A Pennsylvania Financial Statement Form — Husband and Wife Joint is a legal document that allows married couples in Pennsylvania to disclose their financial status during divorce proceedings or other legal matters. This form is used to provide a comprehensive overview of the couple's assets, liabilities, income, and expenses, which helps determine the division of marital property, spousal support, child support, and other financial obligations. The Pennsylvania Financial Statement Form — Husband and Wife Joint is designed to ensure transparency and fairness in legal proceedings by outlining the financial details of both spouses. It requires the disclosure of various financial information, including: 1. Personal Information: The form begins with the spouses' names, addresses, contact details, and their marriage date. This section helps establish the identity and marital status of the couple. 2. Income and Employment: This section requires both spouses to disclose their employment details, such as their current jobs, employers' names, and addresses. It also asks for information regarding any additional sources of income, including investments, rental properties, or business ownership. 3. Assets: This section requires a detailed listing of all assets owned by both spouses, such as real estate properties, vehicles, bank accounts, retirement accounts, stocks, and bonds. Each asset's estimated value and any liabilities associated with it need to be provided as well. 4. Debts and Liabilities: This section includes the disclosure of any outstanding debts, loans, mortgages, or credit card balances held by either spouse individually or jointly. Debts incurred during the marriage are considered marital debts and may be subject to division. 5. Monthly Expenses: Both partners are required to disclose their monthly expenses, including housing costs, utilities, food, transportation, healthcare, childcare, and any other significant expenses. This information helps determine each spouse's standard of living and financial needs. Different variations of the Pennsylvania Financial Statement Form — Husband and Wife Joint may exist based on the specific court jurisdiction or the purpose of the financial statement. For example, certain counties in Pennsylvania might have their own customized forms, although the core information required remains the same. Overall, the Pennsylvania Financial Statement Form — Husband and Wife Joint plays a critical role in divorce and family law matters, helping to ensure a fair and equitable resolution by providing a comprehensive snapshot of the couple's financial status. It serves as an essential tool to aid the court in making informed decisions regarding property division, support payments, and other financial aspects of the divorce process.

