Pennsylvania REV-1648 Filling -- Schedule N/Spousal Poverty Credit is a form used to claim a tax credit for married couples in Pennsylvania if they meet certain income requirements. This credit is also known as the “Spousal Poverty Credit”. It is a tax credit that a married couple may claim if their combined income is less than the maximum credit amount. The maximum amount is determined by the size of the household and the filing status of each spouse. In addition, each spouse must be a Pennsylvania resident. The credit amount is calculated using the Pennsylvania Schedule N/Spousal Poverty Credit Worksheet. This worksheet is used to determine the amount of the credit that a married couple may claim. The worksheet is completed by entering each spouse’s income, filing status, and number of dependents. There are two types of Pennsylvania REV-1648 Filling -- Schedule N/Spousal Poverty Credit. The first type is the Nonrefundable Credit, which is claimed by taxpayers who do not qualify for the refundable credit. The refundable credit is claimed by taxpayers who meet the income requirements and are eligible for the refundable credit.

Pennsylvania REV-1648 Fillin -- Schedule N/Spousal Poverty Credit

Description

How to fill out Pennsylvania REV-1648 Fillin -- Schedule N/Spousal Poverty Credit?

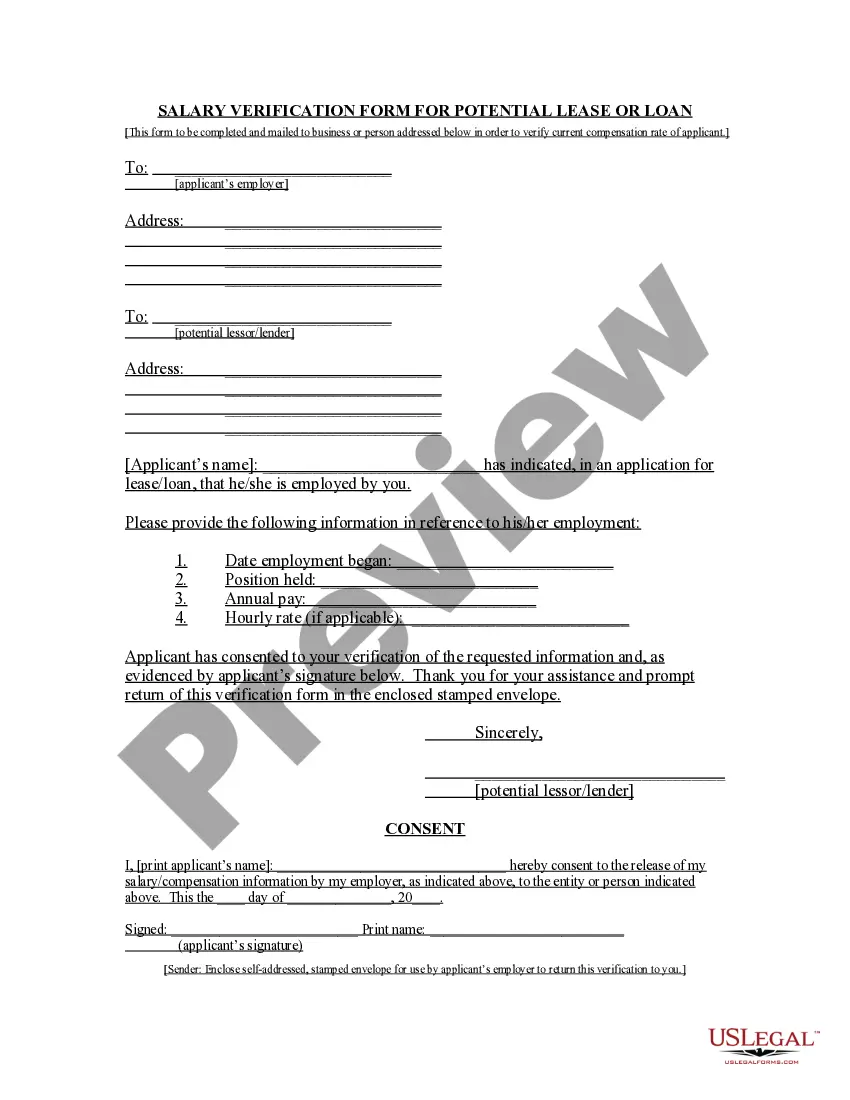

US Legal Forms is the most easy and cost-effective way to locate suitable formal templates. It’s the most extensive online library of business and individual legal paperwork drafted and verified by lawyers. Here, you can find printable and fillable blanks that comply with federal and local laws - just like your Pennsylvania REV-1648 Fillin -- Schedule N/Spousal Poverty Credit.

