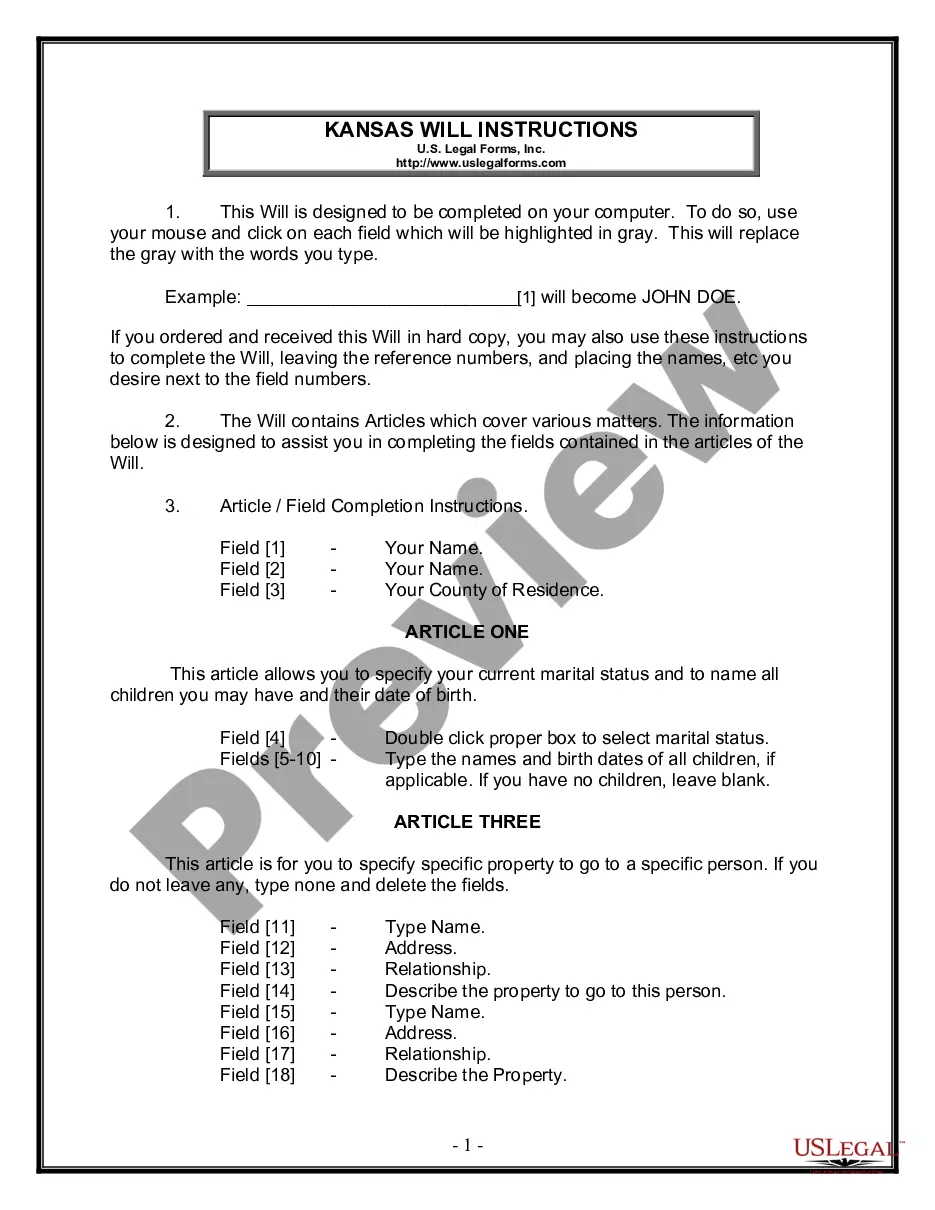

REV-584 -- Brochure: Pennsylvania Inheritance Tax & Safe Deposit Boxes is an informational brochure published by the Pennsylvania Department of Revenue to provide taxpayers with information regarding inheritance taxes as well as the use of safe deposit boxes. The brochure includes information on the types of taxes imposed by the state on inheritances, estate taxes, and gift taxes. It also outlines the rules and regulations regarding the use of safe deposit boxes, including the importance of completing a Safe Deposit Box Rental Agreement. The brochure is available in both English and Spanish versions and there are two types of REV-584 -- Brochure: Pennsylvania Inheritance Tax & Safe Deposit Boxes: one for individuals and one for businesses.

REV-584 -- Brochure: Pennsylvania Inheritance Tax & Safe Deposit Boxes

Description

How to fill out REV-584 -- Brochure: Pennsylvania Inheritance Tax & Safe Deposit Boxes?

US Legal Forms is the most easy and affordable way to locate appropriate legal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and verified by attorneys. Here, you can find printable and fillable templates that comply with national and local laws - just like your REV-584 -- Brochure: Pennsylvania Inheritance Tax & Safe Deposit Boxes.

Getting your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted REV-584 -- Brochure: Pennsylvania Inheritance Tax & Safe Deposit Boxes if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make sure you’ve found the one corresponding to your demands, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your REV-584 -- Brochure: Pennsylvania Inheritance Tax & Safe Deposit Boxes and save it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more efficiently.

Benefit from US Legal Forms, your reliable assistant in obtaining the required formal paperwork. Give it a try!

Form popularity

FAQ

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).

Pennsylvania treats a son-in-law or daughter-in-law as if they are a child for purposes of the inheritance tax. As a result, there is a flat 4.5% PA inheritance tax on assets that pass to the wife or widow and husband or widower of the decedent's child.

Ing to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed.318 Taxes for 2022 are paid in 2023.

All real property and all tangible personal property of a resident decedent, including but not limited to cash, automobiles, furniture, antiques, jewelry, etc., located in Pennsylvania at the time of the decedent's death is taxable.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger; 4.5 percent on transfers to direct descendants and lineal heirs; 12 percent on transfers to siblings; and.

Pennsylvania inheritance tax rates A 4.5% tax rate applies to assets that go to lineal heirs. These include children, stepchildren and grandchildren. A 12% tax rate applies to collateral beneficiaries such as siblings. A 15% tax rate applies to other heirs such as nieces and nephews.

While the federal tax uses a three-year look back period for gifts made by the decedent, there is a one-year look back period for the Pennsylvania inheritance tax. All gifts made within the year prior to the decedent's death are subject to the inheritance tax.

Pennsylvania Inheritance Tax and Gift Tax No tax is applied to transfers to a surviving spouse or to a parent from a child under the age of 21. There is a 4.5% tax applied to transfers to direct descendants and other lineal heirs like grandchildren.