Pennsylvania Demand for Collateral by Creditor

Description

How to fill out Demand For Collateral By Creditor?

Are you in a situation where you frequently require documents for both business or personal purposes.

There is an array of legal document templates available online, but finding reliable versions is not straightforward.

US Legal Forms offers thousands of template options, including the Pennsylvania Demand for Collateral by Creditor, designed to meet federal and state requirements.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can acquire another copy of the Pennsylvania Demand for Collateral by Creditor at any time, if needed. Simply click the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Pennsylvania Demand for Collateral by Creditor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

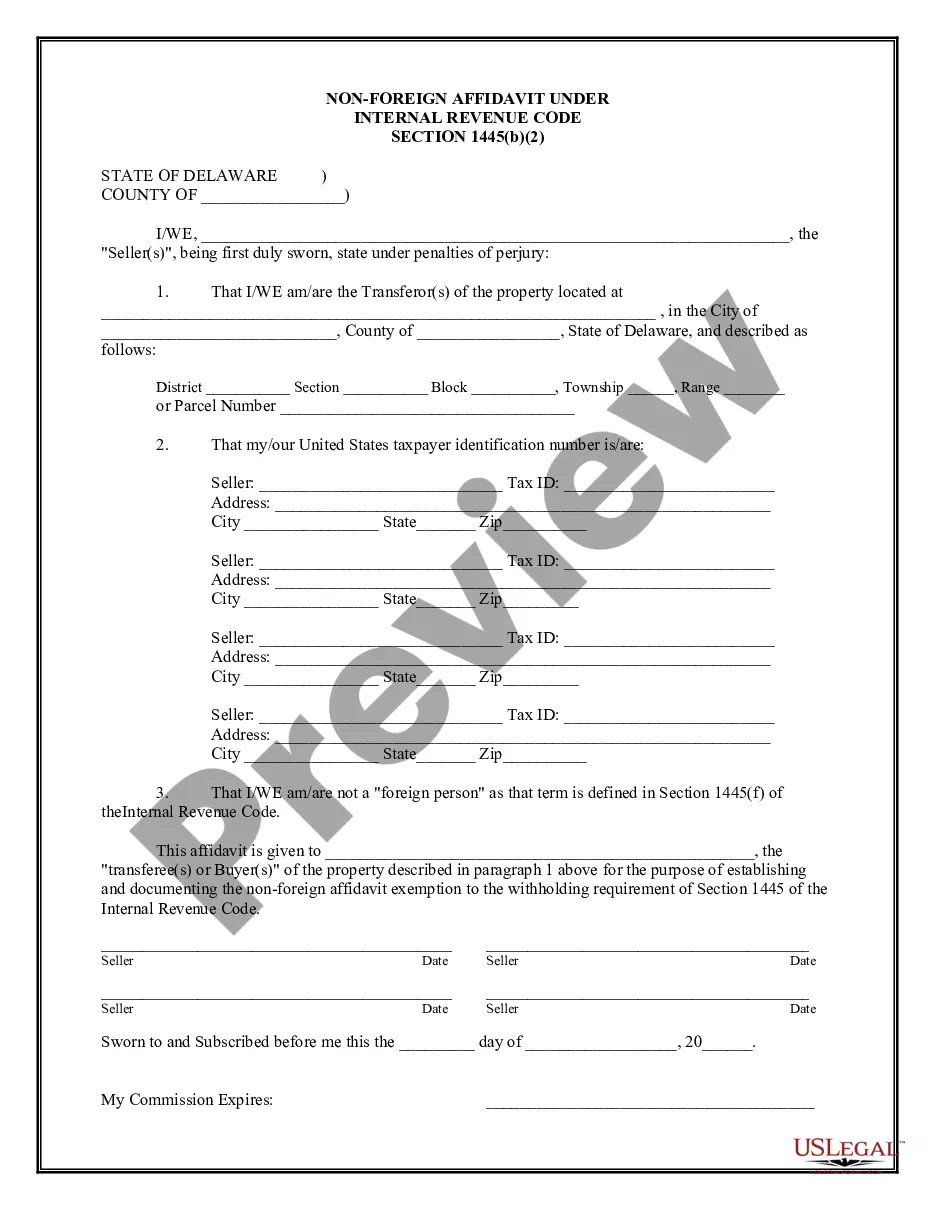

- Use the Preview option to review the form.

- Read the description to confirm that you have selected the right document.

- If the form isn’t what you’re looking for, take advantage of the Search bar to find the template that meets your requirements.

- Once you obtain the right form, click Buy now.

- Select the pricing plan you desire, provide the necessary details to create your account, and complete your purchase using your PayPal or credit card.

Form popularity

FAQ

Yes, the debtor retains certain rights in the collateral even after it has been pledged. This includes the right to use the collateral in most circumstances unless otherwise agreed upon. Knowing these rights is essential, especially when addressing a Pennsylvania Demand for Collateral by Creditor situation.

Creditor debtors have several rights, including the right to receive timely information about the status of their debt and the right to dispute any inaccuracies. Additionally, they may seek fair repayment terms or negotiate collateral terms. Familiarizing yourself with these rights can help in understanding the Pennsylvania Demand for Collateral by Creditor process.

One requirement for a creditor to have an enforceable security interest is that the security agreement must be in writing and signed by the debtor. This ensures that both parties understand the terms and rights associated with the collateral. Understanding this aspect is vital when navigating the Pennsylvania Demand for Collateral by Creditor.

The right to redeem collateral allows a debtor to reclaim their pledged property by paying off the outstanding debt. This right ensures that debtors have a chance to recover their goods before the creditor takes further action. In Pennsylvania, knowing this right is crucial when dealing with a Pennsylvania Demand for Collateral by Creditor.

Yes, a lender or creditor can obtain a security interest in consumer goods through a security agreement. This process allows them to claim rights over the goods in case the debtor defaults. The Pennsylvania Demand for Collateral by Creditor highlights how creditors can secure their interests and protect their assets effectively.

The process by which a security interest becomes enforceable typically involves attachment and perfection. Attachment occurs when the creditor has a security agreement, value is given, and the debtor has rights in the collateral. Perfection can happen through filing a UCC financing statement. For step-by-step instructions, consider using resources from US Legal Forms to guide you in filing correctly.

The right a creditor has to use collateral for recovering a debt is called 'recourse.' This right allows creditors to seize and sell the collateral in case of default. Understanding this concept is vital for any creditor seeking to enforce their Pennsylvania Demand for Collateral by Creditor. US Legal Forms can help clarify these rights through detailed documentation.

Possession of collateral refers to the actual physical control a creditor has over the secured asset. In essence, it allows the creditor to hold the collateral in case the debtor defaults on payment. Proper possession is crucial for enforcing your rights and ensuring compliance with the Pennsylvania Demand for Collateral by Creditor. For clarity, consult legal forms and templates.

The right to take possession of collateral prior to repayment is known as the right of 'repossession.' This right allows creditors to reclaim collateral if the debtor defaults on their obligations. It's important to follow legal procedures, as improper repossession can lead to disputes. Resources like US Legal Forms provide useful templates to navigate these situations.

Enforcing a UCC lien involves a few steps, including notifying the debtor about the outstanding debt and your intention to reclaim collateral. If the debtor fails to respond or settle the debt, you may proceed to seize the collateral following the guidelines set in the UCC. Staying informed about the legal requirements in Pennsylvania ensures that your demand for collateral by creditor is compliant and effective.