Getting your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Pennsylvania REV-1648 Fillin -- Schedule N/Spousal Poverty Credit if you are using US Legal Forms for the first time:

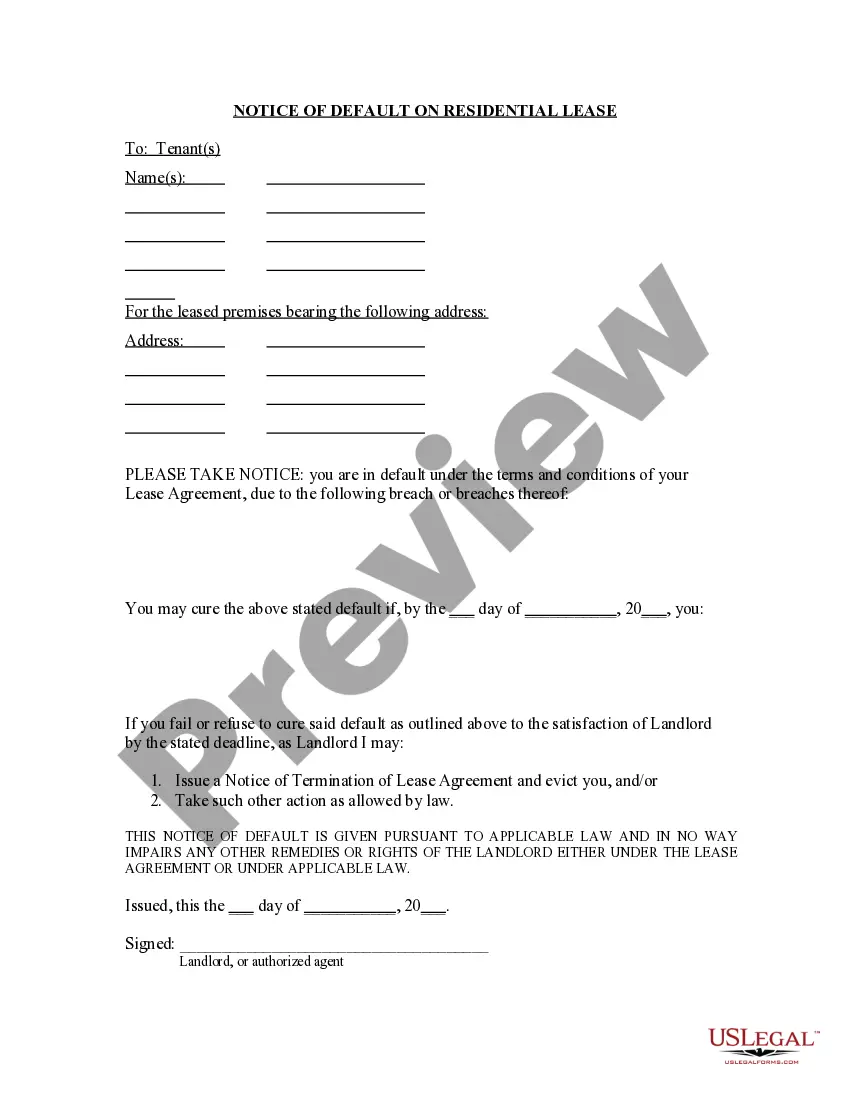

- Read the form description or preview the document to guarantee you’ve found the one meeting your needs, or find another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Pennsylvania REV-1648 Fillin -- Schedule N/Spousal Poverty Credit and download it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more effectively.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the required official documentation. Give it a try!