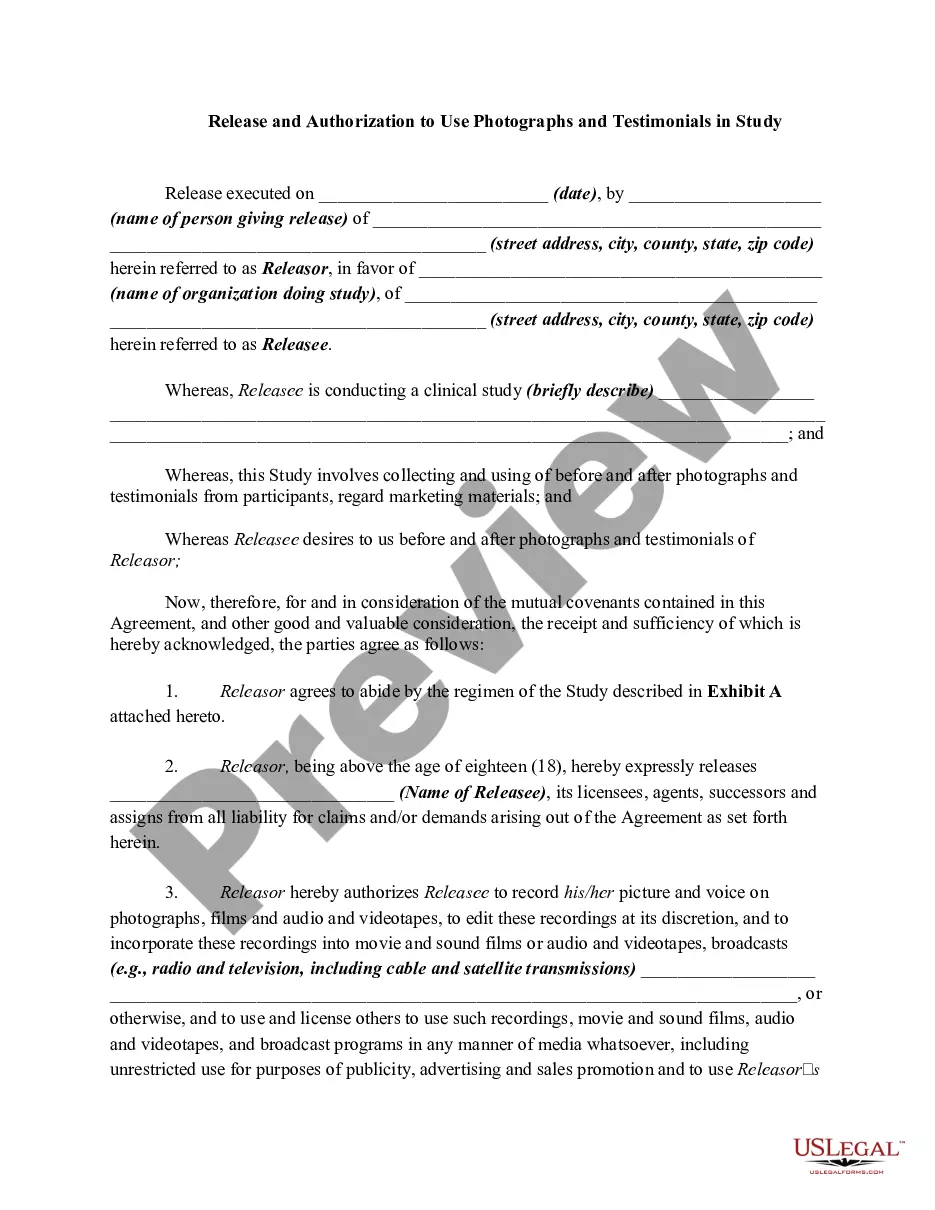

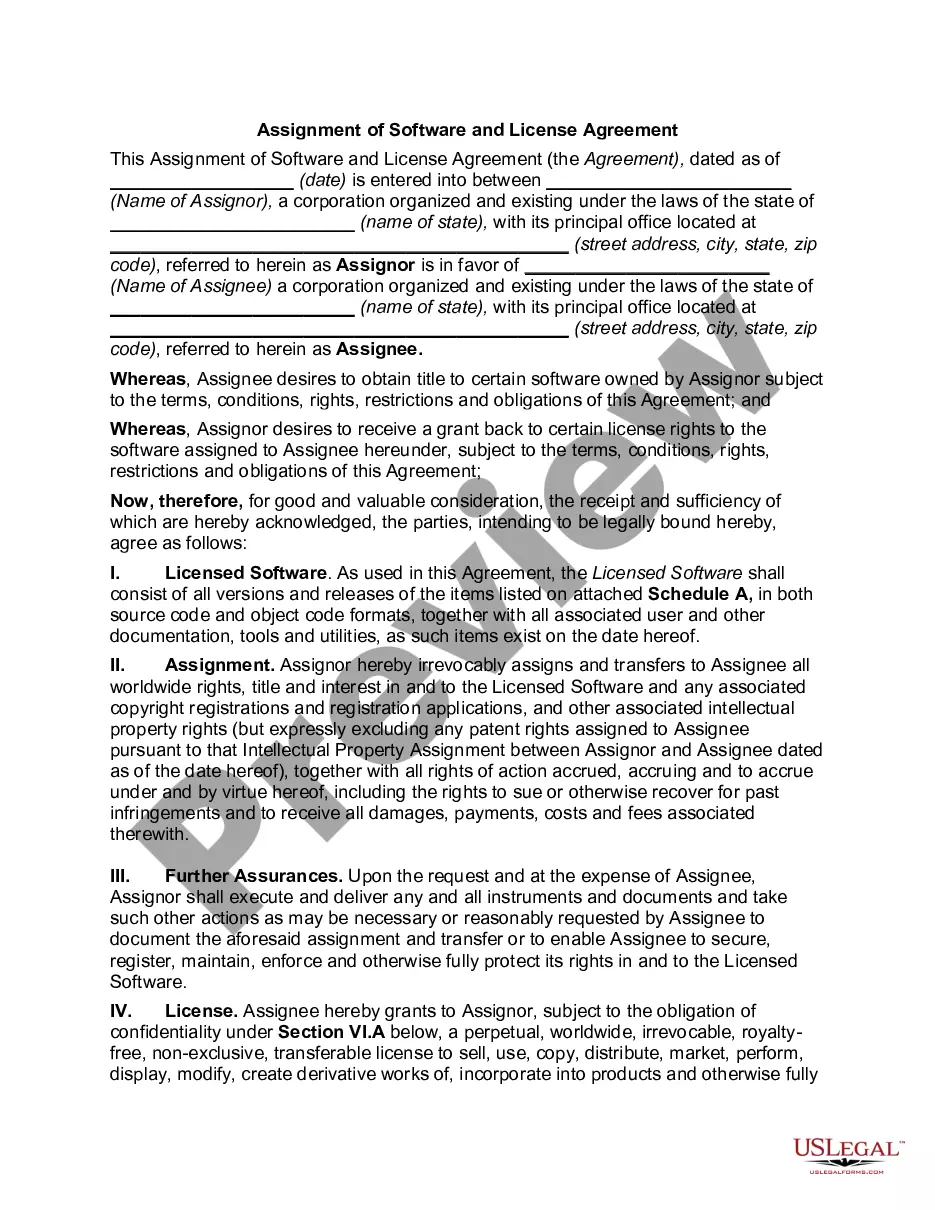

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Pennsylvania Change or Modification Agreement of Deed of Trust

Description

How to fill out Change Or Modification Agreement Of Deed Of Trust?

Are you presently within a situation where you need documents for sometimes company or personal reasons nearly every day time? There are tons of authorized file templates available on the Internet, but locating ones you can depend on is not easy. US Legal Forms delivers thousands of form templates, such as the Pennsylvania Change or Modification Agreement of Deed of Trust, that are created to satisfy federal and state demands.

If you are currently knowledgeable about US Legal Forms site and get a free account, basically log in. Next, you may down load the Pennsylvania Change or Modification Agreement of Deed of Trust design.

If you do not offer an account and wish to begin using US Legal Forms, adopt these measures:

- Find the form you want and ensure it is for that appropriate town/county.

- Use the Review button to examine the form.

- Look at the information to ensure that you have selected the appropriate form.

- In the event the form is not what you`re looking for, take advantage of the Lookup industry to obtain the form that fits your needs and demands.

- If you obtain the appropriate form, click on Get now.

- Choose the prices strategy you would like, fill out the desired info to create your money, and buy the transaction using your PayPal or bank card.

- Select a hassle-free file formatting and down load your backup.

Locate all of the file templates you possess purchased in the My Forms menus. You can obtain a more backup of Pennsylvania Change or Modification Agreement of Deed of Trust at any time, if possible. Just click the essential form to down load or print out the file design.

Use US Legal Forms, the most comprehensive assortment of authorized forms, to save time as well as prevent blunders. The services delivers expertly produced authorized file templates which can be used for a variety of reasons. Produce a free account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

Is a Deed of Trust the Same as a Title? Deed of Trust and Title are both terms you'll likely hear when purchasing property, but they actually are different in purpose and meaning. A Deed of Trust is the loan on the property, and a Title expresses the actual ownership of a property.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

The parents and child create a declaration of trust that sets out the true ownership, and who receives what share of the sale proceeds when the property is finally sold on. In legal jargon, the deed of trust records the parents' beneficial interest in the property.

(sc.Default) A Deed to Trust form used to transfer the grantor's title and interest in real property in Pennsylvania to a trustee of a trust for the grantor's ...

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateOregonYPennsylvaniaYRhode IslandYSouth CarolinaY47 more rows

A Trust Deed is a general term for a document which contains the terms of a Trust. A Declaration of Trust is a type of Trust Deed and is a document by which the person or people who own an asset declare that they hold it on Trust in specified shares for themselves and or other parties.

4th 1331, 1343-1344.) Based on these rules, upon creation of a trust, title to trust property is split between the trustee and the beneficiaries. The trustee holds legal title to the property and the beneficiaries hold equitable title.