Pennsylvania Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

You can spend time online attempting to locate the appropriate legal document format that meets your state and federal requirements.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can download or print the Pennsylvania Exchange Addendum to Contract - Tax Free Exchange Section 1031 from their service.

If available, utilize the Review option to browse through the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can fill out, modify, print, or sign the Pennsylvania Exchange Addendum to Contract - Tax Free Exchange Section 1031.

- Each legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any acquired form, navigate to the My documents section and click the corresponding option.

- If it's your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the county/city of your choice.

- Review the form details to ensure you have chosen the right document.

Form popularity

FAQ

If the sale of your Relinquished Property closed on or between October 18, 2021 and December 31, 2021, the standard 180-day exchange period will be shortened. However, you can file for a tax extension by April 15, 2022 to obtain a full 180-day exchange period.

As we begin 2019, Pennsylvania is still the only state that does not fully recognize I.R.C. Section 1031 tax deferred exchanges because it does not follow federal taxation principles for its Personal Income Tax (PIT).

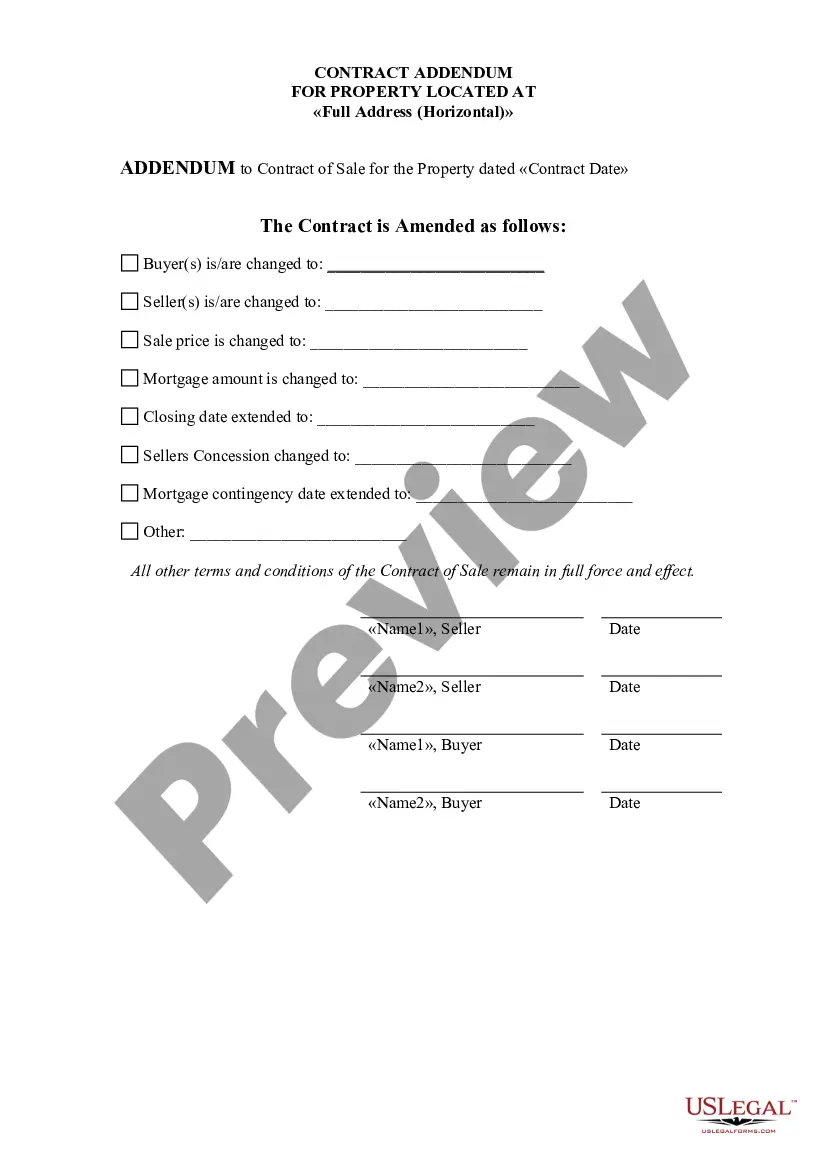

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

Tom: The short answer is yes. Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state. We regularly are dealing with transactions from our home state of Oregon and into California, Washington, and vice versa.

Pennsylvania makes no provision for capital gains. There are no provisions for long-term and short-term gains. Losses are recognized only in the year in which some identifiable event closes and completes the transaction and fixes the amount of loss so there is no possibility of any recovery.

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

PA has long been one of the few states that does not recognize 1031 exchanges or have a similar provision to allow the deferral of state income tax on the exchange of assets held for business use or investment. As you know, a 1031 exchange is a strategy allowed under Internal Revenue Code Section 1031.

For instance, when an installment sale includes seller financing for which the seller wishes to complete a 1031 exchange but will be receiving some or all of the buyer's installment payments beyond the 180 day window for concluding the exchange.

Notes and the 1031 ExchangeThough a contract sale can be incorporated in an exchange, it may not be possible to accomplish this goal all the time. In order for a note to be used in an exchange, you, the Exchangor, must not have actual or constructive receipt of the note.

For a Section 1031 exchange, it is imperative that the purchase and sale contracts for both parties be assignable.