The Pennsylvania Agreement for Compensation for Death (PADD) is a program that provides financial assistance to the families of workers who have been fatally injured on the job in Pennsylvania. The program is funded by the state of Pennsylvania and administered by the Pennsylvania Department of Labor and Industry (DLI). PADD provides up to $50,000 in death benefits to the survivors of an employee who has died as a result of a work-related injury or illness. There are three types of PADD: the Lump Sum Fund, the Death Benefit Fund, and the Pension Fund. The Lump Sum Fund provides a one-time lump sum payment to the survivors of the deceased worker. The Death Benefit Fund provides a monthly benefit to the survivors of the deceased worker, and the Pension Fund provides a lifetime pension to the survivors of the deceased worker.

Pennsylvania Agreement for Compensation for Death

Description

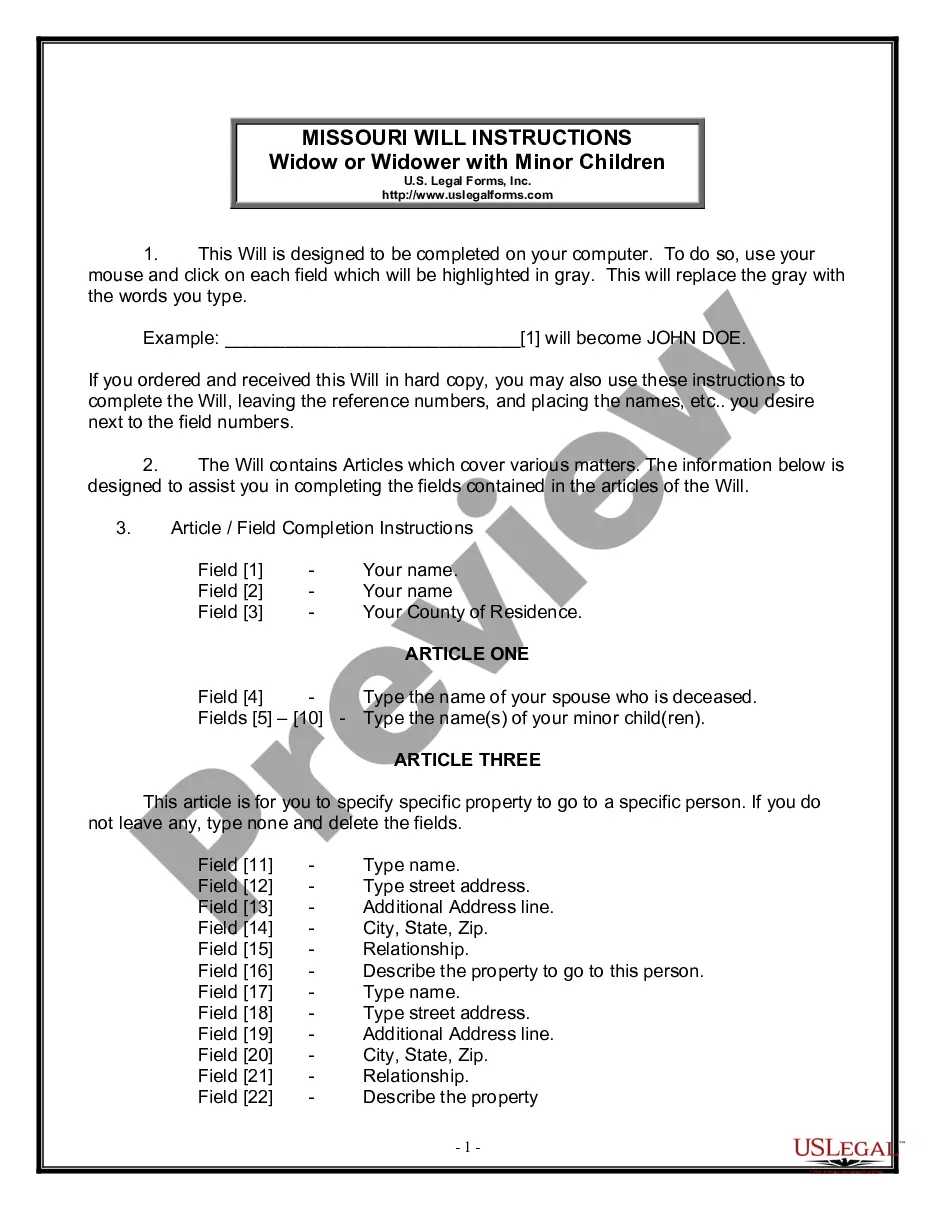

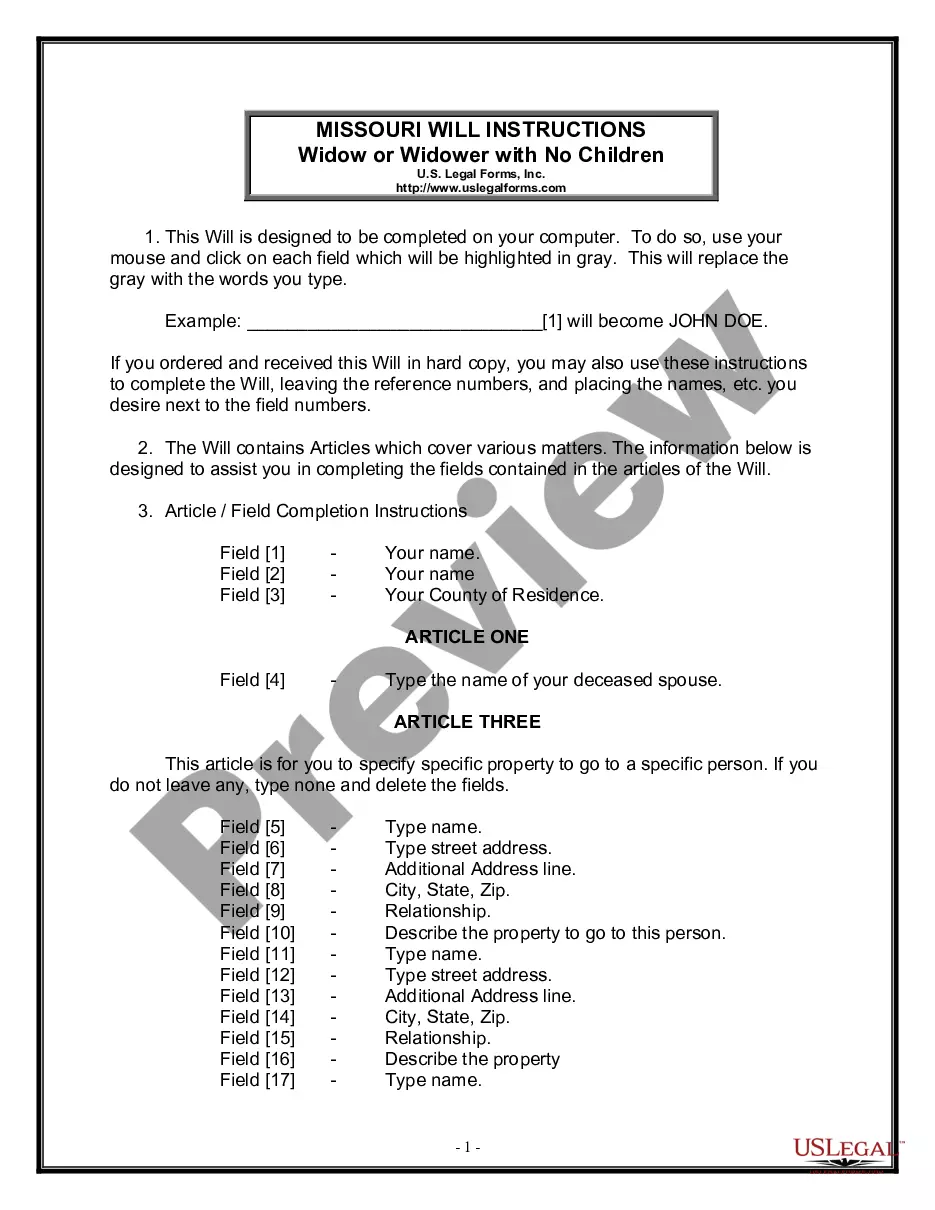

How to fill out Pennsylvania Agreement For Compensation For Death?

Working with official paperwork requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Pennsylvania Agreement for Compensation for Death template from our library, you can be certain it meets federal and state regulations.

Dealing with our service is easy and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to obtain your Pennsylvania Agreement for Compensation for Death within minutes:

- Make sure to carefully examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Pennsylvania Agreement for Compensation for Death in the format you prefer. If it’s your first experience with our service, click Buy now to proceed.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Pennsylvania Agreement for Compensation for Death you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

