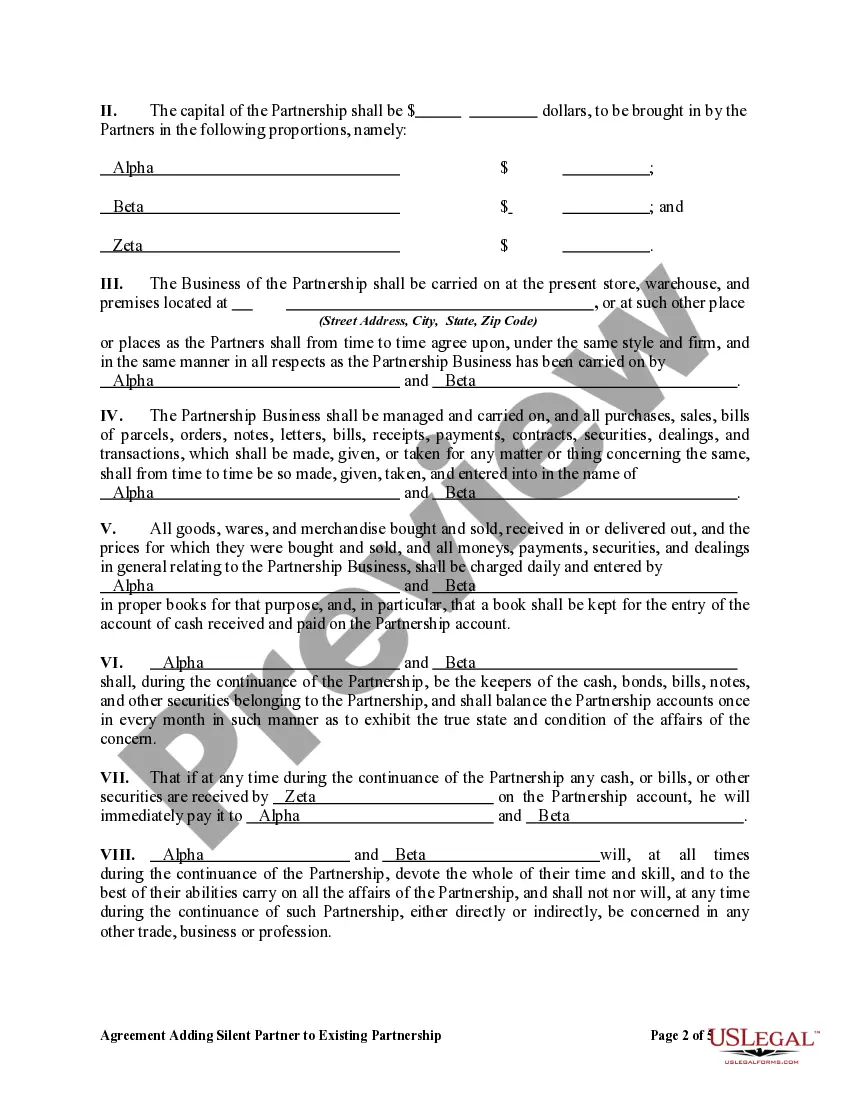

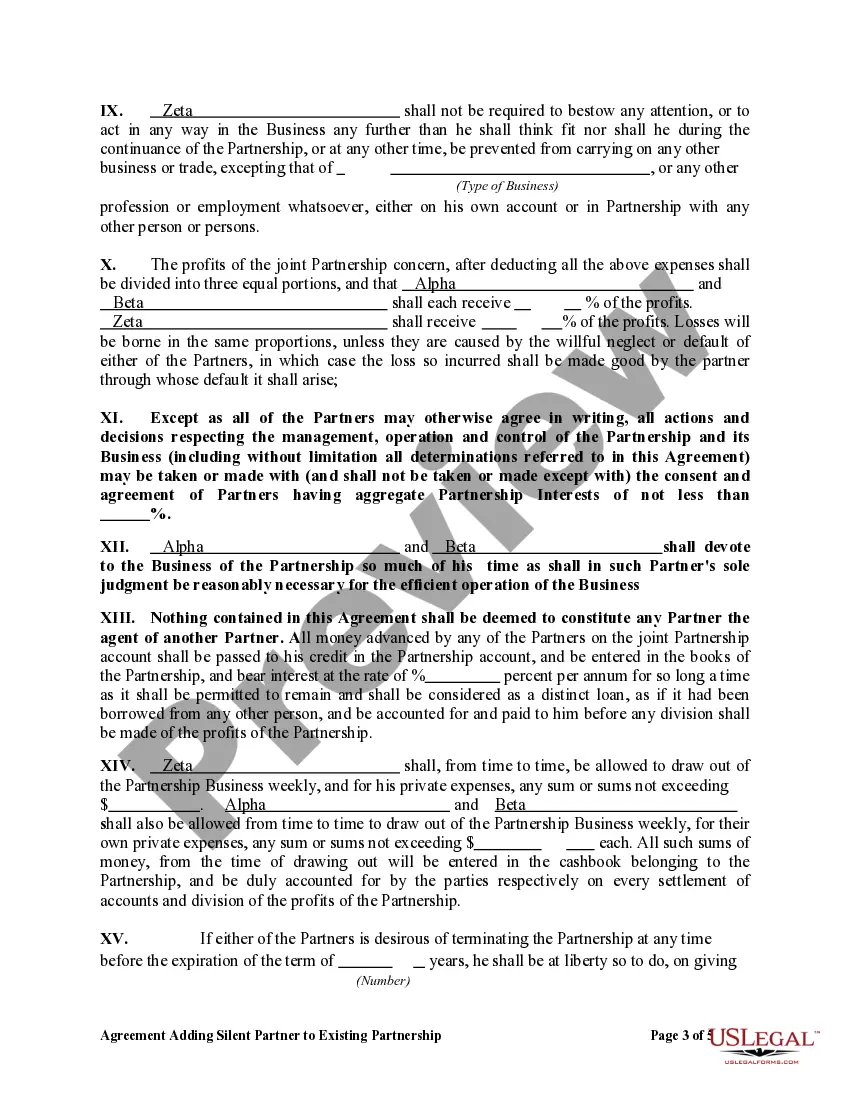

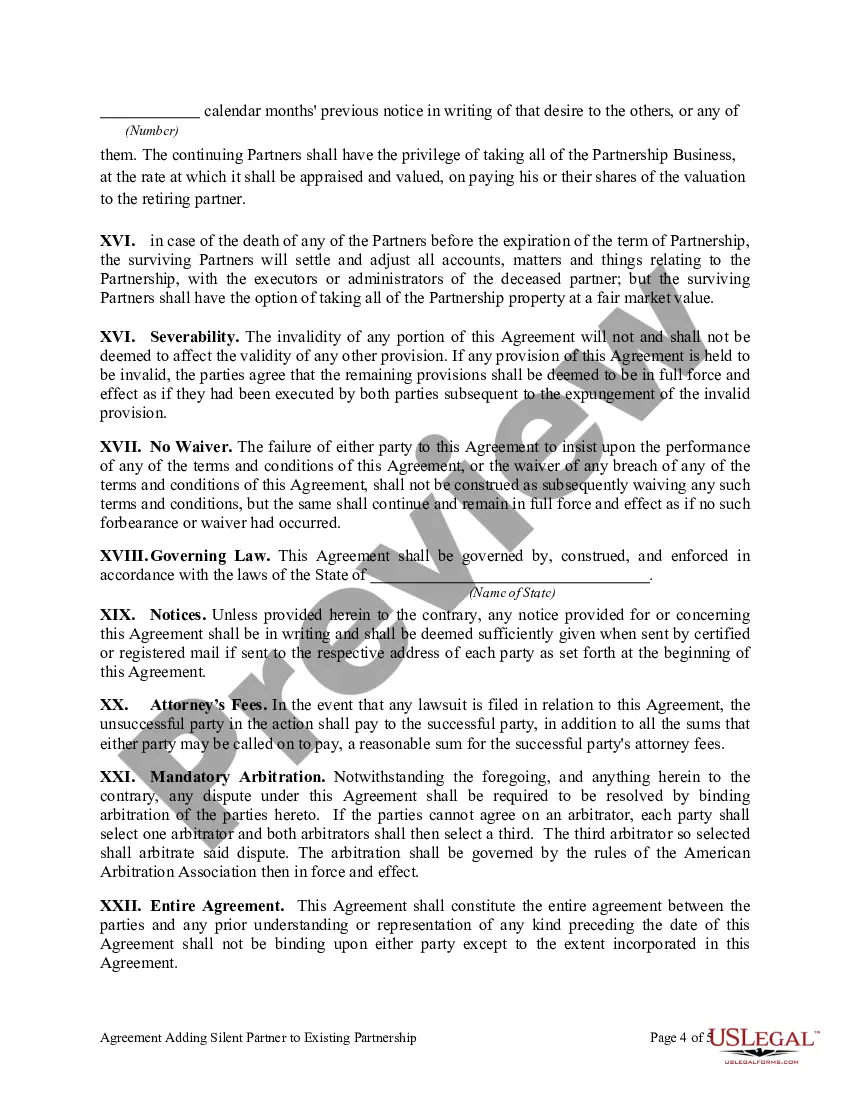

The Pennsylvania Agreement Adding Silent Partner to Existing Partnership refers to a legal document used in the state of Pennsylvania to elevate an existing partnership with the inclusion of a silent partner. This agreement is crucial for outlining the terms, conditions, and responsibilities of the new silent partner within the partnership structure. The purpose of this agreement is to provide a clear understanding between all partners involved and to mitigate any potential conflicts or misunderstandings that may arise during the addition of a silent partner. It ensures that all parties involved are aware of the rights and obligations of the silent partner, as well as the impact on the existing partnership. There are several types of Pennsylvania Agreement Adding Silent Partner to Existing Partnership, including: 1. General Partnership Agreement: This type of agreement governs the overall operations, roles, and responsibilities of the partnership. It outlines the rights and obligations of each partner, including the silent partner. 