Pennsylvania REV-516 -- Notice of Transfer (For Stocks, Bonds, Securities or Security Accounts Held in Beneficiary Form) is a form used to transfer ownership of stocks, bonds, securities, or security accounts held in beneficiary form from one owner to another. The form is used in Pennsylvania, and is issued by the Department of Revenue. The form must be completed by the transferor and the transferee and must be signed by both parties. It must also be accompanied by the appropriate transfer documents and a Certificate of Death (if applicable). This form must be filed with the county recorder of deeds office in the county where the transferor resides. There are 2 types of Pennsylvania REV-516 -- Notice of Transfer (For Stocks, Bonds, Securities or Security Accounts Held in Beneficiary Form): 1. Transfer of Beneficiary Ownership of Stocks, Bonds, Securities or Security Accounts 2. Transfer of Beneficiary Ownership of Security Accounts.

Pennsylvania REV-516 -- Notice of Transfer (For Stocks, Bonds, Securities or Security Accounts Held in Beneficiary Form)

Description Pa Inheritance Tax Waiver Form Rev 516

How to fill out Pennsylvania REV-516 -- Notice Of Transfer (For Stocks, Bonds, Securities Or Security Accounts Held In Beneficiary Form)?

Working with legal paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Pennsylvania REV-516 -- Notice of Transfer (For Stocks, Bonds, Securities or Security Accounts Held in Beneficiary Form) template from our library, you can be sure it complies with federal and state regulations.

Working with our service is easy and fast. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to get your Pennsylvania REV-516 -- Notice of Transfer (For Stocks, Bonds, Securities or Security Accounts Held in Beneficiary Form) within minutes:

- Remember to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Pennsylvania REV-516 -- Notice of Transfer (For Stocks, Bonds, Securities or Security Accounts Held in Beneficiary Form) in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Pennsylvania REV-516 -- Notice of Transfer (For Stocks, Bonds, Securities or Security Accounts Held in Beneficiary Form) you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

