The Pennsylvania Claim For Exemption is a form for individuals who want to claim an exemption from certain taxes in Pennsylvania. This form is used to declare an exemption from taxes on certain types of income, such as Social Security, pensions, military service pay, or certain federal income tax refunds. It may also be used to claim an exemption from the Philadelphia Wage Tax or the Local Services Tax. There are two types of Pennsylvania Claim For Exemption. The first type is a Long-Term Claim for Exemption, which must be submitted every year to remain in effect. This form must be completed and sent to the Department of Revenue by April 15th each year. The second type is a Short-Term Claim for Exemption, which can be submitted to the Department of Revenue at any time during the tax year. This form must include supporting documentation and is usually valid for one year.

Pennsylvania Claim For Exemption

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Pennsylvania Claim For Exemption?

If you’re searching for a way to properly prepare the Pennsylvania Claim For Exemption without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business situation. Every piece of paperwork you find on our online service is created in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Adhere to these straightforward guidelines on how to acquire the ready-to-use Pennsylvania Claim For Exemption:

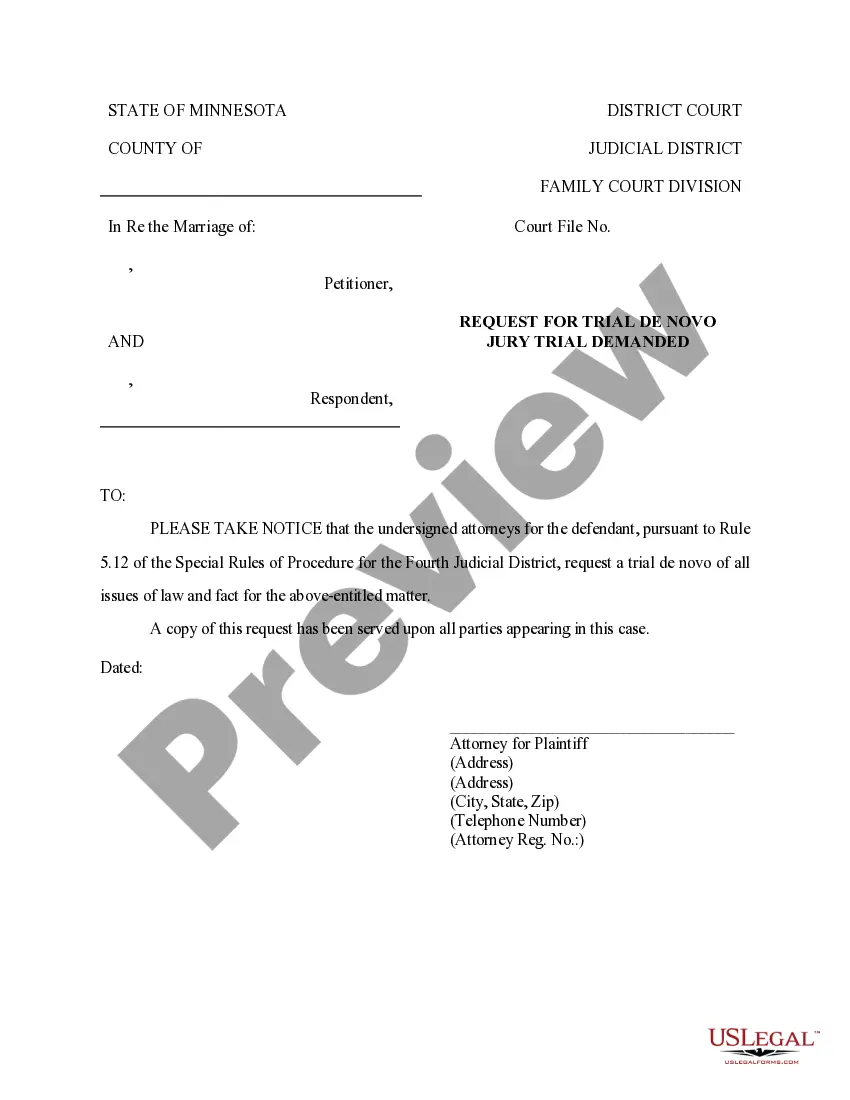

- Make sure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and select your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Pennsylvania Claim For Exemption and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

What happens if a defendant does not pay a judgement? A creditor can enforce the judgement and use state laws to seize assets in the hands of the debtor or third parties to collect the amount owed.

The writ authorizes the sheriff's office to take certain action to collect the monies against the debtor. When you file a writ of execution you are then directing the sheriff to take some additional action concerning the judgment. This can apply significant pressure for the debtor to pay.

Once granted, a Writ of Execution is good for 90 days.

In Pennsylvania most retirement accounts are protected from creditors. As with any legal question, it is important to have an experienced attorney evaluate your retirement assets to ensure they are protected. Generally Pensions, annuities, 401k and 403b accounts are protected from creditors.

Stopping the Writ of Execution The most effective way to stop a writ of execution is to ask the Judgment Creditor to stop it. The sheriff will often back off if the parties are working to resolve the judgment.

Simply put, the Motion to Stay the Writ of Possession is a document filed with the court asking the judge to ?stay? or ?stop? the sheriff from executing the Writ of Possession and removing the resident. It can be a typed or handwritten document filed by the resident or the resident's attorney if one is retained.

Pennsylvania exempts from execution on judgment on a contract all wearing apparel of the debtor and his family, bibles and school books in use in the family, as well as $300 worth of any property owned or in pos- session of the debtor.

If a judgment debtor has paid in full, settled, or otherwise complied with a judgment rendered in a magisterial district court, anyone interested in the judgment may request the entry of satisfaction of the judgment by filing a written request in the office of the magisterial district judge who rendered the judgment.