Pennsylvania Transfer of Property under the Uniform Transfers to Minors Act (TMA) is a legal provision that allows individuals to transfer assets to minors without establishing a formal trust or guardianship. This act provides a convenient way for parents or guardians to pass on property or financial assets to their children or beneficiaries. Under the Pennsylvania TMA, parents can transfer various types of property or assets to minors, including real estate, cash, investments, securities, and other valuable possessions. This transfer aims to set up a controlled, custodial account for the minor, managed by a custodian until the minor reaches the age of majority, usually 18 or 21 years old, depending on the state's laws. There are different types of Pennsylvania Transfer of Property under the TMA, which include: 1. Cash or Bank Account Transfers: Parents or guardians can transfer funds from their bank accounts to establish a custodial bank account for the minor. This account allows the custodian to manage the funds until the minor reaches the age of majority. 2. Real Estate Transfers: Pennsylvania TMA permits parents to transfer real estate properties, such as houses or land, to a minor. The custodian manages the property on behalf of the minor until they become of legal age. 3. Investment and Securities Transfers: Parents or guardians can transfer stocks, bonds, mutual funds, and other investment assets to a minor's TMA account. The custodian handles the management and decision-making regarding these investments until the minor comes of age. 4. Personal Property Transfers: Under the Pennsylvania TMA, parents can also transfer personal property, such as vehicles, jewelry, artwork, or valuable collectibles, to a minor. The custodian ensures the safekeeping and appropriate management of these assets until the minor reaches' adulthood. It's important to note that once the transfer is made, the property becomes irrevocable and legally belongs to the minor. However, the custodian retains control over the assets until the minor reaches the age of majority. Pennsylvania Transfer of Property under the TMA offers a practical and straightforward way to pass on property or financial assets to minors, providing them with a foundation for their future. It eliminates the need for complex legal arrangements and ensures that the custodian manages the assets in the best interest of the minor until they attain legal age.

Pennsylvania Transfer of Property under the Uniform Transfers to Minors Act

Description

How to fill out Pennsylvania Transfer Of Property Under The Uniform Transfers To Minors Act?

Have you been inside a placement where you need to have papers for sometimes enterprise or person reasons virtually every day? There are a variety of legitimate record layouts available on the net, but discovering ones you can rely on is not effortless. US Legal Forms gives a huge number of develop layouts, like the Pennsylvania Transfer of Property under the Uniform Transfers to Minors Act, that happen to be created to fulfill state and federal requirements.

In case you are presently acquainted with US Legal Forms website and also have an account, just log in. Afterward, you may download the Pennsylvania Transfer of Property under the Uniform Transfers to Minors Act format.

Should you not provide an bank account and would like to begin to use US Legal Forms, follow these steps:

- Find the develop you require and ensure it is for that right metropolis/area.

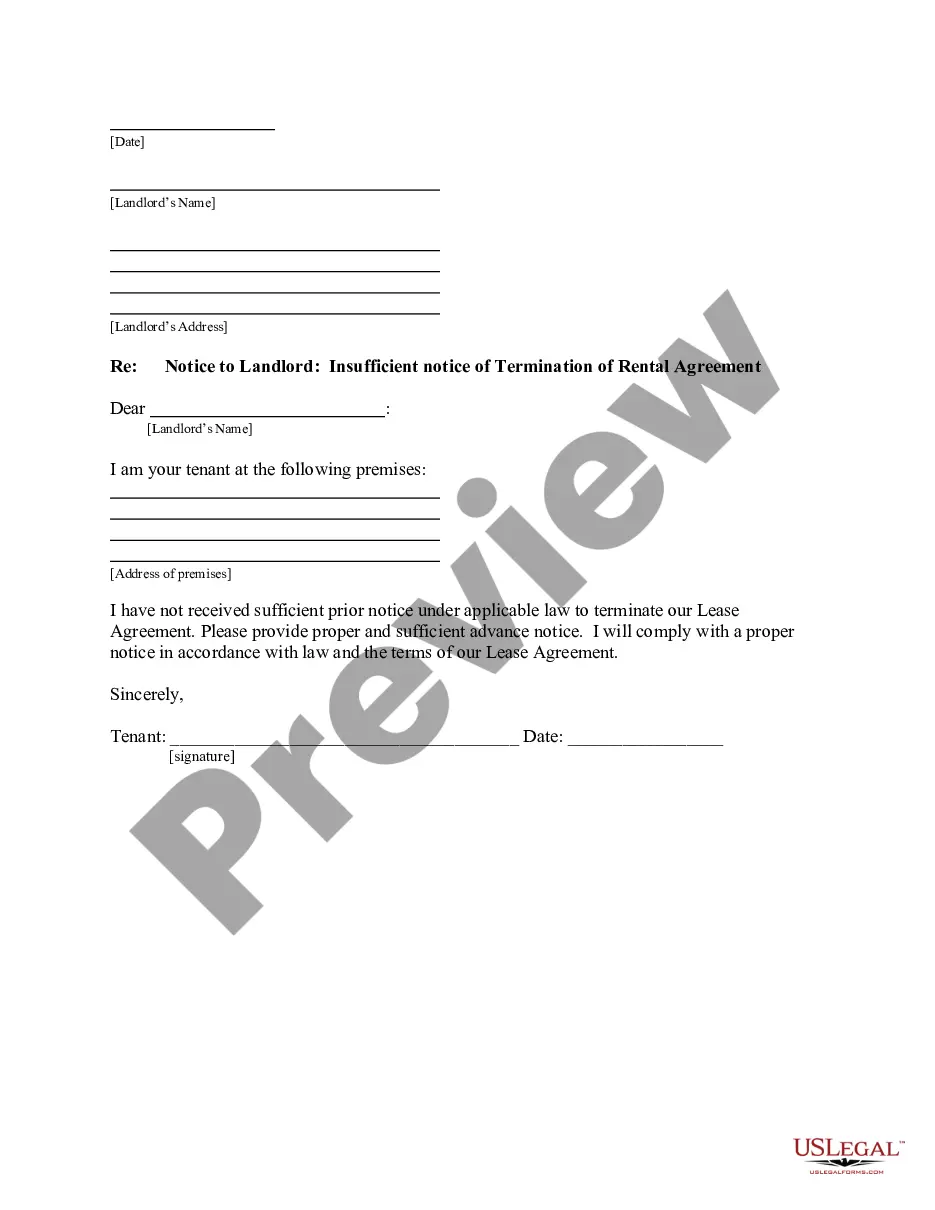

- Take advantage of the Preview switch to check the form.

- Browse the outline to ensure that you have chosen the correct develop.

- In the event the develop is not what you are searching for, use the Research area to find the develop that suits you and requirements.

- Once you get the right develop, just click Get now.

- Opt for the costs program you desire, fill out the required info to make your money, and pay for an order making use of your PayPal or Visa or Mastercard.

- Select a practical data file formatting and download your copy.

Discover all the record layouts you possess bought in the My Forms food selection. You can obtain a further copy of Pennsylvania Transfer of Property under the Uniform Transfers to Minors Act anytime, if required. Just click the essential develop to download or printing the record format.

Use US Legal Forms, one of the most comprehensive collection of legitimate forms, in order to save time and stay away from mistakes. The support gives professionally manufactured legitimate record layouts that can be used for a selection of reasons. Generate an account on US Legal Forms and commence producing your way of life easier.