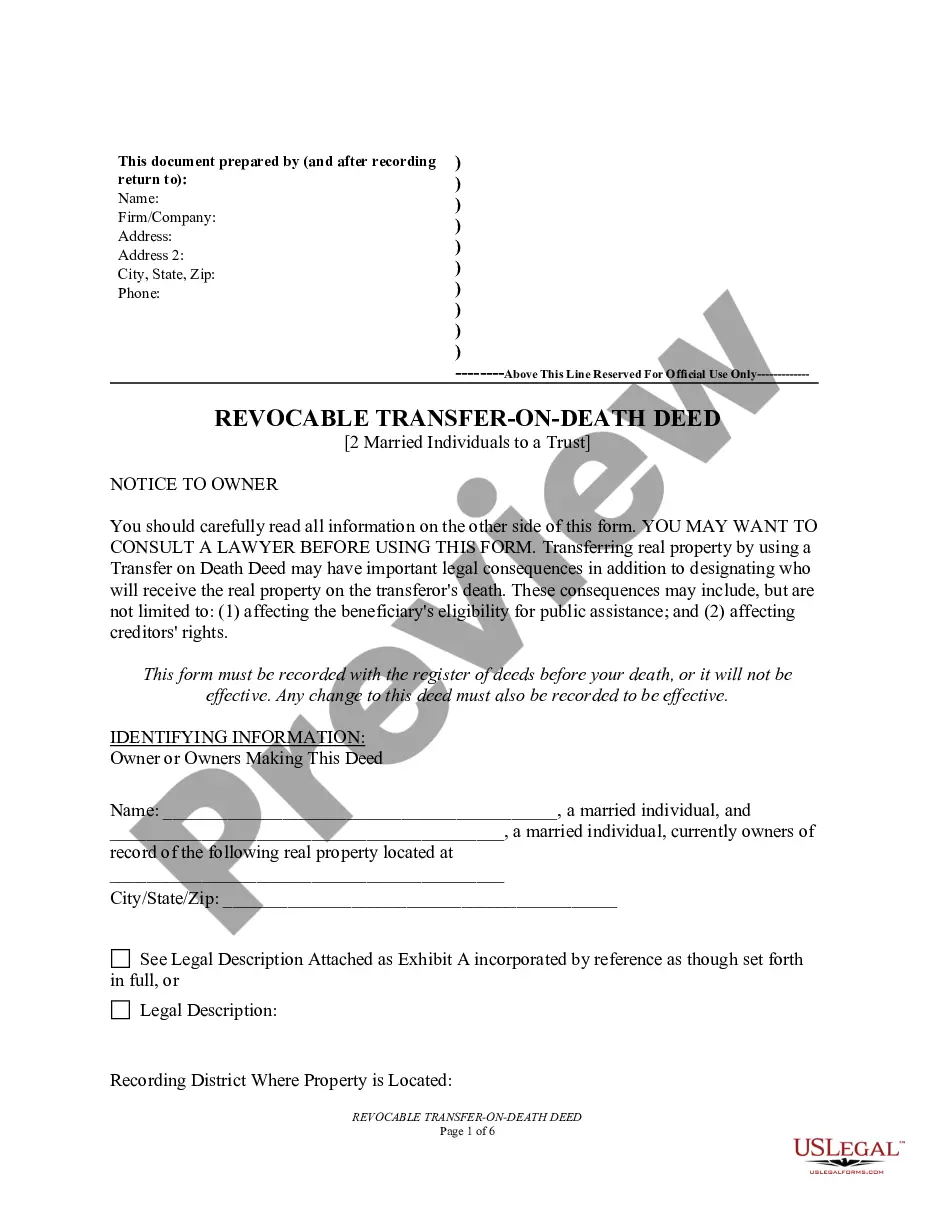

TOD ACCOUNTS DO NOT AVOID DEATH TAXES! In Pennsylvania, the entire value of a TOD account is subject to inheritance tax. WHO IS TO PAY THE DECEDENT'S FINAL BILLS? With TOD accounts, the liquid assets are distributed ?immediately? after death, before the payment of the decedent's final bills and inheritance tax.

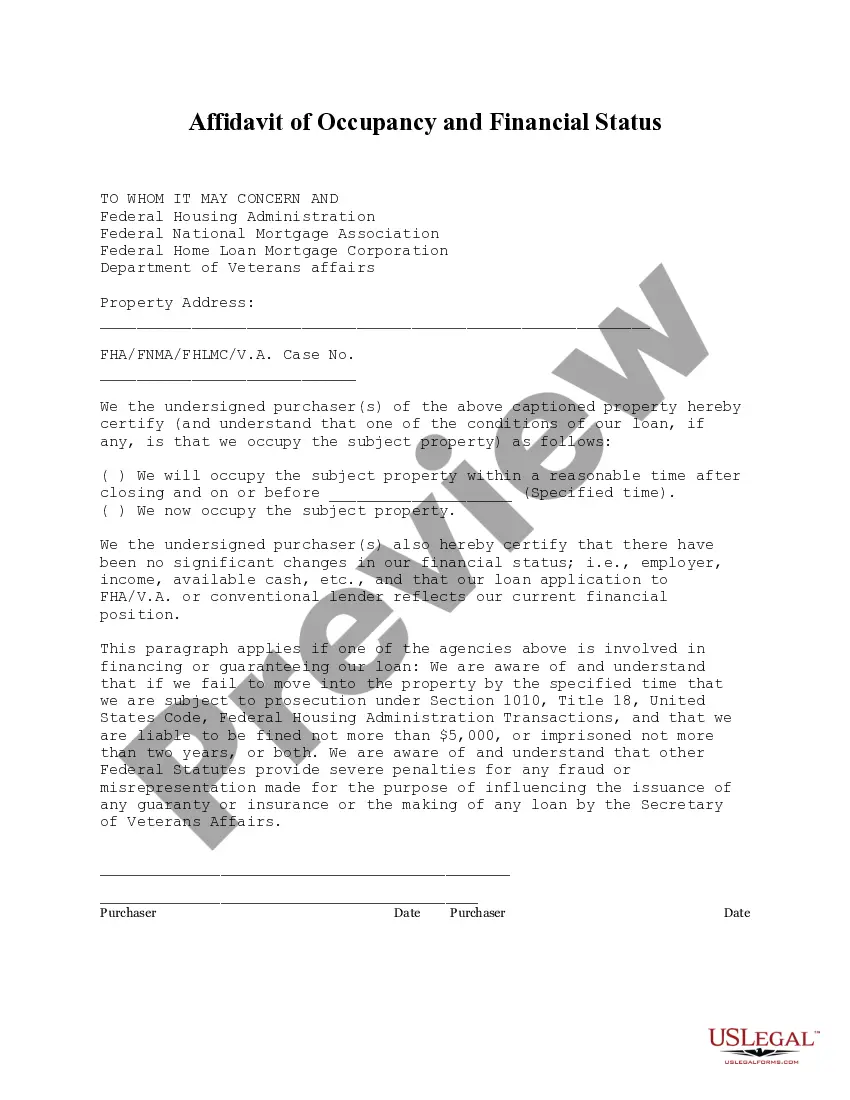

Probate-exempt assets involve specific accounts and assets set up specifically to avoid probate, as discussed above. For example, any assets in a living trust or jointly owned under joint tenancy with survivorship rights are considered non-probate assets. In addition, a payable-on-death account is exempt.

Do You Need to Pay Taxes on a TOD account? Because TODs are considered part of your estate, it may be subject to gift tax, depending on how much money your TOD account holds. If the account holds funds above the federal lifetime gift tax exclusion amount, your estate will likely need to file a tax return.

Pennsylvania lets you register stocks and bonds in transfer-on-death (TOD) form. People commonly hold brokerage accounts this way. If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at your death.

Yes, U.S. Savings Bonds must be included. The form on which the bonds are reported depends on whether they were solely owned, jointly owned or designated to be "payable on death." Savings Bonds in...

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).

Form REV-516 "Notice of Transfer"(Stocks,Bonds, Securities or Security Accounts held in Beneficiary Form) to request Waiver Notice of Transfer, must be completed and submitted to... Form REV-998 and Form REV-999 have replaced PA Schedule D(P/S).

Another way to trigger the inheritance tax in Pennsylvania is to own real estate or tangible personal property that is located within the state. Therefore, if your relative lived outside of the state but bestowed upon you property that was within Pennsylvania, you are subject to the inheritance tax.