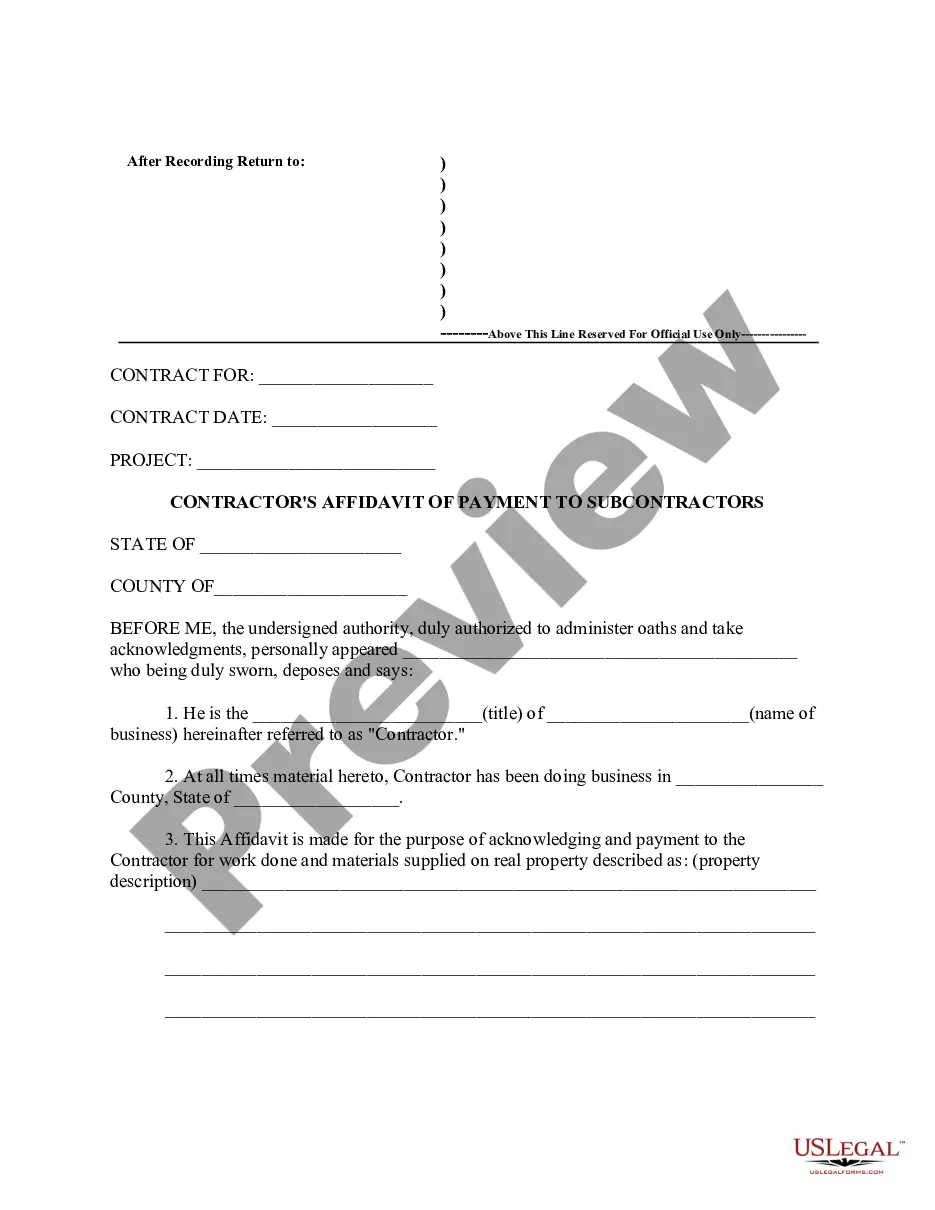

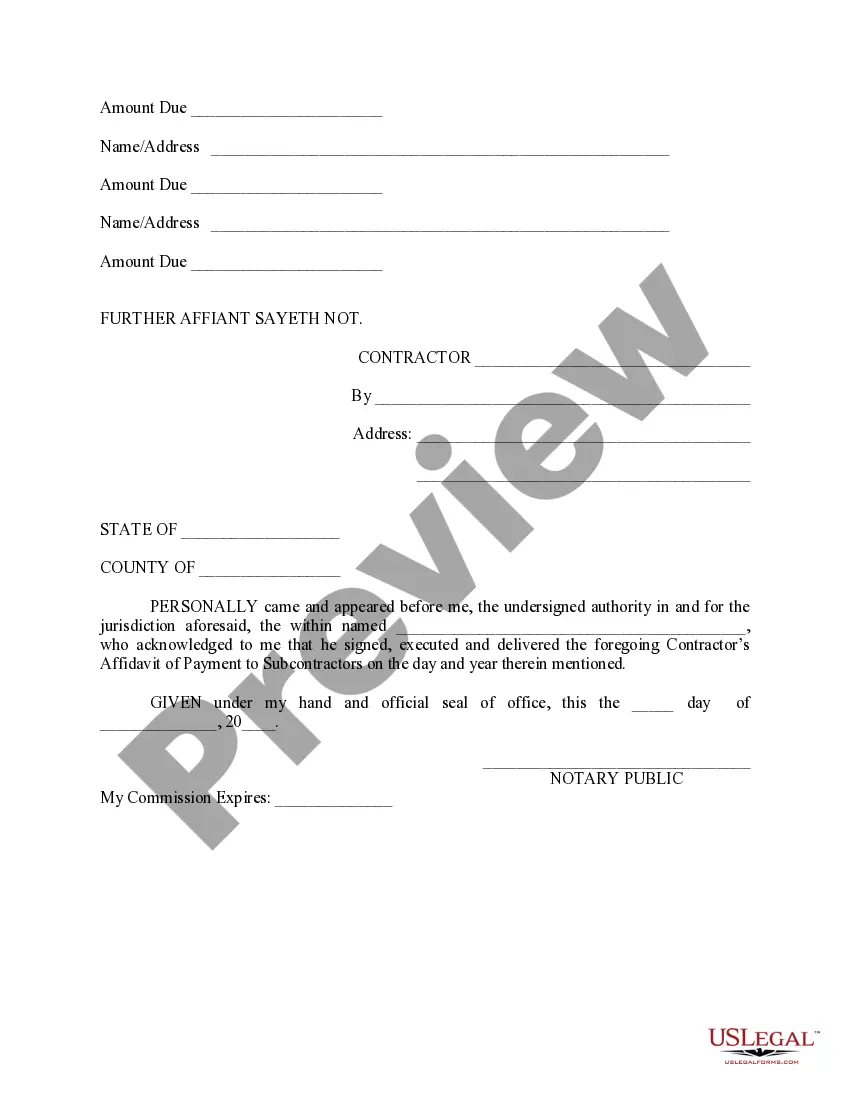

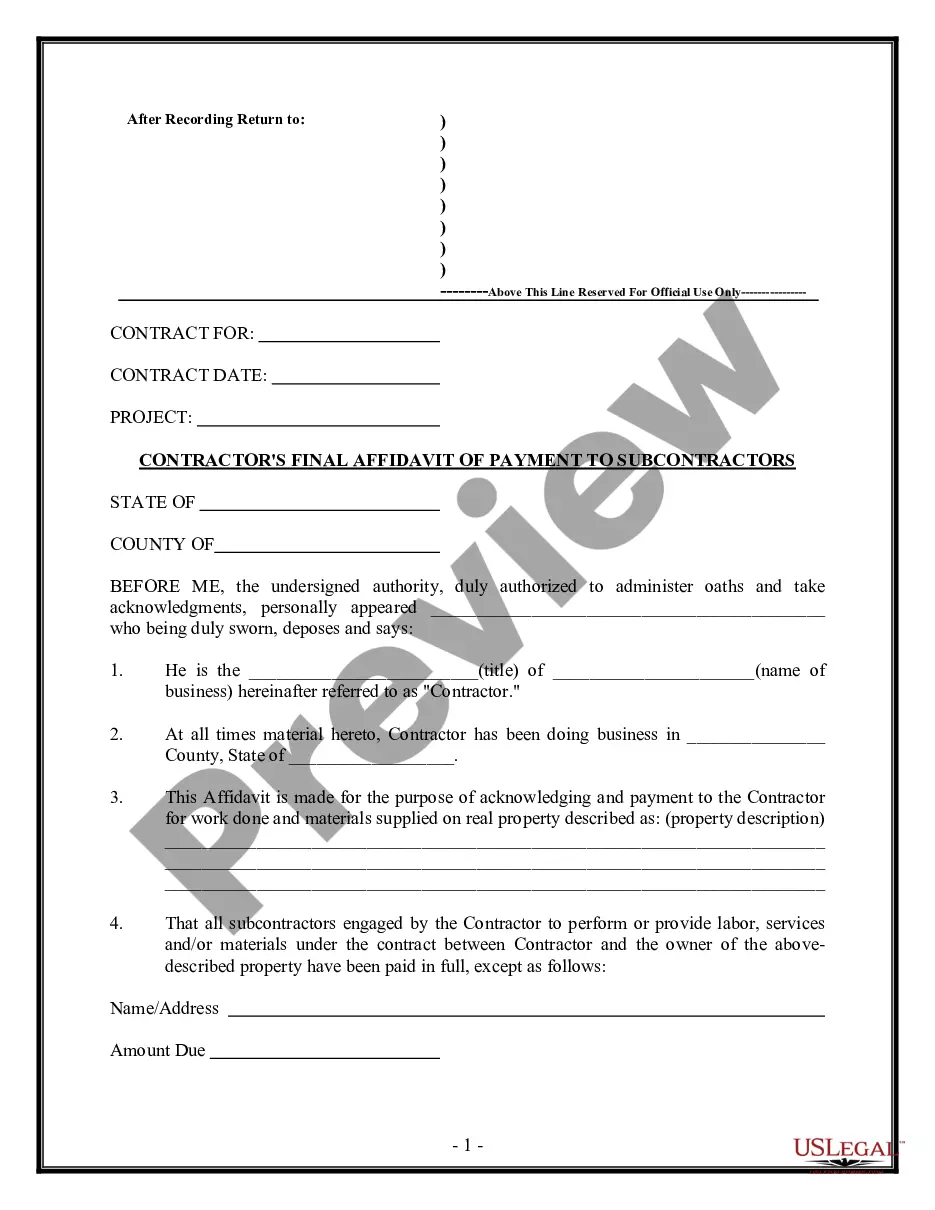

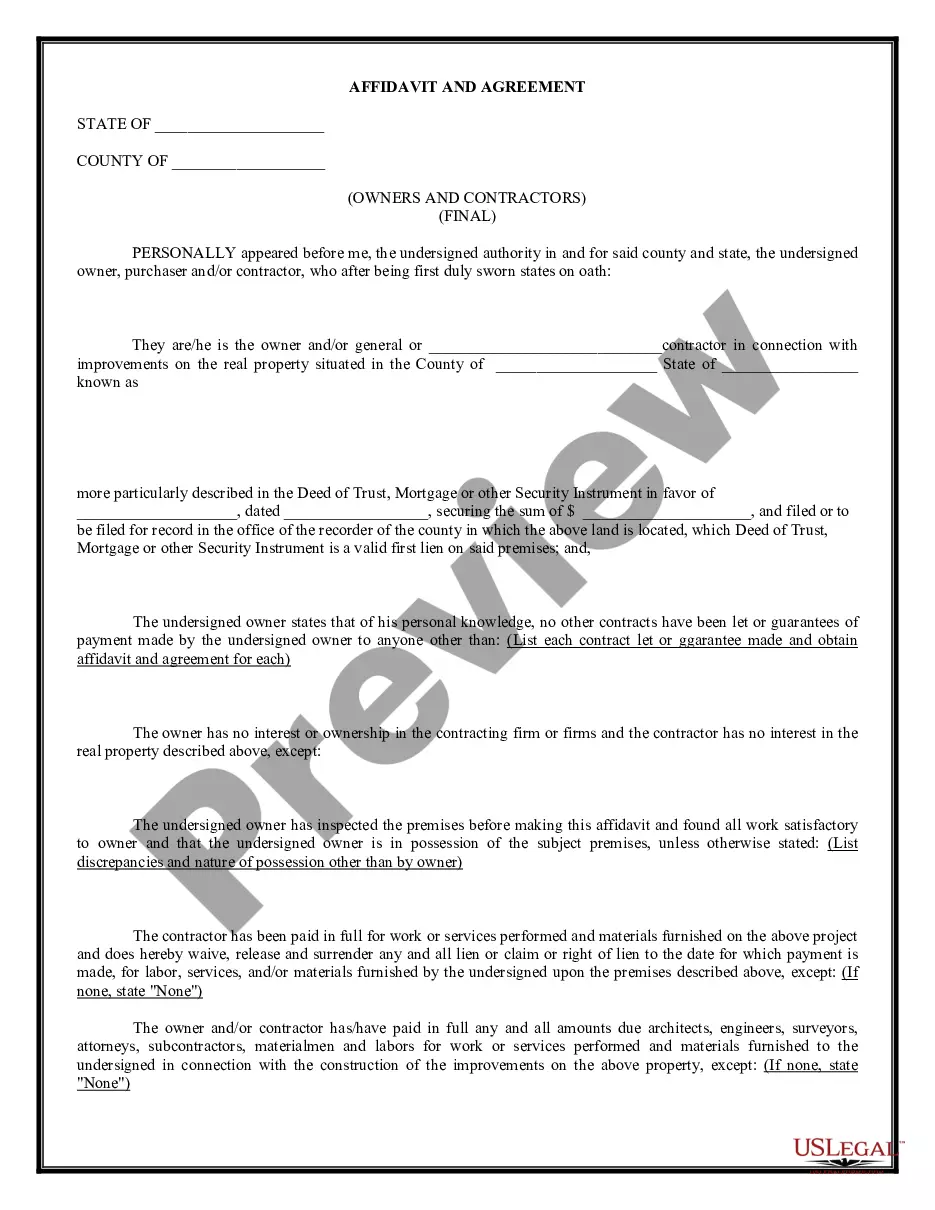

Pennsylvania Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Pennsylvania Contractor's Affidavit of Payment to Subs within minutes.

If you already have a subscription, Log In to access the Pennsylvania Contractor's Affidavit of Payment to Subs in the US Legal Forms database. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Choose the file format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Pennsylvania Contractor's Affidavit of Payment to Subs. Every template you added to your account has no expiration date and belongs to you permanently. So, if you wish to download or print another copy, just navigate to the My documents section and click on the form you need. Gain access to the Pennsylvania Contractor's Affidavit of Payment to Subs with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- To use US Legal Forms for the first time, follow these simple steps.

- Ensure you have selected the correct form for your city/county.