Under Section 307 of the Pennsylvania Workers' Compensation Act, in situations where a person is fatally injured in the course and scope of employment, compensation benefits are payable to the survivors of that person, typically, the widow/widower and their children.

One reason that the survivors should file a fatal claim petition as soon as possible is that workers' compensation provides up to $7,000 for burial expenses for a deceased worker.

OWCP Survivor Benefits ? How Much Will I Receive? As a rule of thumb, you as the surviving spouse of a federal worker will receive 50 percent of their salary at their time of death. However, this figure can go all the way up to 75 percent if you have dependents such as children.

Death benefits are paid at the total temporary disability rate, but not less than $224.00 per week.

Specific loss payments in Pennsylvania are paid out to the injured worker under the condition that you lost a body part or lost the ability to use the body part in question. The amount is based upon the body part that was lost or damaged and how much time you will miss from work due to the injury.

Under the Workers' Compensation Act, injured workers are entitled to indemnity (wage-loss) benefits equal to two-thirds of their weekly wage for a work-related injury.

Pennsylvania?s Act 101 of 1976, the Emergency and Law Enforcement Personnel Death Benefits Act, provides for a one-time payment of death benefits to the surviving spouse, minor children, or parents of firefighters, ambulance or rescue squad members, and law enforcement officers killed in the performance of their duties

If you are a widow or widower with no children, you are entitled to 51% of the weekly wages earned by your deceased loved one. If there is one child in the family, the amount increases to 60% of weekly wages. If there are two or more children, you are entitled to 66 2/3%.