This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

Pennsylvania Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand

Description

How to fill out Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand?

US Legal Forms - among the greatest libraries of authorized types in the United States - offers a wide range of authorized papers web templates you are able to acquire or produce. Using the website, you can get 1000s of types for enterprise and person purposes, sorted by classes, claims, or search phrases.You can find the most up-to-date versions of types like the Pennsylvania Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand within minutes.

If you already have a membership, log in and acquire Pennsylvania Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand in the US Legal Forms collection. The Download switch can look on each type you see. You have access to all earlier saved types from the My Forms tab of your own account.

In order to use US Legal Forms for the first time, listed here are straightforward guidelines to obtain started out:

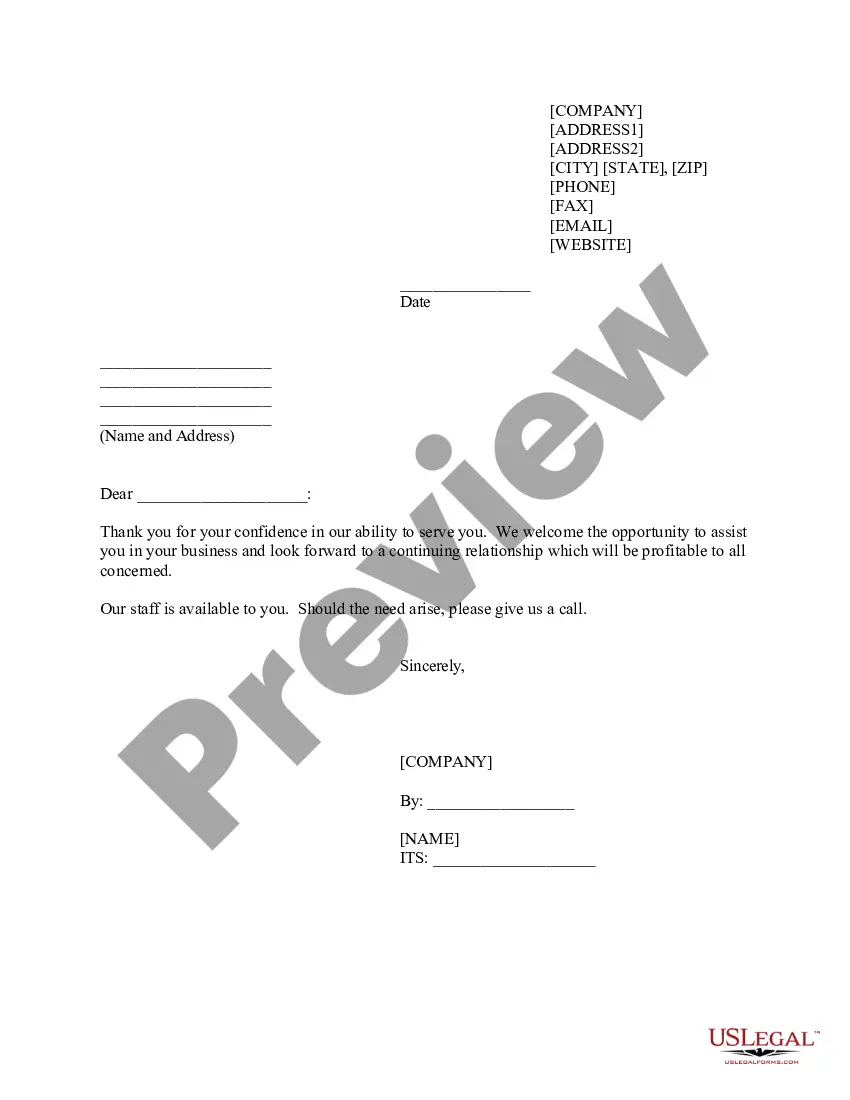

- Ensure you have picked out the correct type for the town/region. Click on the Preview switch to examine the form`s content. Browse the type description to actually have chosen the proper type.

- In case the type doesn`t satisfy your specifications, use the Search area on top of the display screen to get the the one that does.

- When you are content with the form, verify your selection by clicking on the Get now switch. Then, select the pricing strategy you want and supply your qualifications to sign up to have an account.

- Method the deal. Make use of charge card or PayPal account to perform the deal.

- Find the formatting and acquire the form on your device.

- Make modifications. Load, modify and produce and indication the saved Pennsylvania Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

Every single template you added to your money lacks an expiration particular date which is yours eternally. So, if you would like acquire or produce another version, just go to the My Forms area and then click about the type you need.

Get access to the Pennsylvania Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand with US Legal Forms, the most considerable collection of authorized papers web templates. Use 1000s of specialist and condition-certain web templates that satisfy your small business or person demands and specifications.

Form popularity

FAQ

There are two types of bad faith insurance claims: first-party and third-party. First-party insurance claims are those that policyholders bring against their insurance company for not covering their damages. In these cases, plaintiffs believe their insurance provider withholds payment on a claim they shouldn't.

Examples of Insurance Bad Faith: Offering less money than a claim is worth. Delaying or denying decisions on claims or requests for approval for medical treatment. Refusing to pay a valid claim. Making threatening statements.

As an implied condition, dealing in bad faith may give rise to a cause of action in most states. Bad faith acts are circumstance specific but include some of the following: Maliciously failing to fulfill legal or contractual obligations. Willfully misleading another.

Failure to defend and indemnify you as a policyholder may constitute ?bad faith? by the insurer. Courts look to the insurance policy language to determine whether a risk is covered and what your ?reasonable expectation? should be. Whenever the insurance policy is ambiguous, the court resolves it your favor.

Insured's bad faith It seeks to apportion fault and damages depending on the harm that resulted from the bad faith of the insurer and any wrongful conduct or bad faith on the part of the insured. California was the first state to adopt this defense, and it might not be available in all jurisdictions.