2. Silent Partner Agreement: This agreement specifically focuses on the rights, responsibilities, and limitations of the silent partner. It may include provisions related to capital contributions, profit distribution, and decision-making authority. 3. Capital Contribution Agreement: In cases where the silent partner is required to make a financial contribution to the partnership, a capital contribution agreement may be necessary. This agreement specifies the amount and terms of the investment made by the silent partner. 4. Profit Distribution Agreement: This type of agreement determines how the profits of the partnership will be distributed among the partners, including the newly added silent partner. It may outline the percentage shares or any other agreed-upon method for the distribution. 5. Authority and Decision-Making Agreement: In the case of a silent partner, it is essential to clarify their role in decision-making processes. This agreement outlines the extent of the silent partner's authority and involvement in partnership decisions, including any voting rights they may possess. When drafting a Pennsylvania Agreement Adding Silent Partner to Existing Partnership, it is crucial to include key components such as the names and contact details of all partners, the purpose and duration of the partnership, the silent partner's capital contribution (if applicable), and their share in profits and losses. Additionally, the agreement should address the silent partner's participation in decision-making, the process for resolving disputes, and any provisions for modification or termination of the agreement. It is recommended to consult with a qualified attorney during the creation of a Pennsylvania Agreement Adding Silent Partner to Existing Partnership to ensure all legal requirements and considerations are met.

Pennsylvania Agreement Adding Silent Partner to Existing Partnership

Description

How to fill out Pennsylvania Agreement Adding Silent Partner To Existing Partnership?

Are you in a place where you need papers for both enterprise or personal uses almost every time? There are a variety of legitimate document themes available on the Internet, but finding ones you can trust is not simple. US Legal Forms offers a huge number of form themes, just like the Pennsylvania Agreement Adding Silent Partner to Existing Partnership, that are published to satisfy federal and state demands.

In case you are presently familiar with US Legal Forms web site and also have an account, basically log in. Following that, it is possible to download the Pennsylvania Agreement Adding Silent Partner to Existing Partnership format.

