A Pennsylvania Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legally binding contract between an employer and a self-employed individual in the state of Pennsylvania. This agreement outlines the terms and conditions of employment where the compensation is based on a percentage of sales made by the contractor. In this type of agreement, the contractor is considered self-employed and acts as an independent contractor rather than an employee. They have more autonomy and flexibility in determining their work schedule and the methods they used to achieve sales targets. The contractor is responsible for their own taxes, social security contributions, and other statutory obligations. The Pennsylvania Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor generally includes the following key elements: 1. Parties: The agreement identifies the employer, who engages the services of the contractor, and the contractor, who provides their services in exchange for compensation based on a percentage of sales. 2. Scope of Work: This section defines the specific role and responsibilities of the contractor. It may outline the products or services they will be selling, the target market or territory, and any sales goals or quotas they need to achieve. 3. Compensation: The agreement details how the contractor will be compensated. Typically, the compensation is based on a percentage of the sales they generate. This section may also specify the payment frequency and any additional commissions, bonuses, or incentives that may apply. 4. Term and Termination: The length of the agreement is specified here, including the start and end dates. It may also include provisions for terminating the agreement before the end date, such as by providing notice or for cause. 5. Intellectual Property: If applicable, this section addresses ownership and usage rights of any intellectual property developed or used during the course of employment. 6. Confidentiality and Non-Compete: This section may include provisions to protect the employer's confidential information and trade secrets, as well as restrictions on the contractor's ability to compete with the employer during and after the employment period. 7. Governing Law: The agreement may specify that it is governed by the laws of Pennsylvania, ensuring that any disputes are resolved according to Pennsylvania statutes. Other types of Pennsylvania Employment Agreements — Percentage of Sale— - Self-Employed Independent Contractor may include variations in compensation structures, such as tiered commission rates based on sales volume or different commission structures for different product lines or services. The specific terms and conditions of these agreements may vary depending on industry, business size, and individual negotiation.

Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

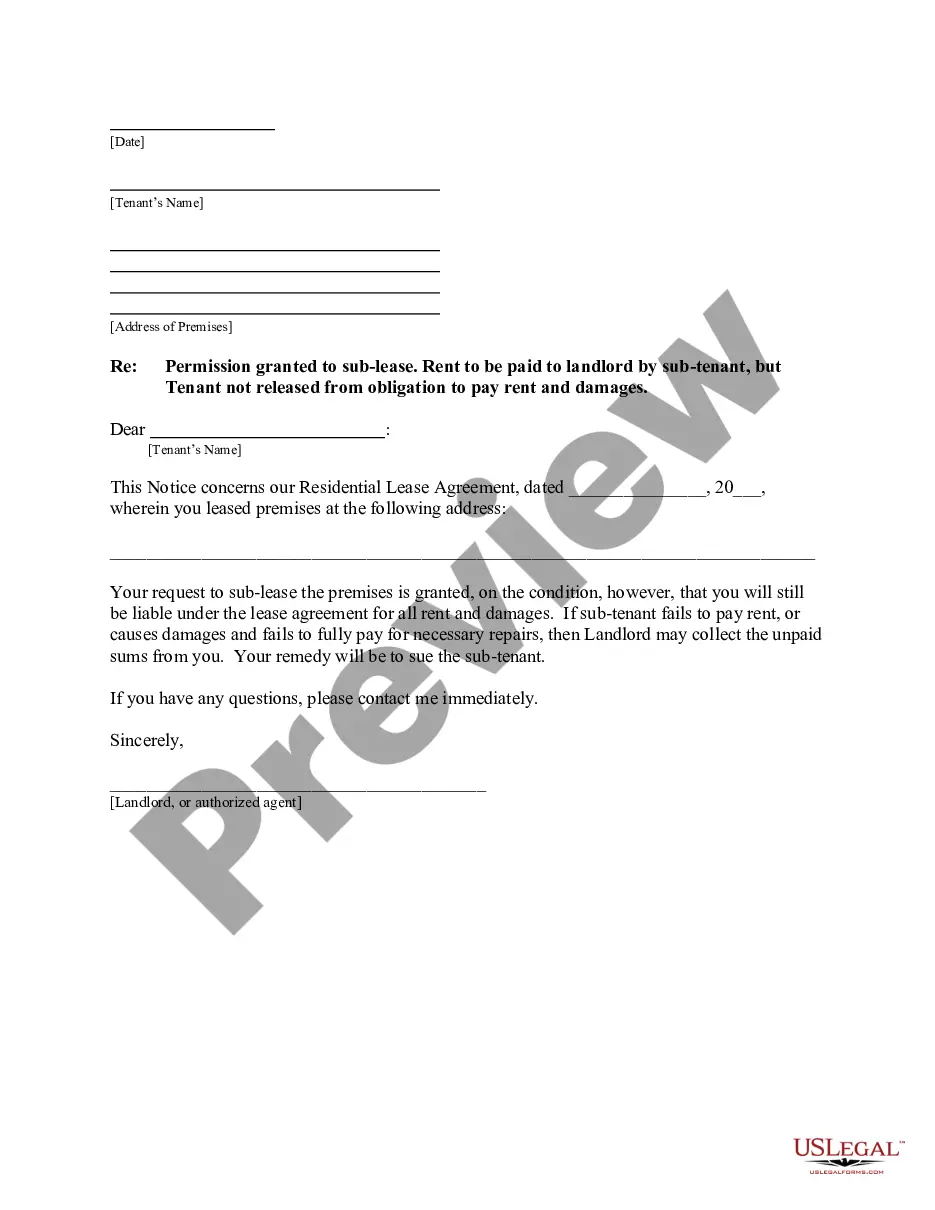

How to fill out Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

You have the capability to spend hours online searching for the legal document format that satisfies both state and federal requirements you will need.

US Legal Forms provides a vast array of legal templates that have been evaluated by experts.

It is easy to download or print the Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor from my service.

If available, utilize the Preview button to look through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Next, you can complete, modify, print, or sign the Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

- Every legal document format you buy is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the region/city of your choice.

- Review the form description to ensure you have selected the correct form.

Form popularity

FAQ

The percentage an independent contractor should earn often depends on the industry, services provided, and market demand. Generally, a contractor should aim for compensation that reflects their labor, skills, and the value they bring to their clients. Utilizing a Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor can help define terms, ensuring you receive a fair percentage that aligns with your contributions.

The 2-year contractor rule refers to an IRS guideline that addresses the classification of independent contractors. If a contractor works for the same client for over two years, the relationship may raise questions regarding their classification for tax purposes. Properly structured Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor arrangements help clarify these roles, ensuring compliance while protecting your interests.

The ratio of employees to contractors can fluctuate significantly across industries and organizations. In many cases, businesses utilize contractors to fill specific roles without the long-term commitment of hiring employees. Embracing a Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor can attract talent and keep staffing costs flexible while benefiting both parties involved.

Determining your hourly rate as a 1099 contractor can vary based on your industry and expertise. Generally, consider factors such as the demand for your skills, your experience, and the market rate in Pennsylvania. It is crucial to research current trends related to the Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor to establish a competitive rate that reflects your value.

The tax rate for self-employed individuals receiving Form 1099 is similar to regular income tax rates and includes self-employment tax at 15.3%. This means you'll need to consider the combined tax obligation when determining net earnings. Understanding this can guide independent contractors in structuring their Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor effectively.

To write an independent contractor agreement, start by clearly defining the scope of work, payment terms, and timelines. Include essential clauses, such as confidentiality and termination conditions, to protect both parties. Utilizing platforms like uslegalforms can streamline this process, helping you formulate a strong Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

As a rule of thumb, independent contractors should set aside about 25-30% of their income for taxes. This accounts for federal, state, and self-employment taxes. Planning ahead in this manner will assist in maintaining financial security and responsibility when fulfilling requirements of a Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

The self-employment tax rate for independent contractors remains at 15.3%. This covers both employer and employee contributions to Social Security and Medicare. Knowing this tax rate helps independent contractors effectively manage finances and obligations when creating a Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

Self-employment tax is generally 15.3%, which consists of Social Security and Medicare taxes. This tax applies to net earnings from self-employment for independent contractors. It's important to understand this percentage, especially when drafting a Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

The percentage that an independent contractor earns typically relates to the services they provide or the sales they generate. This percentage can be part of a negotiated commission structure reflected in the contract. When establishing your Pennsylvania Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, it’s important to determine a fair percentage that recognizes your contribution while meeting the client’s needs. This can lead to successful long-term working relationships.

Interesting Questions

More info

Our job is to help you write an agreement which fulfills your needs and meets your financial needs, such as health, retirement, and legal. We will advise you on how to write a legally binding contract, and provide you with free templates and detailed instructions for creating your own unique contracts.