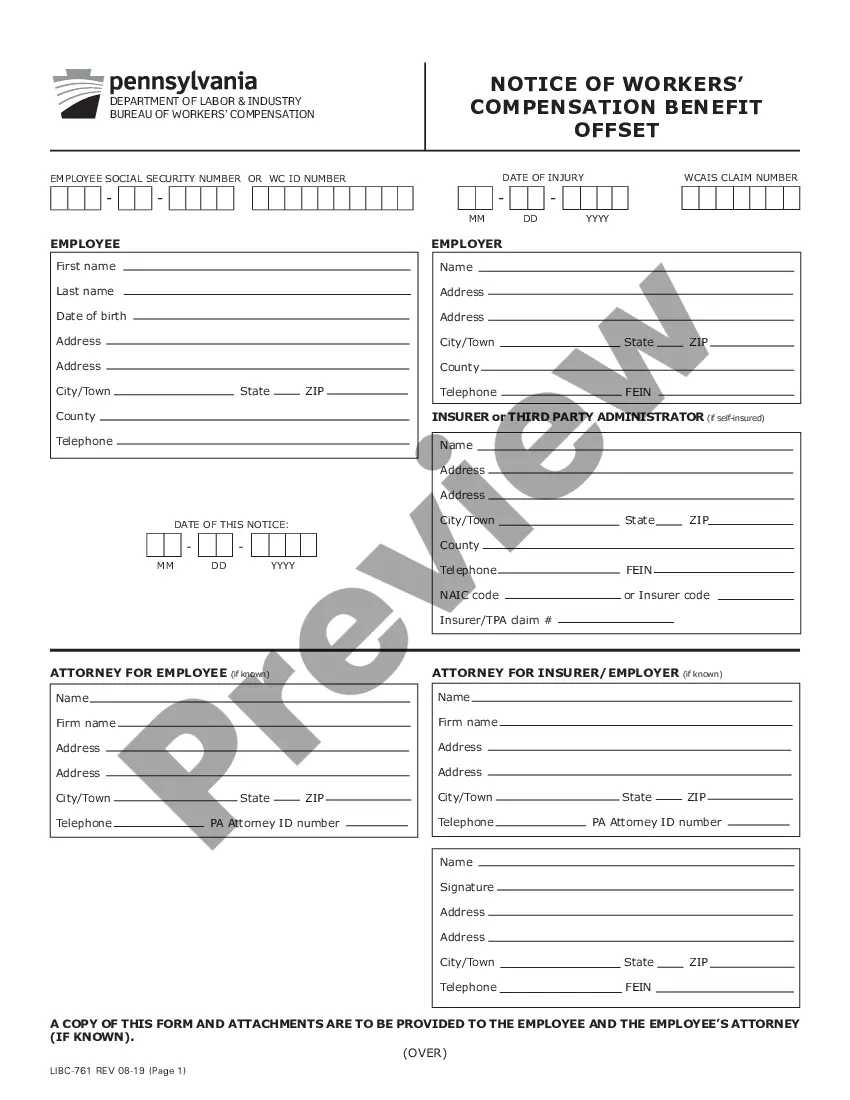

The Pennsylvania Notice of Workers Compensation Benefit Offset is a legal notice that informs an employee of their right to receive workers’ compensation benefits. This notice outlines the employee’s rights to receive benefits and states any applicable offsets to the benefits. The Pennsylvania Notice of Workers Compensation Benefit Offset is required to be provided to the employee after the employer has received notice of a claim for workers’ compensation. There are two types of Pennsylvania Notice of Workers Compensation Benefit Offset: the offset notice for permanent total disability benefits and the offset notice for permanent partial disability benefits. The offset notice for permanent total disability benefits informs the employee of their right to receive benefits and any applicable offsets. The offset notice for permanent partial disability benefits informs the employee of their right to receive benefits, any applicable offsets, and the duration of the benefits.

Pennsylvania Notice of Workers Compensation Benefit Offset

Description

How to fill out Pennsylvania Notice Of Workers Compensation Benefit Offset?

If you’re searching for a way to appropriately prepare the Pennsylvania Notice of Workers Compensation Benefit Offset without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every personal and business scenario. Every piece of paperwork you find on our online service is created in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these simple guidelines on how to obtain the ready-to-use Pennsylvania Notice of Workers Compensation Benefit Offset:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and select your state from the dropdown to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Pennsylvania Notice of Workers Compensation Benefit Offset and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Section 311 of the Pennsylvania Workers' Compensation Act provides that notice of a work injury must be given to an employer within 120 days or it is barred.

The law says the combination of both benefits can't be over 80 percent of the worker's average weekly wage before the accident. The Social Security Administration (SSA) calculates how much to reduce the individual's SSDI benefit based on the WC benefit. ?This reduction is called the 'offset,' ? said Christopher J.

Workers' comp cannot stop paying without notice. ing to the Pennsylvania Department of Labor & Industry (DLI), the insurer responsible for issuing workers' compensation payments must notify the injured party that their benefits have been terminated.

Impact on SSI Benefits: If you receive SSI benefits, any lump sum settlement you receive will be counted as income in the month that you receive it. This means that it could reduce your SSI benefits for that month or even eliminate them entirely if the settlement is large enough.

80% of the worker's ?average current earnings,? or. the ?total family benefit? measured by the total amount of SSDI received by all of the members of the recipient's family in the first-month worker's compensation is received.

1994) (?Section 204(a) prohibits, as against public policy, an employer from agreeing with his employee to hold employer harmless for any future injury the employee may suffer.?) (emphasis changed).

Q: What are offsets? A. Offsets are provisions in your disability coverage that allow your insurer to deduct from your regular benefit other types of income you receive or are eligible to receive from other sources due to your disability.

Exhibit 3 - Workers' Compensation Offset. Exhibit 3 shows how a SSA-1099 looks when there is Worker's Compensation Offset and explains that Social Security benefits potentially subject to tax will include any workmen's compensation whose receipt caused any reduction in Social Security disability benefits.