Pennsylvania REV-1504 -- Schedule C — Closely-Held Corporation, Partnership or Sole-Proprietorship is a form used by the Pennsylvania Department of Revenue to report the income, gains, losses, deductions, and credits of a closely-held business. It is used by corporations, partnerships, and sole proprietorship to report their income on the state level. It is also used to calculate the amount of tax due to the state. The form has three different versions depending on the type of business entity filing: 1. Schedule C-Closely-Held Corporation: Used by corporations that are owned and managed by fewer than 5 shareholders. 2. Schedule C-Partnership: Used by partnerships to report the income, gains, losses, deductions, and credits of the business. 3. Schedule C-Sole-Proprietorship: Used by businesses that are owned and managed by a single individual. The form requires businesses to provide information on their income, expenses, and other financial information. It also requires businesses to calculate their net income or loss, which is then used to determine the amount of tax due.

Pennsylvania REV-1504 -- Schedule C - Closely-Held Corporation, Partnership or Sole-Proprietorship

Description

How to fill out Pennsylvania REV-1504 -- Schedule C - Closely-Held Corporation, Partnership Or Sole-Proprietorship?

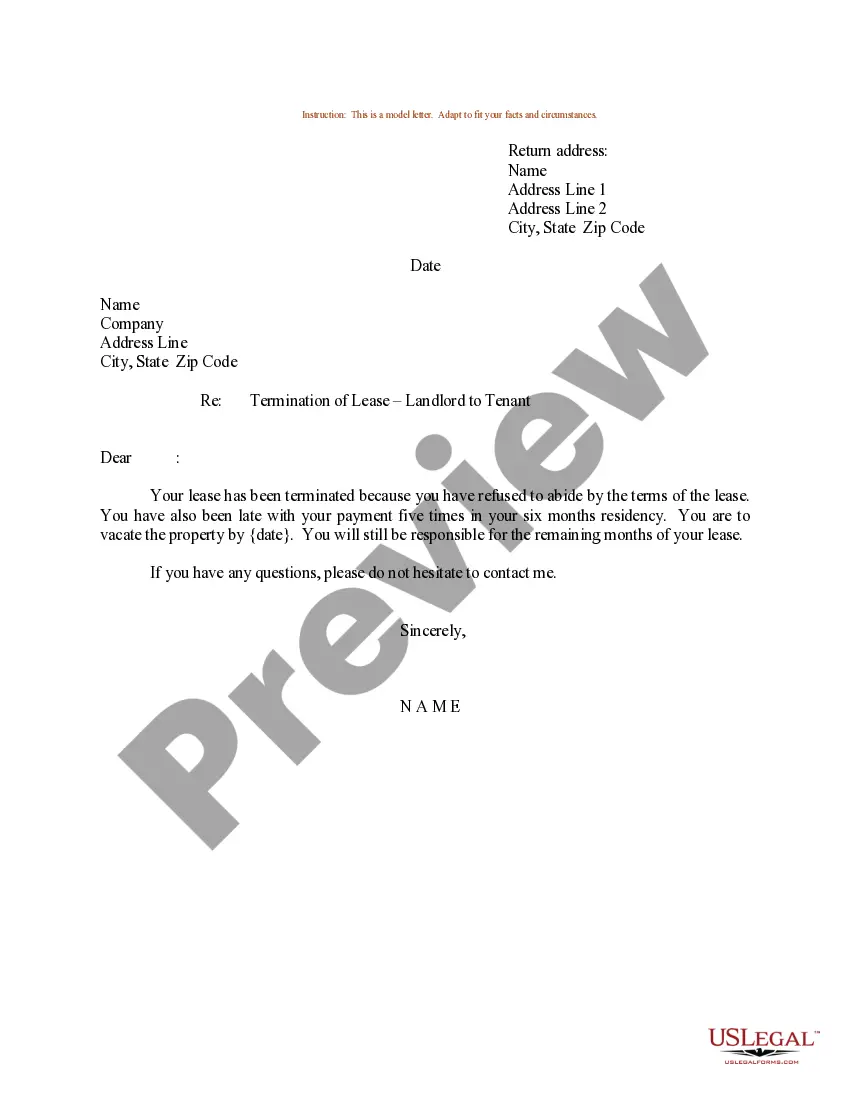

How much time and resources do you often spend on drafting official paperwork? There’s a greater option to get such forms than hiring legal specialists or wasting hours browsing the web for a proper blank. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Pennsylvania REV-1504 -- Schedule C - Closely-Held Corporation, Partnership or Sole-Proprietorship.

To acquire and prepare a suitable Pennsylvania REV-1504 -- Schedule C - Closely-Held Corporation, Partnership or Sole-Proprietorship blank, adhere to these simple instructions:

- Look through the form content to ensure it meets your state laws. To do so, check the form description or use the Preview option.

- If your legal template doesn’t meet your requirements, find another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Pennsylvania REV-1504 -- Schedule C - Closely-Held Corporation, Partnership or Sole-Proprietorship. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Pennsylvania REV-1504 -- Schedule C - Closely-Held Corporation, Partnership or Sole-Proprietorship on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most trusted web solutions. Join us now!

Form popularity

FAQ

Give your assets away If you give assets away and you survive for at least 7 years then all gifts are free and avoid inheritance tax. If you die within 7 years then inheritance tax will be paid on a reducing scale.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.

Cash, investments or property held in a trust sit outside of your estate for inheritance tax purposes, and can therefore help you avoid an inheritance tax bill. You may want to set up a trust for your children, grandchildren, or other family members.

One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes.

The most important exemption is for property that is owned jointly by a husband and wife. Therefore, if you and your spouse own all of your property jointly, upon death of the first spouse there will be no Pennsylvania inheritance tax.

REV-1313 -- Application for Refund of Pennsylvania Inheritance/Estate Tax. REV-1381 -- Stocks/Bonds Inventory. REV-1500 -- Inheritance Tax Return - Resident Decedent. REV-1502 -- Schedule A - Real Estate.

The purpose of REV-1543 is to make sure that the tax on a joint bank account is paid regardless of whether an estate files a REV-1500. The purpose of checkbox E on the REV- 1543 is to deflect tax collection efforts away from the surviving joint owner toward the estate, so that the tax is not being collected twice.

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).