Pennsylvania Financial Statement Form - Husband and Wife Joint

Description

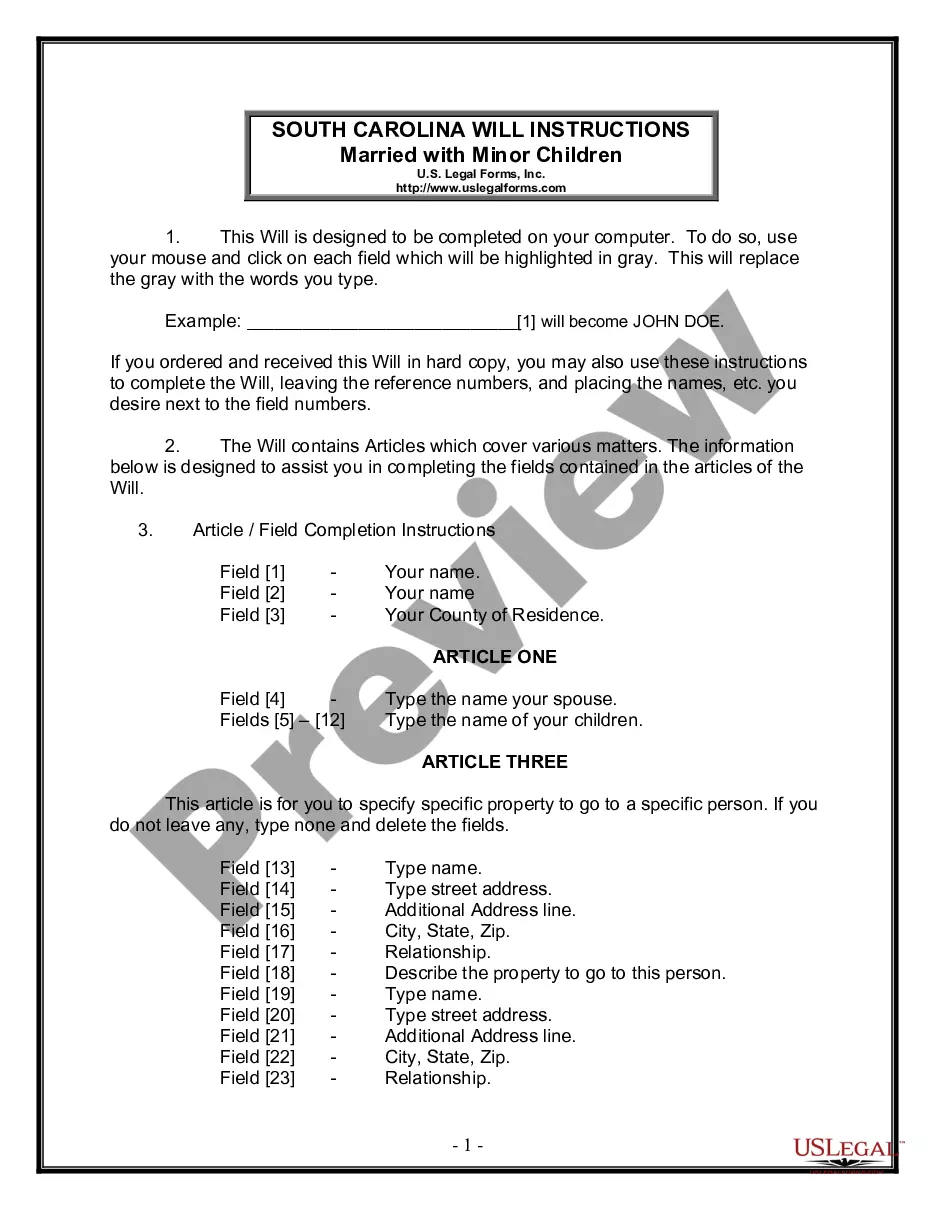

How to fill out Pennsylvania Financial Statement Form - Husband And Wife Joint?

Finding the correct legitimate document template can be a struggle.

Of course, there are numerous templates accessible online, but how will you acquire the authentic type you desire? Utilize the US Legal Forms website.

The service provides a multitude of templates, including the Pennsylvania Financial Statement Form - Husband and Wife Joint, which can serve both business and personal purposes.

- All the forms are reviewed by experts and meet state and federal requirements.

- If you are already signed in, Log In to your account and then click the Obtain button to download the Pennsylvania Financial Statement Form - Husband and Wife Joint.

- Use your account to view the legal forms you have previously acquired.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you can follow.

- First, ensure you have selected the correct form for your area. You can browse the form using the Review button and read the form description to verify it is the right one for you.

Form popularity

FAQ

Box 1 on the 1099-R (Gross Distribution) is taxable unless the distribution is from a Pennsylvania-eligible plan or you retired after meeting the age conditions or years of service conditions of the plan. If this distribution is taxable, you may use the cost recovery method to determine the taxable portion.

Attach copies of Income Forms W-2s, 1099s, and other income documents to the front of your Form 1040. You should send your Tax Return through the US Postal Service with a method for delivery tracking. This way, you will know when the IRS receives your Tax Return.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

What do I need to file my taxes?Personal Information. Tax Identification Numbers are mandatory items on your checklist.Dependent(s) Information.Sources of Income.Employed.Unemployed.Self-Employed.Rental Income.Retirement Income.More items...

All copies of Forms W-2, 1099-R, 1099-MISC, 1099-NEC and any other documents reporting compensation must be included with the tax return. Form 1099-R Filing Tips have been added to the compensation instructions for taxpayers required to include those documents.

Use PA-40 Schedule O to report the amount of deductions for contributions to Medical Savings or Health Savings Ac- counts and/or the amount of contributions to an IRC Section 529 Qualified Tuition Program and/or IRC Section 529A Pennsylvania ABLE Savings Program by the taxpayer and/or spouse.

40 form is the Pennsylvania Department of Revenue's official paper form that the state's residents use to file state income taxes. Pennsylvania is one of the 41 U.S. states that require residents to pay a personal income tax each year.

Taxpayers can utilize a new online filing system to file their 2020 Pennsylvania personal income tax returns for free. Visit mypath.pa.gov to access the new system, which also allows taxpayers to make payments, view notices, update account information and find the answers to frequently asked questions.

Use PA-40 Schedule W-2S to report compensation received from employment, miscellaneous non-employee compensa- tion and taxable distributions from retirement plans. Use PA- 40 Schedule W-2S to record information regarding distributions from annuities taxable as interest income.