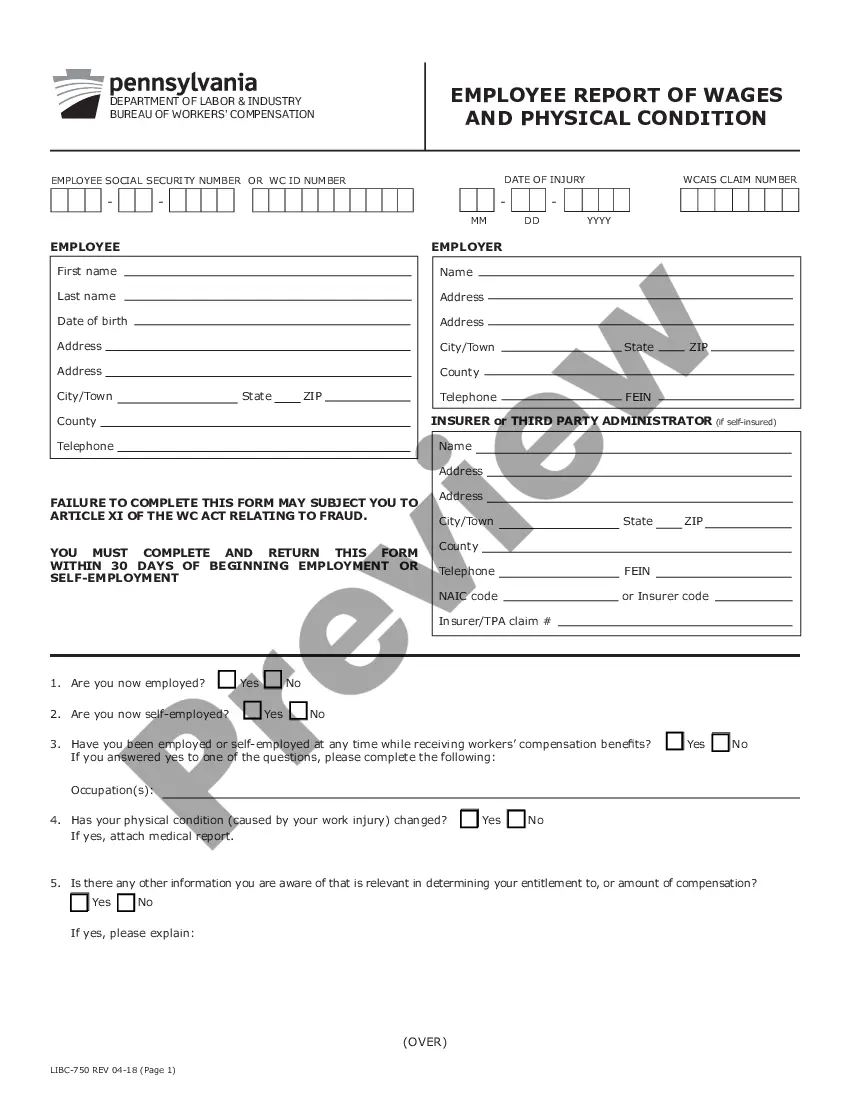

The Pennsylvania Employee Report of Wages (PA-W3) is an annual report required by the Department of Revenue and used to report employer-paid wages and taxes withheld from Pennsylvania employees. All employers who are subject to the Pennsylvania Personal Income Tax are required to file this report. The PA-W3 is used to report the following information: employee’s name, address, Social Security number, and wages paid; employer’s name, address, and federal employer identification number; and the total amount of taxes withheld. The PA-W3 is due by the last day of February of the following year for which the wages and taxes were reported. There are two types of Pennsylvania Employee Report of Wages: the PA-W3C, which is used to report wages and taxes for calendar year; and the PA-W3E, which is used to report wages and taxes for fiscal year.

Pennsylvania Employee Report of Wages

Description

How to fill out Pennsylvania Employee Report Of Wages?

How much time and resources do you normally spend on composing formal paperwork? There’s a greater opportunity to get such forms than hiring legal experts or wasting hours searching the web for a proper blank. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Pennsylvania Employee Report of Wages.

To acquire and prepare a suitable Pennsylvania Employee Report of Wages blank, follow these easy steps:

- Look through the form content to ensure it meets your state requirements. To do so, check the form description or utilize the Preview option.

- In case your legal template doesn’t satisfy your needs, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Pennsylvania Employee Report of Wages. If not, proceed to the next steps.

- Click Buy now once you find the correct document. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally secure for that.

- Download your Pennsylvania Employee Report of Wages on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us today!

Form popularity

FAQ

In Pennsylvania, an employer must pay an employee for accrued vacation upon separation from employment if its policy or contract provides for such payment.

Pennsylvania requires that final paychecks be paid on the next scheduled payday, regardless of whether the employee quit or was terminated.

15. How Soon after I Quit Do I Have to Be Paid? If you quit your job, are laid off, or are fired, your employer must pay you all monies you earned by the next scheduled pay day.

Final pay is subjected to mandatory withholding, such as federal income tax, Social Security tax, Medicare tax, state-mandated taxes and applicable wage garnishments. Certain voluntary deductions, such as medical and dental benefits depend on company policy.

Under the Pennsylvania Workers' Compensation Act, injured workers are entitled to wage loss (?indemnity benefits?) based on the earnings at the time of injury. Generally speaking, indemnity benefits are calculated based on two-thirds (2/3) of your average weekly wage (?AWW?).

Workers' Compensation is tax-free. In Pennsylvania, the weekly compensation rate amounts to 66% of the injured worker's average weekly wage if they earned between $810.76 and $1,621.50 prior to the injury. For workers who earn between $600.56 and $810.75, the weekly compensation rate is $540.50.

Final paychecks in Pennsylvania State law requires employers to pay an employee who has separated from the business for any reason their final paycheck no later than the next payday. If an employee requests their final paycheck be mailed, the employer must comply.

The Pennsylvania Workers' Compensation Act provides wage loss and medical benefits to compensate employees suffering from work- related injuries or diseases. The Act also provides for death benefits to the dependents of workers who die as a result of a work-related injury or disease.