Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state regulations and are examined by our experts. So if you need to prepare Pennsylvania 2009-2016-Repository-Property-List (3.6 MiB), our service is the perfect place to download it.

Obtaining your Pennsylvania 2009-2016-Repository-Property-List (3.6 MiB) from our catalog is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they locate the correct template. Later, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a brief guideline for you:

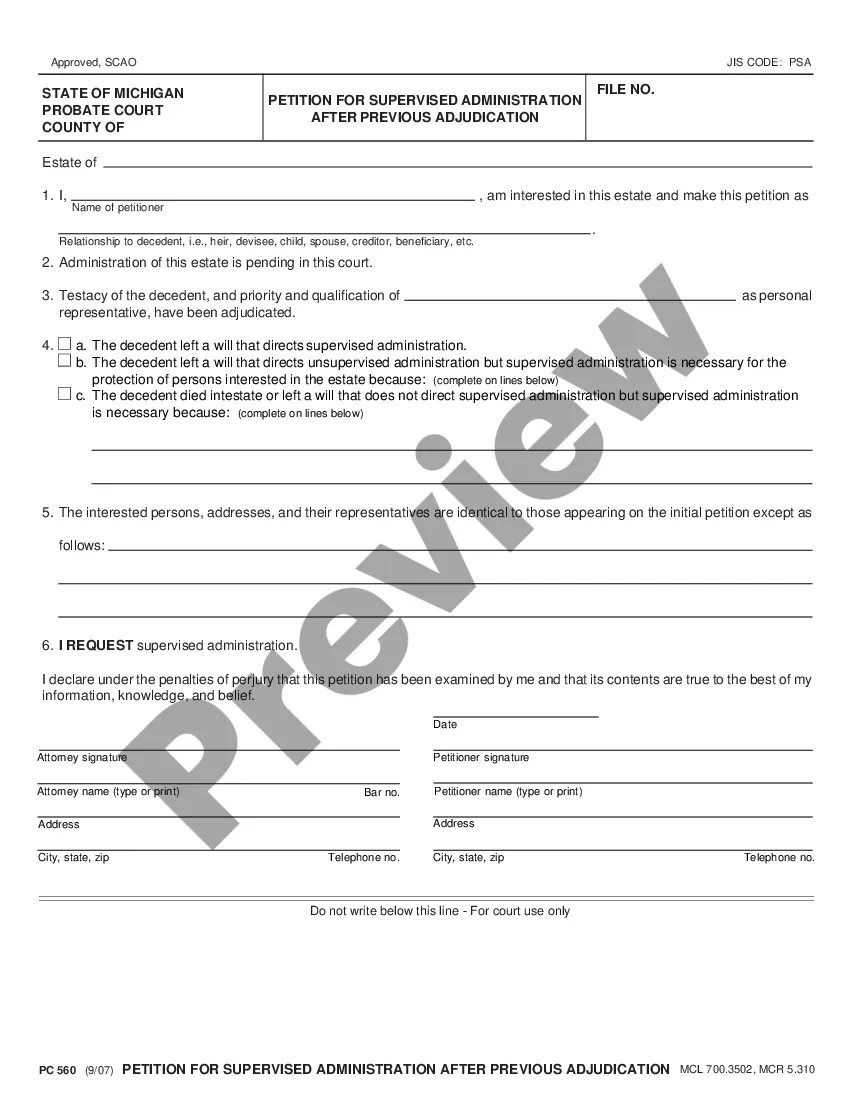

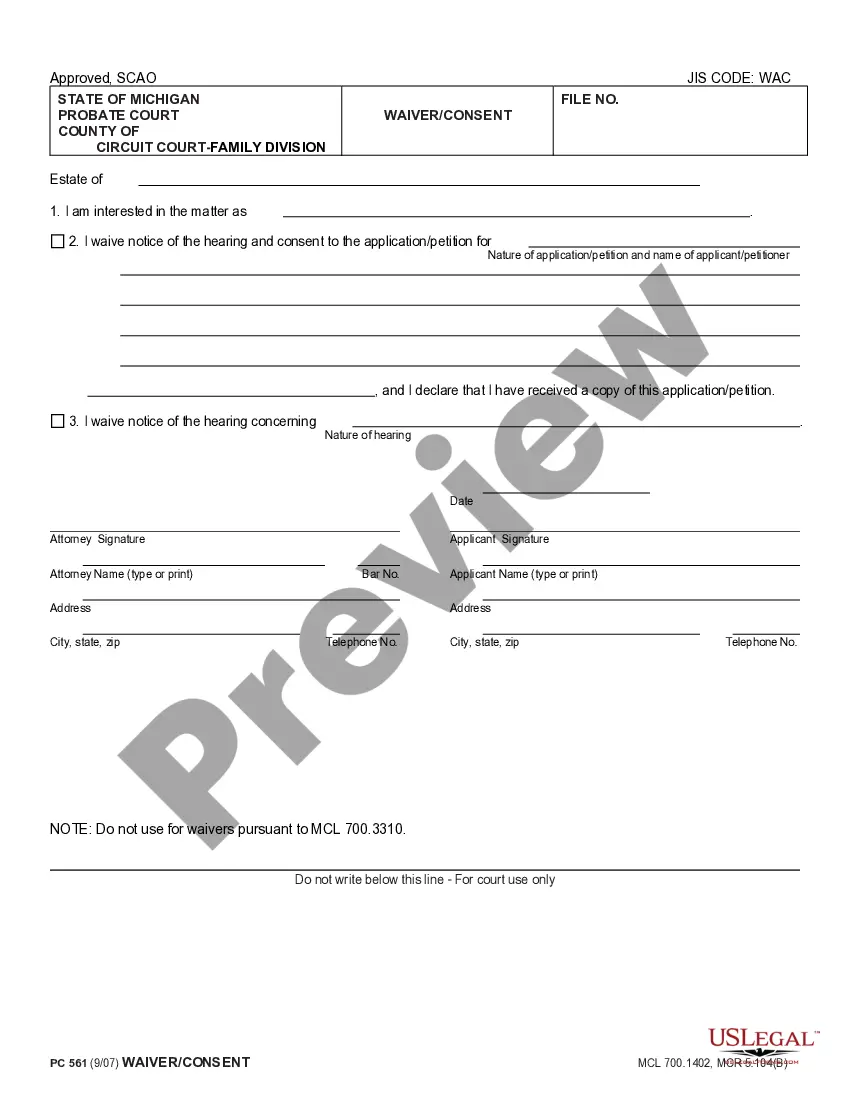

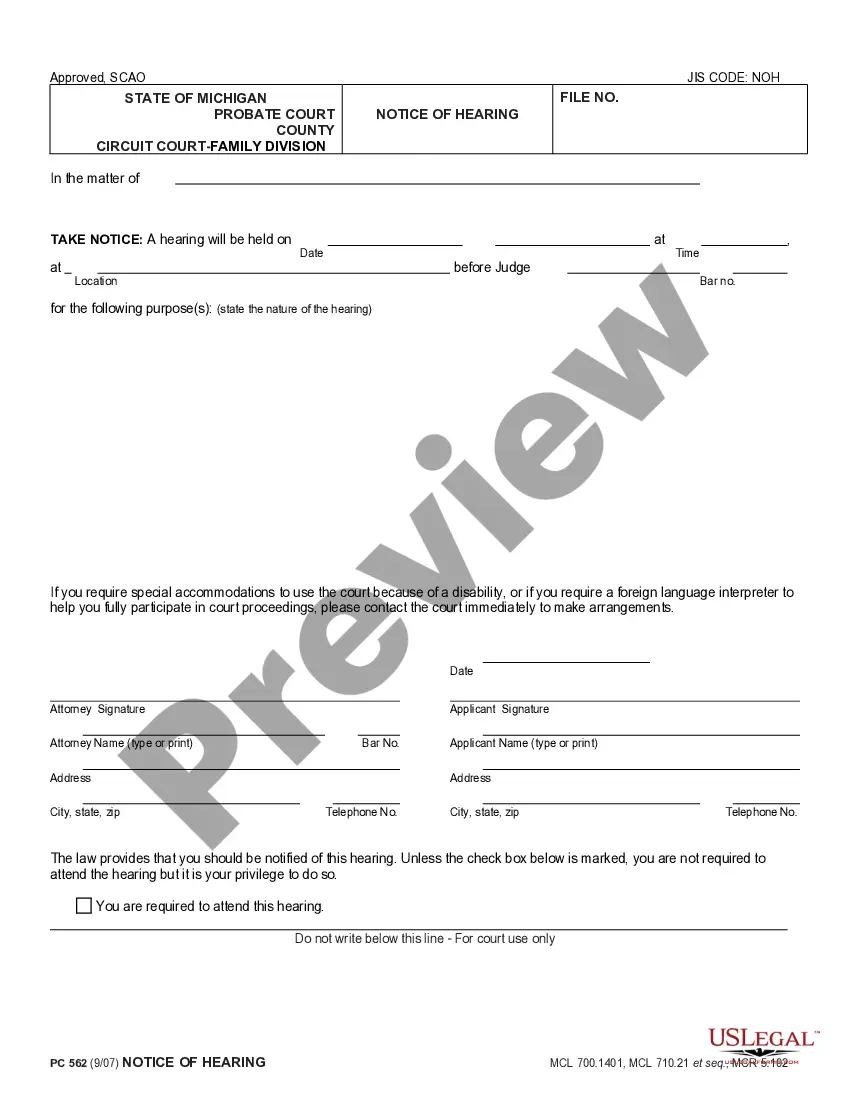

- Document compliance verification. You should carefully review the content of the form you want and ensure whether it suits your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now once you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Pennsylvania 2009-2016-Repository-Property-List (3.6 MiB) and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any formal document quickly and easily any time you need to, and keep your paperwork in order!

This is a free and clear sale. A deed is prepared once consent is received.The Repository is a list of properties that have been presented at the Northampton County Upset Sale and Judicial Sale, but remain unsold. Repository properties are sold free and clear of all tax and municipal claims, mortgages, liens except ground rents and possibly IRS Liens, if any. The application submission period is April 19, 2023-June 19, 2023. Only liens for property taxes and charges were sold; water and sewer liens were not included. 2021 Lien Sale Final Lists. If your property is on this list it has been foreclosed without further right of redemption. Foreclosed Unoccupied Structures and Vacant Lots.