If you do not come with an accounts and need to begin using US Legal Forms, adopt these measures:

- Find the form you need and ensure it is for your correct area/area.

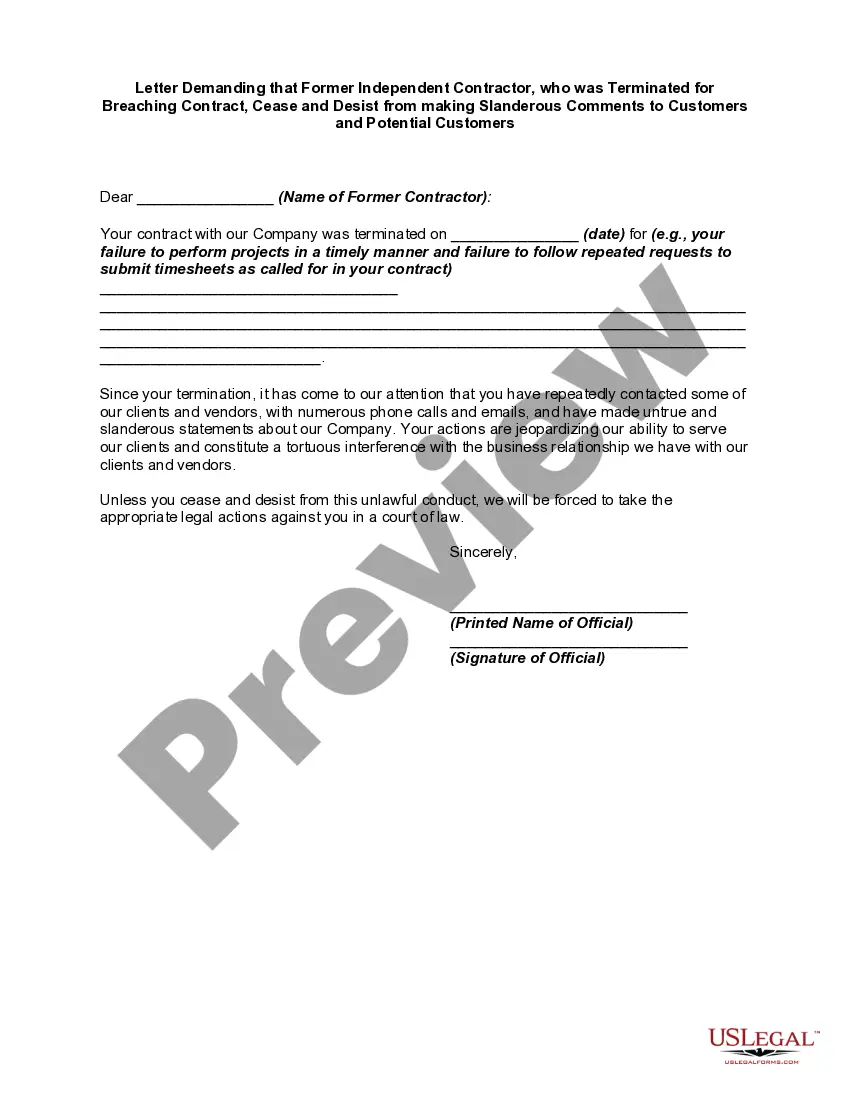

- Use the Preview button to review the form.

- Look at the description to ensure that you have chosen the appropriate form.

- If the form is not what you`re looking for, utilize the Research area to find the form that meets your needs and demands.

- When you get the correct form, just click Get now.

- Pick the rates plan you desire, complete the specified details to create your bank account, and purchase the order making use of your PayPal or bank card.

- Select a practical file file format and download your version.

Get each of the document themes you might have purchased in the My Forms menu. You can get a more version of Pennsylvania Agreement Adding Silent Partner to Existing Partnership anytime, if required. Just select the needed form to download or printing the document format.

Use US Legal Forms, probably the most extensive assortment of legitimate kinds, to conserve efforts and stay away from mistakes. The services offers skillfully created legitimate document themes that you can use for a variety of uses. Create an account on US Legal Forms and begin making your life a little easier.