Pennsylvania Renunciation is the process of legally giving up the right to be a resident of the commonwealth of Pennsylvania. This action is taken by persons who are moving away from Pennsylvania, or changing their residency to another state. There are two types of Pennsylvania Renunciation: voluntary and involuntary. Voluntary Renunciation is an individual's conscious decision to no longer be a resident of the state. This is done by filing Form REV-1630 with the Department of Revenue. This action should be taken before the individual moves away from the state, so that their status as a resident of Pennsylvania is clear and the individual is not subject to state income taxes. Involuntary Renunciation is when an individual is disqualified from being a resident of the state due to their physical absence from the state. This can happen if the individual is out of the state for more than 183 days in a year, or if the individual has declared another state as their domicile. In this case, the individual does not need to file any paperwork to be considered a non-resident of Pennsylvania.

Pennsylvania Renunciation

Description

How to fill out Pennsylvania Renunciation?

If you’re looking for a way to appropriately prepare the Pennsylvania Renunciation without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every individual and business scenario. Every piece of paperwork you find on our online service is created in accordance with federal and state regulations, so you can be sure that your documents are in order.

Follow these simple instructions on how to acquire the ready-to-use Pennsylvania Renunciation:

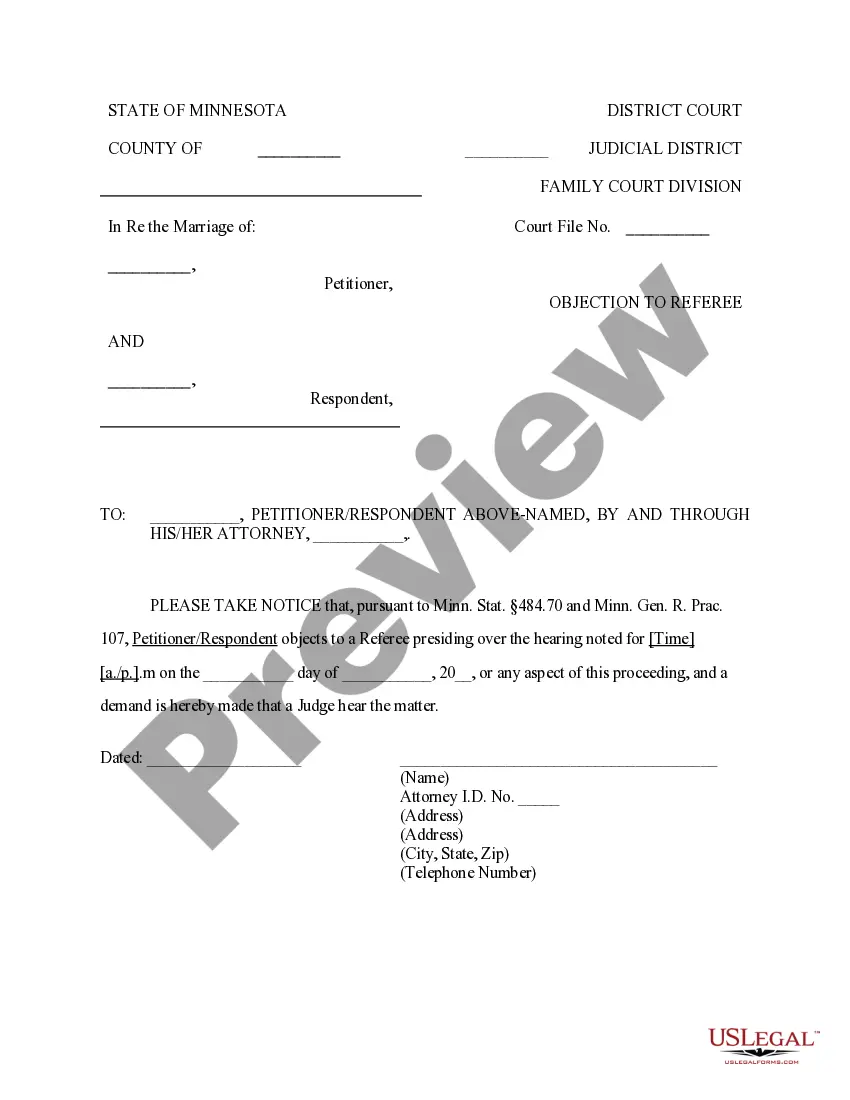

- Ensure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the dropdown to find an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Pennsylvania Renunciation and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

A Family Settlement Agreement is often the easiest way to close an estate in PA because it does not involve any judicial proceedings. If all of the heirs and administrators of the estate agree, a contract can be prepared detailing all of the distributions and payments that have been made.

The purpose of the renunciation form is to defer the right to serve as the estate administrator to another person. If the heirs to a decedent's estate cannot agree who will serve as the administrator, then a petition must be filed with the Register of Wills.

Settling an uncontested estate takes anywhere from 9 months to 18 months. However, property can often be transferred before the probate process is fully complete.

You need to file a document with the Register of Wills called a ?Renunciation? (Form 3). That basically means you are turning down the job of executor. The contingent executor named in the will takes over at this point. What must I do if I am named executor?

A Pennsylvania estate is ready to close once all of the assets have been marshalled, after the inventory has been approved, after appraisement of the inheritance tax return, and after satisfaction or resolution of the outstanding claims and liabilities of the estate.

Pennsylvania Probate Fee Schedule ? Attorney Fees For Estate Settlement In PA Value of Estate% of EstateFee$0.01 to $25,000.007%$1,750.00$25,000.01 to $50,000.006%$1,500.00$50,000.01 to $100,000.005%$2,500.00$100,000.01 to $200,000.004%$4,000.005 more rows

The process of settling an estate involves naming a personal representative, collecting estate assets, filling appropriate forms with the Register of Wills, notifying heirs, providing a public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the laws of

If a friend or family member has passed without a will, their estate still needs to be handled through probate. Instead of deciding how their estate will pass to their heirs by looking at their last will and testament, Pennsylvania's ?intestacy statute? governs how their money and assets will be dispersed instead.