Pennsylvania Option For the Sale and Purchase of Real Estate - Commercial Building

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Commercial Building?

If you need to finalize, acquire, or produce legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Utilize the site's straightforward and user-friendly search to locate the documents you require.

Numerous templates for business and personal purposes are categorized by type and jurisdiction, or by keywords.

Step 4. Once you have found the form you want, click the Purchase now button. Select the payment plan you prefer and provide your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Pennsylvania Option for the Sale and Purchase of Real Estate - Commercial Building with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to retrieve the Pennsylvania Option for the Sale and Purchase of Real Estate - Commercial Building.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct region/state.

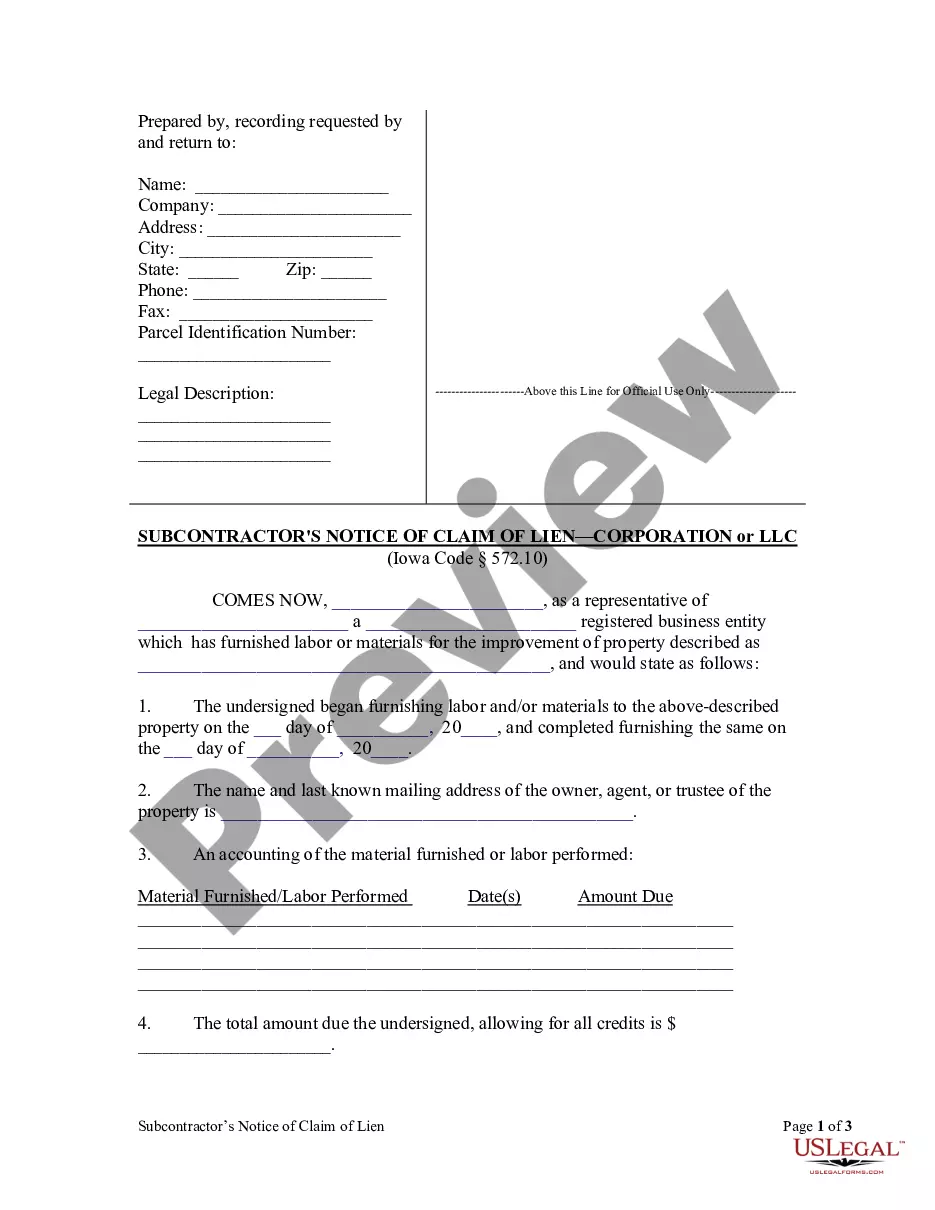

- Step 2. Use the Preview option to review the document's content. Make sure to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find other forms in the legal type library.

Form popularity

FAQ

Who Creates the Purchase and Sale Agreement? A real estate agent typically creates a purchase and sale agreement. However, in some cases, depending on local real estate laws, an attorney might be the one who makes the deal. Regardless of who creates the agreement, you can always negotiate terms and conditions.

