A Pennsylvania Deed of Trust — Multistate is a legal document that serves as a security instrument in real estate transactions in the state of Pennsylvania. This document is required when a borrower obtains a loan to purchase a property and pledges the property as collateral to secure the loan. The Pennsylvania Deed of Trust — Multistate contains several important provisions and details regarding the terms and conditions of the loan, the obligations of the borrower, and the rights of the lender. Some relevant keywords that may be associated with this document include: 1. Property description: The deed of trust provides a detailed description of the property being pledged as collateral, including its address, legal description, and parcel identification number. 2. Parties involved: It identifies the parties involved in the agreement, such as the borrower (also known as the trust or), the lender (also known as the beneficiary), and the trustee. The trustee is typically a neutral third party who holds the legal title to the property until the loan is repaid. 3. Loan terms: The deed of trust outlines the terms of the loan, including the loan amount, interest rate, repayment period, and any applicable fees or charges. It may also specify the consequences of default, such as foreclosure. 4. Escrow provisions: If the borrower agrees to an escrow arrangement, the deed of trust may include provisions for the lender to collect additional funds to cover property taxes, insurance premiums, and other related expenses. 5. Covenants: The document may include certain promises and covenants by the borrower, such as maintaining adequate insurance coverage, not encumbering the property with additional liens, and keeping the property in good condition. It is important to note that while the Pennsylvania Deed of Trust — Multistate is a standardized document, there may be variations or types specific to different counties in Pennsylvania. Some variations may include county-specific requirements or additional provisions tailored to local laws and regulations. These variations may be named after the respective county, such as "Philadelphia County Deed of Trust — Multistate" or "Allegheny County Deed of Trust — Multistate."

Pennsylvania Deed of Trust - Multistate

Description

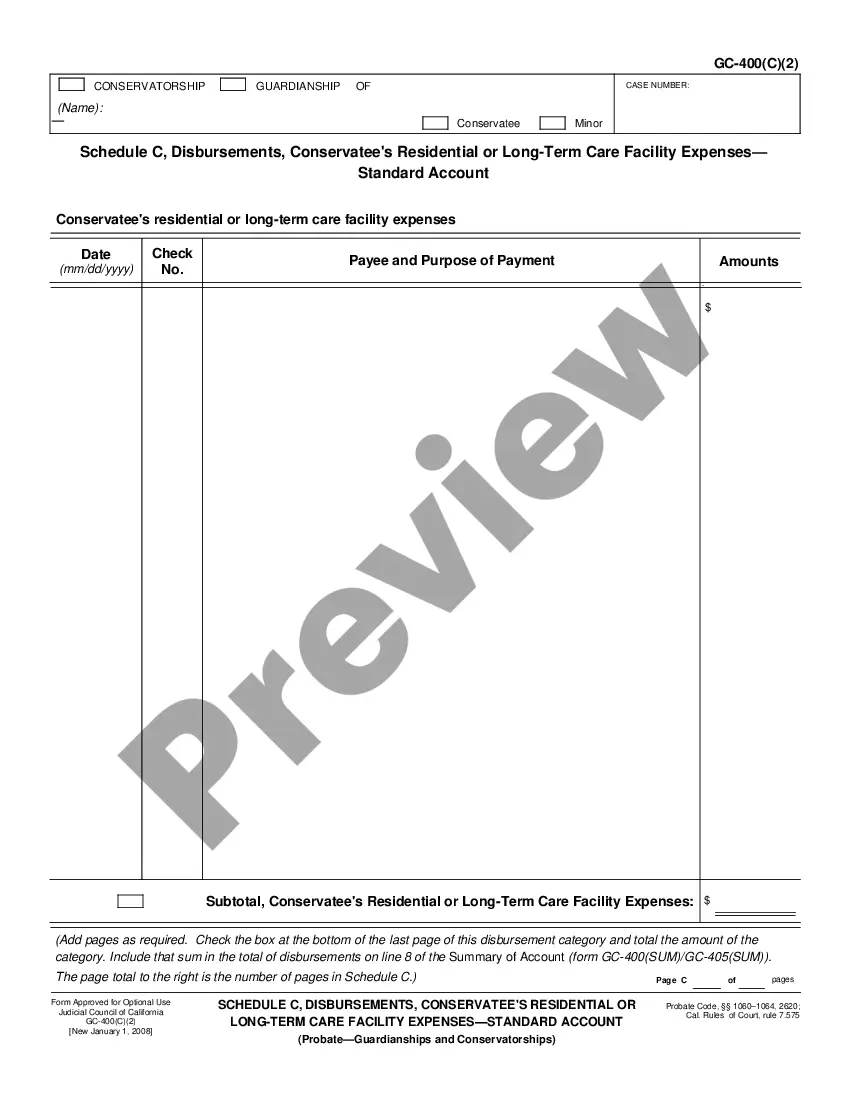

How to fill out Pennsylvania Deed Of Trust - Multistate?

You can invest time on-line searching for the legitimate papers format that meets the federal and state requirements you want. US Legal Forms provides a huge number of legitimate varieties that happen to be examined by pros. You can actually obtain or print the Pennsylvania Deed of Trust - Multistate from my support.

If you already have a US Legal Forms profile, you may log in and click on the Obtain switch. Next, you may comprehensive, revise, print, or sign the Pennsylvania Deed of Trust - Multistate. Every legitimate papers format you purchase is your own eternally. To have one more copy for any obtained form, visit the My Forms tab and click on the related switch.

If you use the US Legal Forms website initially, stick to the straightforward instructions below:

- Initially, be sure that you have selected the best papers format for your county/city of your choice. See the form description to ensure you have chosen the correct form. If accessible, use the Review switch to check from the papers format too.

- If you want to locate one more edition of the form, use the Search area to get the format that meets your requirements and requirements.

- When you have located the format you want, simply click Buy now to move forward.

- Choose the costs program you want, type in your references, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You can use your charge card or PayPal profile to pay for the legitimate form.

- Choose the structure of the papers and obtain it to your system.

- Make changes to your papers if necessary. You can comprehensive, revise and sign and print Pennsylvania Deed of Trust - Multistate.

Obtain and print a huge number of papers layouts while using US Legal Forms web site, that offers the largest variety of legitimate varieties. Use specialist and state-distinct layouts to tackle your small business or person requires.

Form popularity

FAQ

In Pennsylvania, a living trust is a legal agreement in which the testator's assets, including bank accounts, home, securities, etc., can be transferred and handled by an individual, including the testator, or corporation, such as a trust or bank.

Focusing on this geographical region, the Deed of Trust is the preferred or required security instrument for real property in the following states: Maryland, North Carolina, Tennessee, Virginia and West Virginia. Mortgages are used in Kentucky, Ohio and Pennsylvania.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Pennsylvania Deed of Trust Form. Use our Deed of Trust to create a contract in which a third-party holds property until a borrower pays back debt to the lender. With a deed of trust, a lender loans money to a borrower to purchase a home or other property.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Except as otherwise provided in the instrument, title to real and personal property may be held in the name of the trust, without in any manner diminishing the rights, powers and duties of the trustees as provided in subsection (a).

Focusing on this geographical region, the Deed of Trust is the preferred or required security instrument for real property in the following states: Maryland, North Carolina, Tennessee, Virginia and West Virginia. Mortgages are used in Kentucky, Ohio and Pennsylvania.