This form is an assumption agreement for a Small Business Administration (SBA) loan. Party assuming the loan agrees to continue payments thereon. SBA agrees to the assumption of the loan and release of original debtor. Adapt to fit your circumstances.

Pennsylvania Assumption Agreement of SBA Loan

Description

How to fill out Assumption Agreement Of SBA Loan?

You can allocate time online attempting to locate the authentic documents template that satisfies the federal and state regulations you require.

US Legal Forms offers thousands of authentic forms that are examined by experts.

You can actually download or print the Pennsylvania Assumption Agreement of SBA Loan from my service.

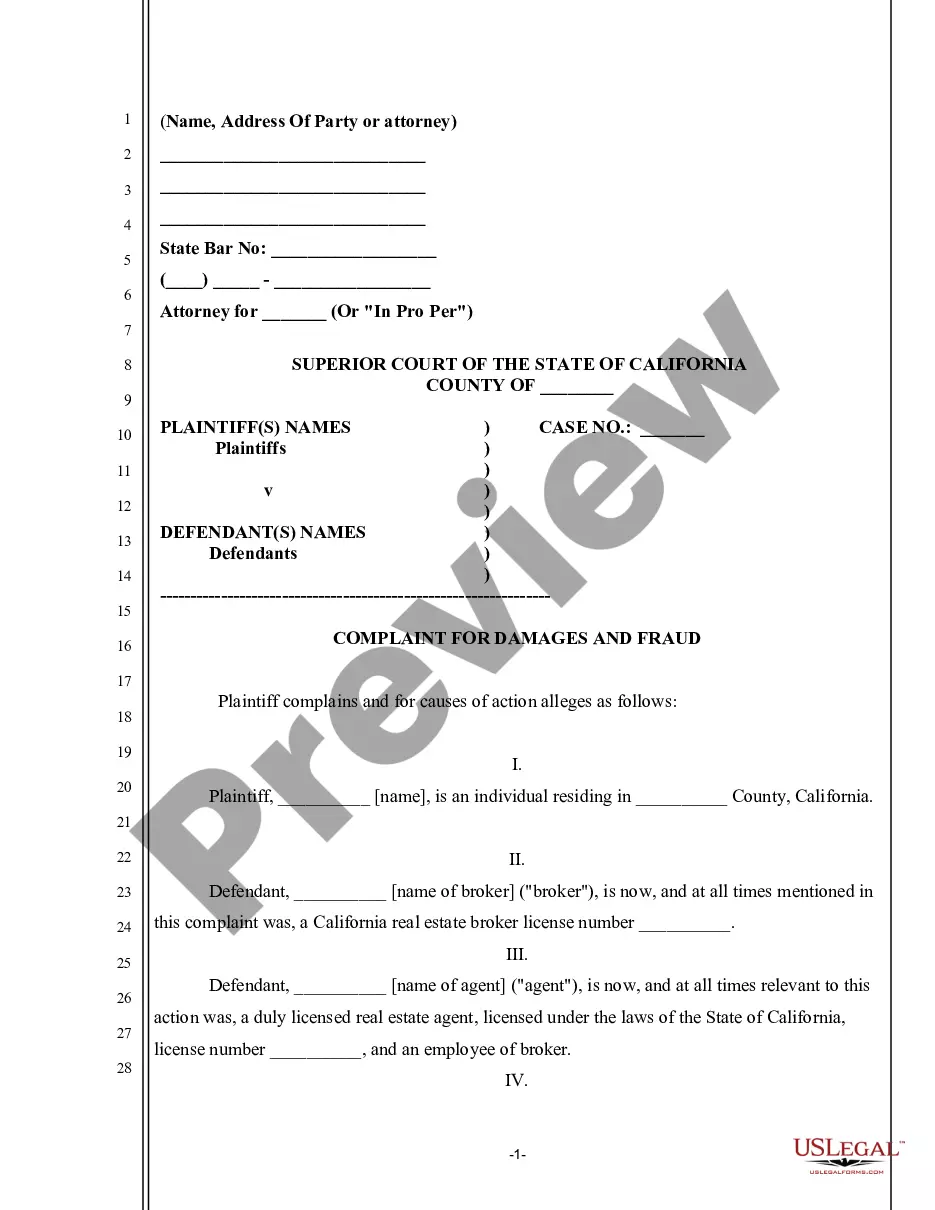

If available, utilize the Review button to examine the documents template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the Pennsylvania Assumption Agreement of SBA Loan.

- Every single authentic documents template you purchase is yours permanently.

- To acquire an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct documents template for the area/city you choose.

- Review the form information to confirm you have selected the appropriate form.

Form popularity

FAQ

Loans under $200,000 do not require a personal guarantee, but there is an EIDL personal guarantee for loans above that amount. The guarantee is required of all individuals or entities that own 20% or more of the business.

Default on the SBA Loan First, the lender will seek payment from the business for the outstanding balance of the loan. However, if the business cannot pay the full amount, the lender will foreclose on the collateral pledged by the business. Your business assets may not have much value.

If there is a transfer of ownership, the addition or deletion of a guarantor to the loan requires approval. While the Cares Act EIDLs do not require a personal guaranty for loans under $200,000.00, the SBA still nevertheless requires its approval of the transfer.

SBA loans are fully assumable with SBA approval. Getting this approval, however, can be very complex. Any borrower attempting to assume an SBA loan will be carefully examined by the SBA and must meet a lengthy list of requirements.

Assumption of SBA Loan. A borrower may request for another person to assume the borrower's legal obligations and benefits under the SBA loan documents.

Upon your death, if the SBA loan is not yet fully paid off, the life insurance company first pays the lender what is owed from your policy's death benefit. The remaining proceeds go to your policy's beneficiaries.

SBA loans and SBA express loans can be used for a wide range of expenses. According to the SBA, you can use these loans for most business purposes, including start-up, expansion, equipment purchases, working capital, inventory or real-estate purchases.

In case of death, the deceased's estate is used to pay off the debt. However, if the person has an insufficient estate or no estate at all, the creditors will have no choice but to write off the debt. Federal student loan debts are wiped off in case the borrower or the parent of the borrower dies.

Fortunately for borrowers, SBA loans, including the SBA 7(a) loan, are fully assumable with SBA approval. However, if you're selling your business, getting approval from the SBA for another borrower to assume your loan can be somewhat complex.

Fortunately for borrowers, SBA loans, including the SBA 7(a) loan, are fully assumable with SBA approval. However, if you're selling your business, getting approval from the SBA for another borrower to assume your loan can be somewhat complex.