A Sale and Purchase Agreement (SPA) is a legally binding contract outlining the agreed upon conditions of the buyer and seller of a property (e.g., a corporation). It is the main legal document in any sale process.

An option to purchase real estate is a legally-binding contract that allows a prospective buyer to enter into an agreement with a seller, in which the buyer is given the exclusive option to purchase the property for a period of time and for a certain (sometimes variable) price.

The purpose of an options contract in real estate is to offer the buyer alternatives. Outcomes may vary according to the type of buyer, including early exercise, option expiration, or second-buyer sales. Real estate professionals use option contracts to provide flexibility on specific types of real estate transactions.

Broadly, a real estate option is a specially designed contract provision between a buyer and a seller. The seller offers the buyer the option to buy a property by a specified period of time at a fixed price. The buyer purchases the option to buy or not buy the property by the end of the holding period.

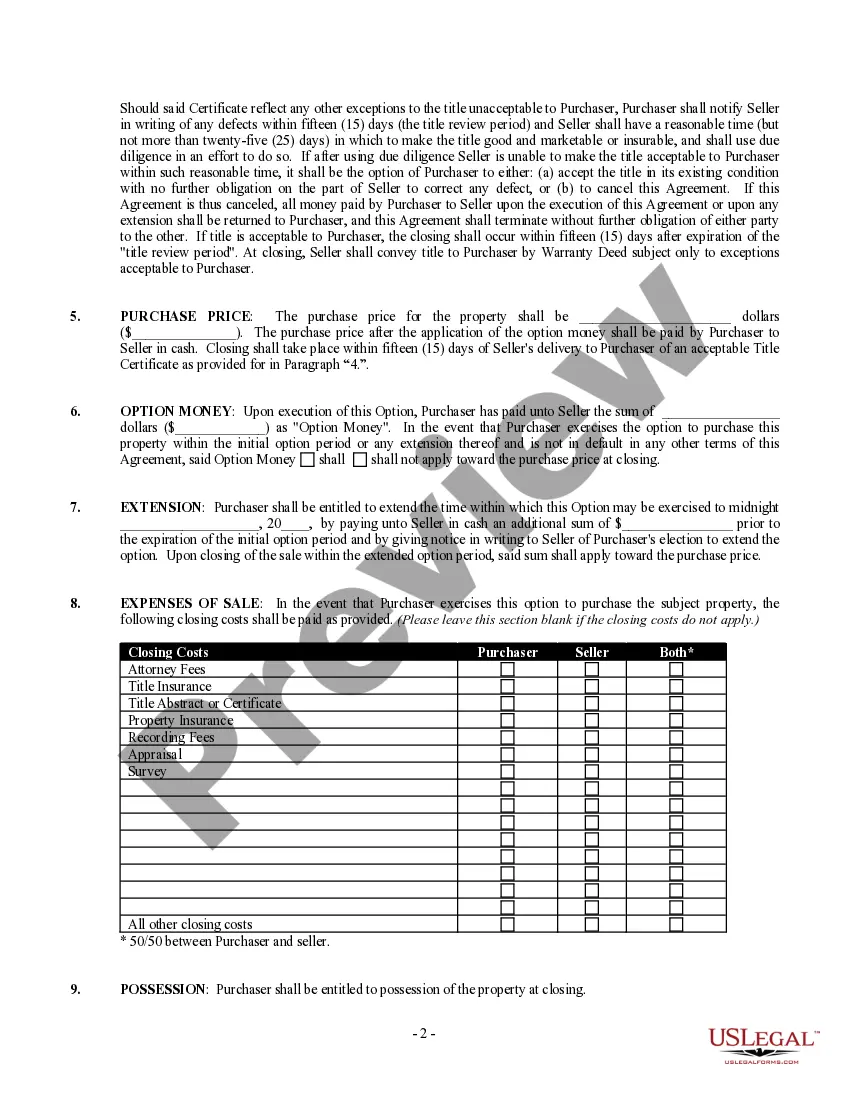

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

If you're a buyer or seller looking for a sale and purchase agreement, you'll need to contact your lawyer or conveyancer, a licensed real estate professional or the Auckland District Law Society (ADLS). You can also purchase digital sale and purchase agreement forms online.

Commercial properties are usually purchased with the intent to generate income or set up commercial space. Commercial property includes office buildings, industrial property, medical center, retail stores, hotels, hostels, schools, warehouses, etc.

Broadly, a real estate option is a specially designed contract provision between a buyer and a seller. The seller offers the buyer the option to buy a property by a specified period of time at a fixed price. The buyer purchases the option to buy or not buy the property by the end of the holding period.

A real estate purchase option is a contract on a specific piece of real estate that allows the buyer the exclusive right to purchase the property. Once a buyer has an option to buy a property, the seller cannot sell the property to anyone else.