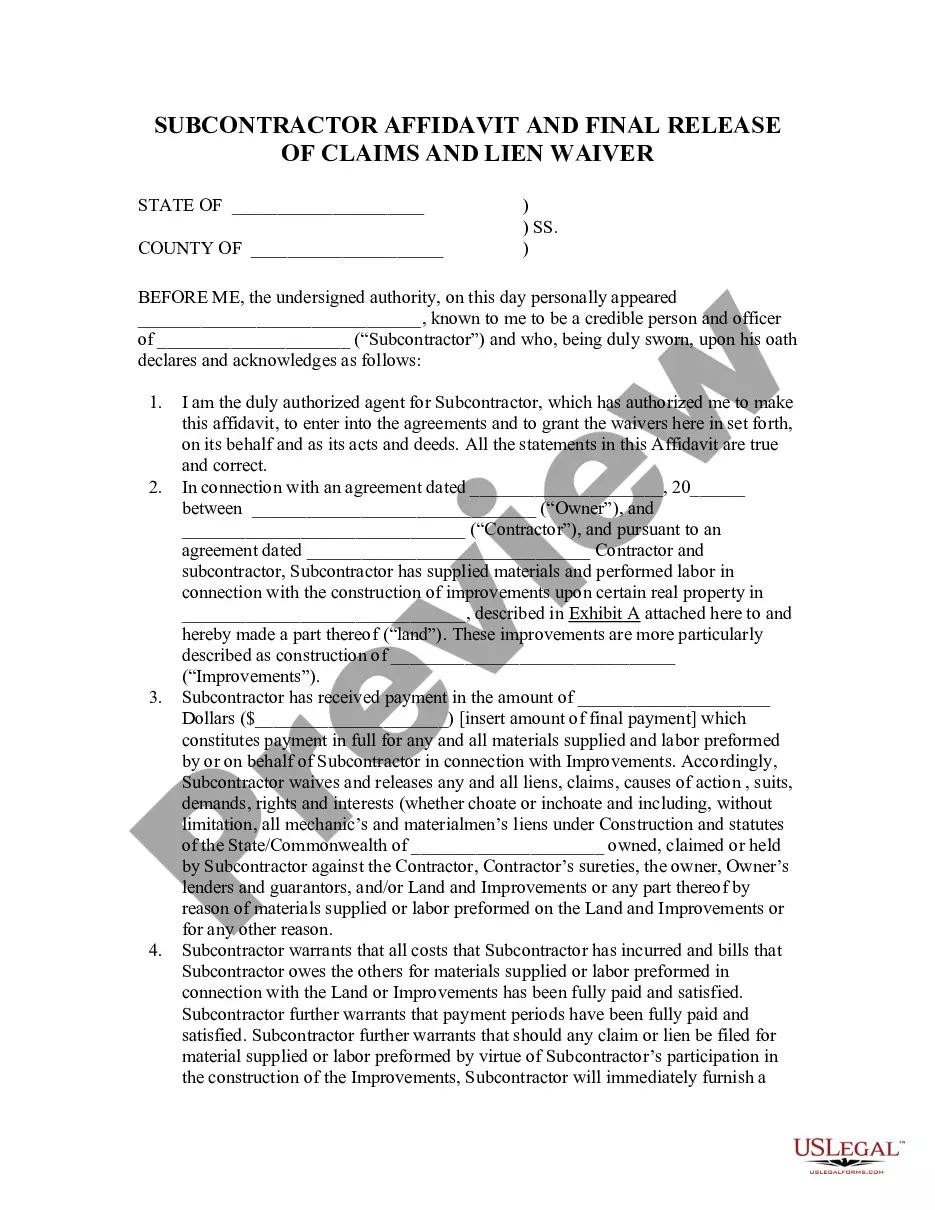

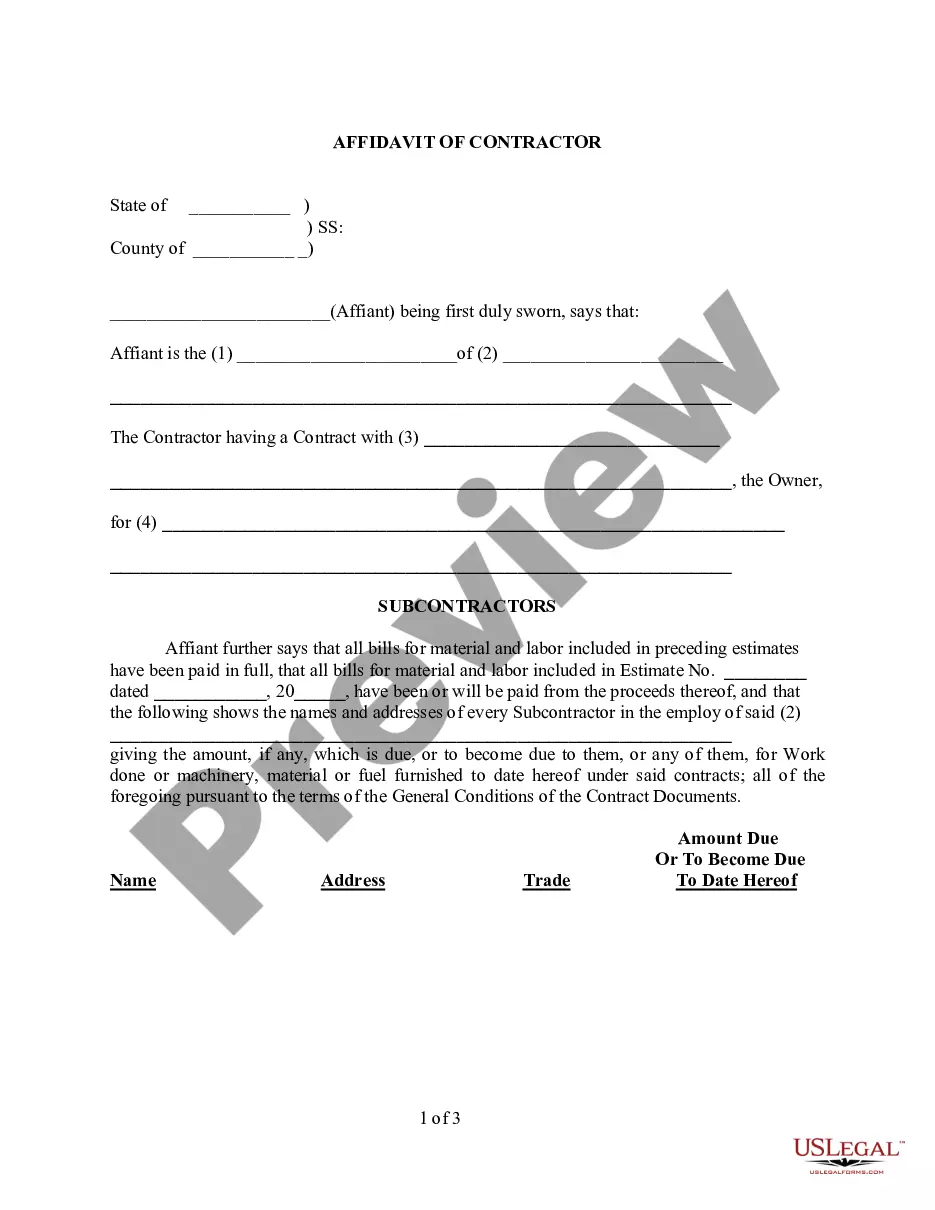

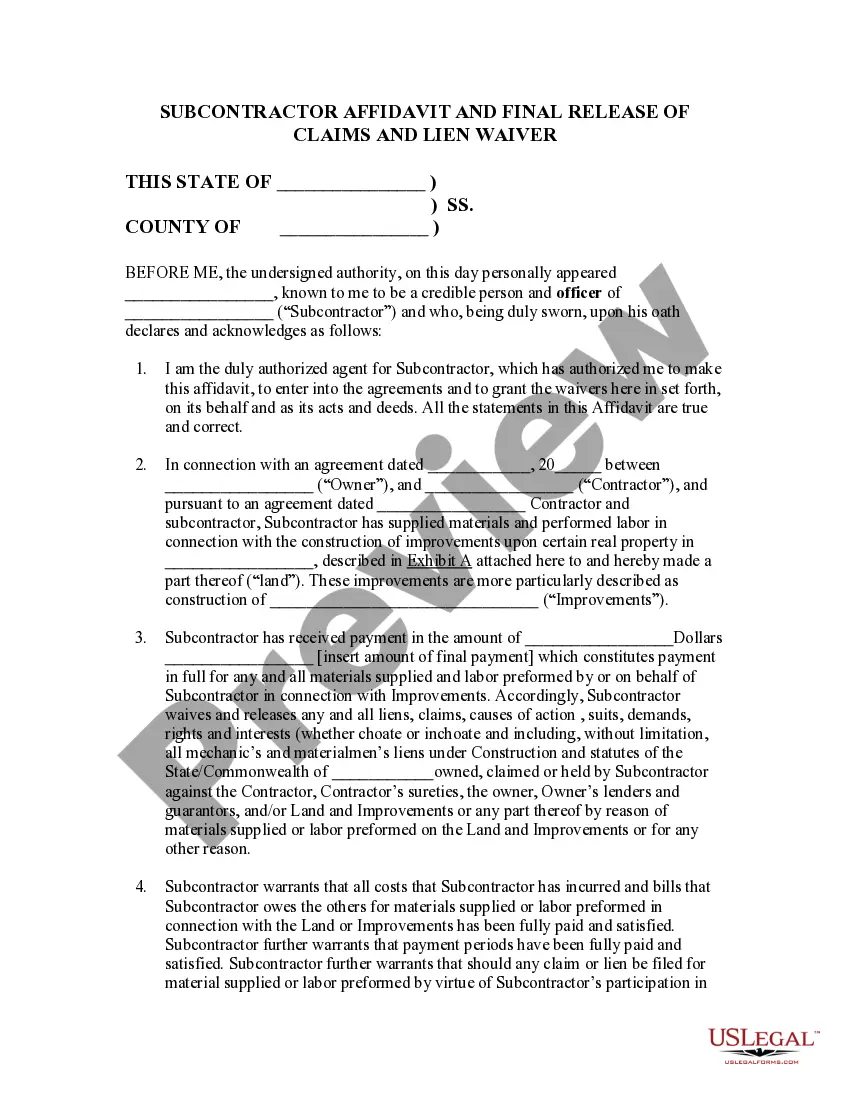

- Click on the Review button to examine the content of the form.

- Read the form description to ensure that you have chosen the right type.

- If the form doesn't meet your needs, utilize the Search field at the top of the screen to find the suitable one.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, select the pricing plan that works for you and provide your information to create an account.

Form popularity

FAQ

In order to get paid, subcontractors need to issue invoices to the contractors they work for. Every invoice you issue needs to include some basic information, including: An invoice number: a unique code that follows a sequential order.

It is unfortunately common for a contractor to fail to pay a subcontractor within the agreed terms. If so, the subcontracting party is entitled to pursue debt collection action to recover what is owed to them.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

A general rule of contributory negligence is that a main contractor is not liable for the negligence of its independent subcontractor. There are some exceptions to this rule, including: The main contractor had actual knowledge that the sub-contractor's work had been done in a foreseeably dangerous way and condoned it.

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.

Can a Contractor Sue for Non-Payment? The short answer is yes. If you've exhausted all other means, you can bring the case to a small claims court. It's a good idea to speak to a lawyer first to see what your options are and whether it's worth it.

How to get paid (faster) on every construction projectGet licensed.Write a credit policy.Prequalify potential customers.Get the contract in writing.Collect information about the property and other parties.Track your deadlines.Send Preliminary Notice.Submit Detailed Pay Applications or Invoices.More items...?

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

A direct payment clause says that if you have paid the main contractor for work done by subcontractors and your money is not passed on to them, you can pay the subcontractor directly and deduct the payment from any other monies due to the main contractor.