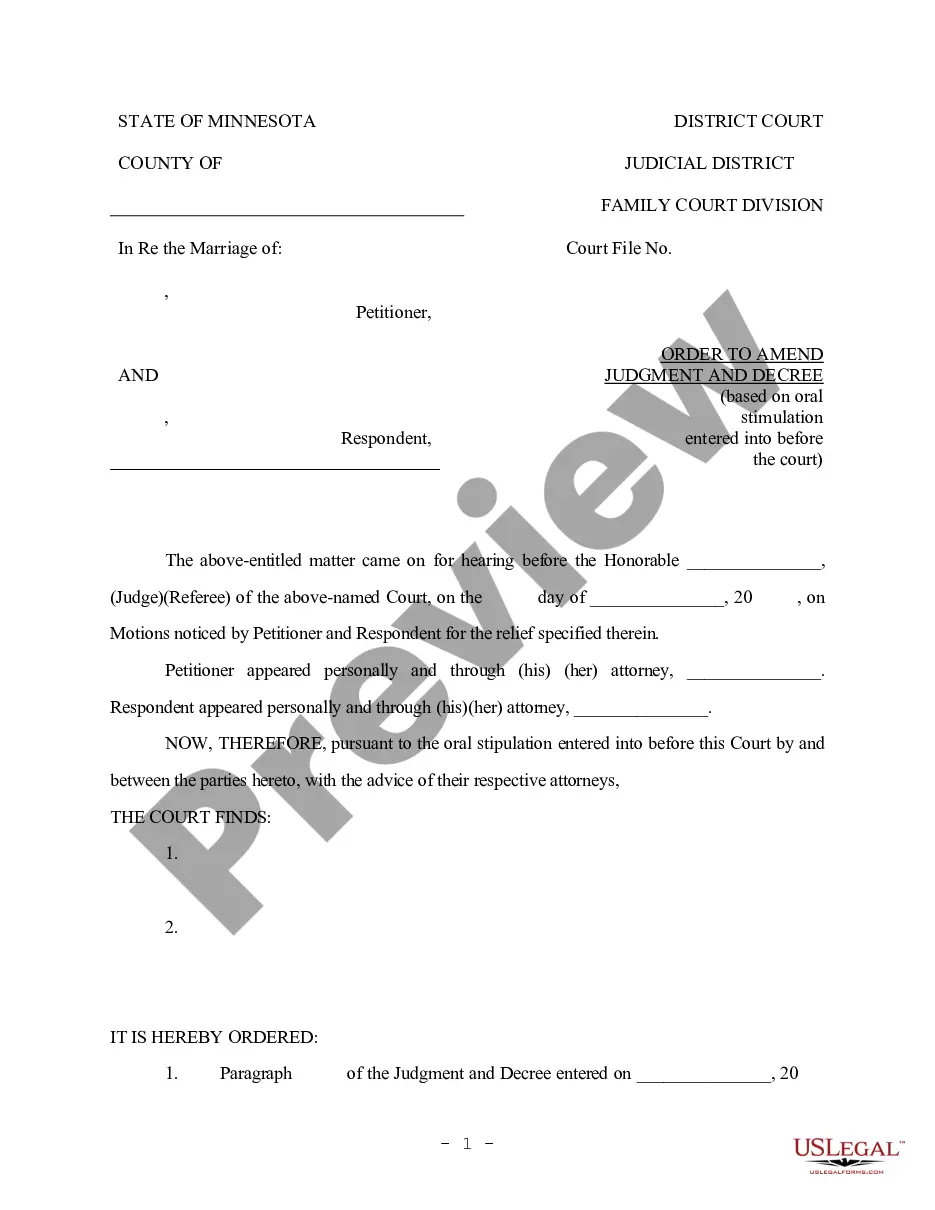

The Pennsylvania Precise to Tax Costs is a legal form used in the state of Pennsylvania to request that court costs be taxed against the losing party in a civil case. It is generally filed by the prevailing party’s attorney on behalf of the plaintiff or defendant. The Pennsylvania Precise to Tax Costs is a form provided by the Supreme Court of Pennsylvania and must be completed in accordance with rules and regulations set forth by the court. There are two main types of Pennsylvania Precise to Tax Costs: the Precise to Tax Costs for Civil Cases and the Precise to Tax Costs for Criminal Cases. The Civil Precise to Tax Costs is used in civil cases, such as divorce, contract, and tort cases, and requires the prevailing party to provide a signed statement of the costs they are asking to be taxed. The Criminal Precise to Tax Costs is used in criminal cases, such as DUI and assault cases, and requires the court to sign off on the costs before they can be taxed.

Pennsylvania Praecipe to Tax Costs

Description

How to fill out Pennsylvania Praecipe To Tax Costs?

US Legal Forms is the most easy and affordable way to locate suitable legal templates. It’s the most extensive online library of business and personal legal documentation drafted and checked by attorneys. Here, you can find printable and fillable blanks that comply with federal and local regulations - just like your Pennsylvania Praecipe to Tax Costs.

Getting your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Pennsylvania Praecipe to Tax Costs if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make sure you’ve found the one meeting your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you like most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Pennsylvania Praecipe to Tax Costs and download it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your reputable assistant in obtaining the required formal paperwork. Give it a try!

Form popularity

FAQ

Rule 240 - In Forma Pauperis (a) A party seeking leave to proceed in forma pauperis shall apply to the Court for such status. The application shall include as an attachment the affidavit of the party demonstrating an inability to pay the costs of litigation.

A document that a plaintiff files with the prothonotary to commence a civil action in a Pennsylvania court of common pleas before filing a complaint (Pa. R. Civ.

What is a Subpoena? A Subpoena is a court order. You can use a Subpoena to require a person to come to court, go to a deposition, or give documents or evidence to you. You must serve the Subpoena on the person.

A Writ of Summons must be served within 30 days after it was filed.

Civil Complaint (Includes One Certified Mail Service)$156.00Registered Mail$15.00Judgment by Confession - Cognovit$156.00Counterclaim / Crossclaim$50.00Third Party Complaint$50.0034 more rows

Philadelphia Civil Rule 1303(c) sets forth the procedures to be followed for continuances of arbitration cases in both non-emergency and emergency situations.

The word comes from the Latin word praecipio, meaning ?I command (or order) this,? and it often appears in the term ?writ of praecipe.? In the US, praecipes are writs that have one of the following functions: Commanding a defendant to perform an act or to demonstrate why he or she should not perform that act.

A writ of summons is a court order requiring a person or entity to respond to a lawsuit. In general, writs are not used in every case. Instead, they are specific to lawsuits that are related to civil proceedings and criminal law.