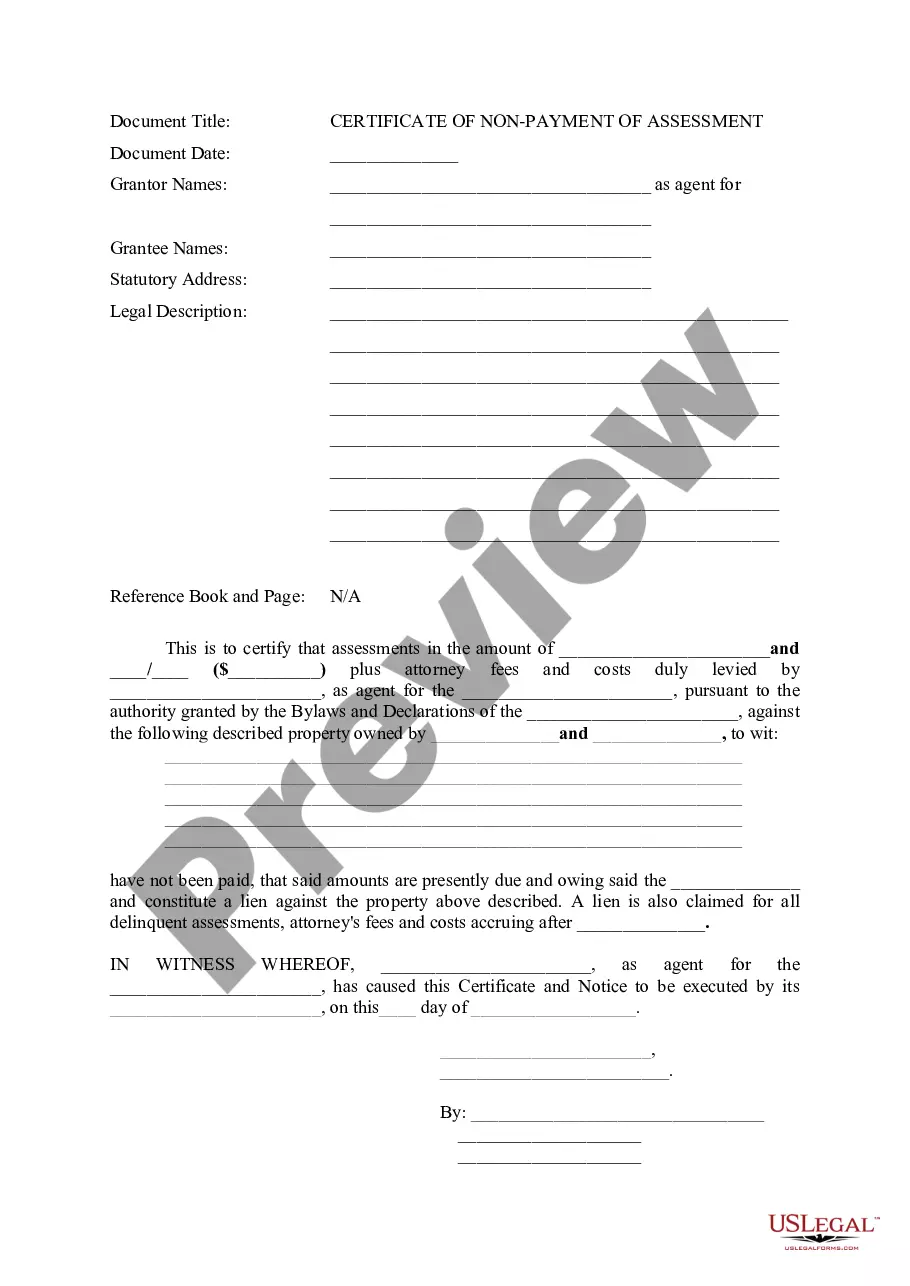

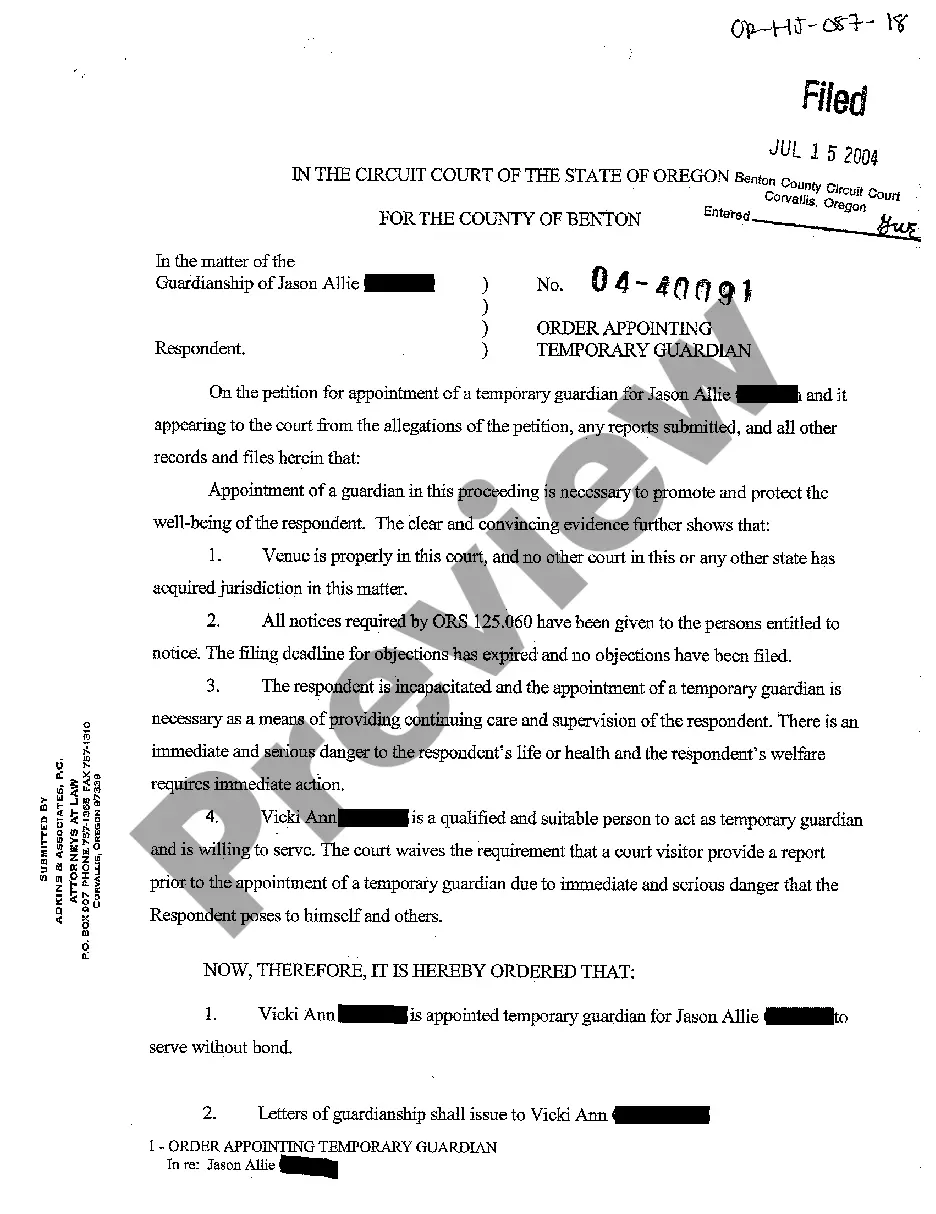

The Pennsylvania Change in Assessed Value Appeal Form is a document that is used to appeal an increased property assessment value from the local county assessor’s office. This form is used by property owners to challenge a change in their assessed value. It is important to note that this form must be filled out and submitted to the county assessor’s office within 45 days of the assessment date in order to be considered. There are two main types of Pennsylvania Change in Assessed Value Appeal Forms, which include the Residential Appeal Form and the Commercial Appeal Form. The Residential Appeal Form is used by homeowners to challenge an increase in their assessed value, while the Commercial Appeal Form is used by businesses and commercial property owners. Both forms require property owners to provide detailed information about their property, including the assessed value, the proposed change, and any evidence to support the appeal. It is important to note that the Pennsylvania Change in Assessed Value Appeal Form must be completed accurately and completely in order for the appeal to be considered. Once the form is submitted, the county assessor’s office will review the request and make a decision on the appeal.

The Pennsylvania Change in Assessed Value Appeal Form is a document that is used to appeal an increased property assessment value from the local county assessor’s office. This form is used by property owners to challenge a change in their assessed value. It is important to note that this form must be filled out and submitted to the county assessor’s office within 45 days of the assessment date in order to be considered. There are two main types of Pennsylvania Change in Assessed Value Appeal Forms, which include the Residential Appeal Form and the Commercial Appeal Form. The Residential Appeal Form is used by homeowners to challenge an increase in their assessed value, while the Commercial Appeal Form is used by businesses and commercial property owners. Both forms require property owners to provide detailed information about their property, including the assessed value, the proposed change, and any evidence to support the appeal. It is important to note that the Pennsylvania Change in Assessed Value Appeal Form must be completed accurately and completely in order for the appeal to be considered. Once the form is submitted, the county assessor’s office will review the request and make a decision on the appeal.