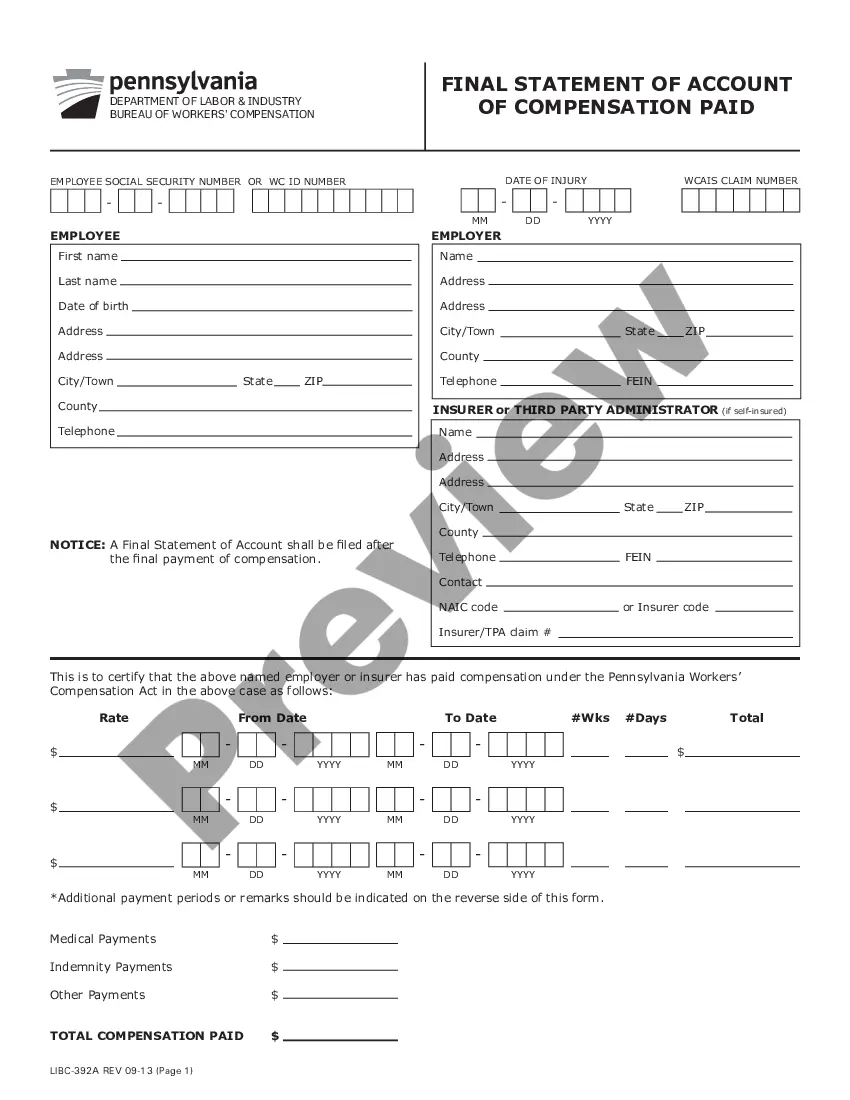

The Pennsylvania Final Statement of Account of Compensation Paid is a document used to report the amount of compensation paid to an employee in the state of Pennsylvania. This document is typically used in payroll processes and provides a detailed record of the employee’s annual earnings and deductions. It includes the employee’s name, address, Social Security number, and pay period start and end dates. The statement also includes the total wages earned during the reporting period, deductions for taxes, health insurance, and other benefits, as well as any additional compensation such as bonuses or overtime. There are two different types of Pennsylvania Final Statement of Account of Compensation Paid: Form UC-2 and Form UC-2A. Form UC-2 is used to report wages and deductions from pay periods that began on or before December 31, 2019, while Form UC-2A is used to report wages and deductions from pay periods that began on or after January 1, 2020.

Pennsylvania Final Statement of Account of Compensation Paid

Description

How to fill out Pennsylvania Final Statement Of Account Of Compensation Paid?

How much time and resources do you typically spend on composing formal paperwork? There’s a better way to get such forms than hiring legal experts or spending hours searching the web for a proper template. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, such as the Pennsylvania Final Statement of Account of Compensation Paid.

To obtain and complete a suitable Pennsylvania Final Statement of Account of Compensation Paid template, follow these simple instructions:

- Look through the form content to make sure it meets your state regulations. To do so, read the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your requirements, find another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Pennsylvania Final Statement of Account of Compensation Paid. If not, proceed to the next steps.

- Click Buy now once you find the correct document. Select the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally safe for that.

- Download your Pennsylvania Final Statement of Account of Compensation Paid on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

What is a Notice of Temporary Compensation Payable? An NTCP is a form sent by your employer or their insurer to notify you that your claim has been temporarily accepted. This means that you will begin receiving compensation for medical expenses and lost wages if applicable.

If the insurance company or employer accepts your claim, then you can expect workers' compensation checks within roughly 28 days of your date of injury.

Section 305(d) provides: ?when any employer fails to secure the payment of compensation under this act as provided in sections 305 and 305.2, the injured employee or his dependents may proceed either under this act, or in a suit for damages at law as provided by Article II.?

Under the Workers' Compensation Act, injured workers are entitled to indemnity (wage-loss) benefits equal to two-thirds of their weekly wage for a work-related injury.

1994) (?Section 204(a) prohibits, as against public policy, an employer from agreeing with his employee to hold employer harmless for any future injury the employee may suffer.?) (emphasis changed).

SECTION 302(a): A contractor who subcontracts all or any part of a contract and his insurer shall be liable for the payment of compensation to the employees of the subcontractor unless the subcontractor primarily liable for the payment of such compensation has secured its payment as provided for in this act.

Section 311 of the Pennsylvania Workers' Compensation Act provides that notice of a work injury must be given to an employer within 120 days or it is barred.

Permanent restrictions are your doctor's orders to never return to regular work. These are usually only issued if your doctor believes you will never fully recover from your injury. Often times, after you suffer a work injury and start treatment with a doctor, you will be given work restrictions.