyer, you must not have owned your primary residence during the past three years. Veterans or buyers in certain target counties don't have to meet first-time home buyer restrictions to take advantage of PHFA programs.

What income is required for a 400k mortgage? To afford a $400,000 house, borrowers need $55,600 in cash to put 10 percent down. With a 30-year mortgage, your monthly income should be at least $8200 and your monthly payments on existing debt should not exceed $981. (This is an estimated example.)

FHA loans require as little as 3.5 percent, and VA loans and USDA loans have no down payment requirement at all.

The Downpayment Toward Equity Act provides eligible first-time home buyers up to $25,000 cash for down payment on a home, closing costs on a mortgage, interest rate reductions via discount points, and other home purchase expenses. As of June 1, 2023, the program requires that home buyers: Be a first-time home buyer.

PA home buyer stats ?Minimum? down payment assumes 3% down on a conventional mortgage with a minimum credit score of 620. If you're eligible for a VA loan (backed by the Department of Veterans Affairs) or a USDA loan (backed by the U.S. Department of Agriculture), you may not need any down payment at all.

While requirements vary between programs, you'll need at least a 620 credit score to qualify for most statewide programs and at least $1,000 of your own funds towards a down payment. (Please note that exceptions apply.) In addition, income and purchase price restrictions apply for some programs.