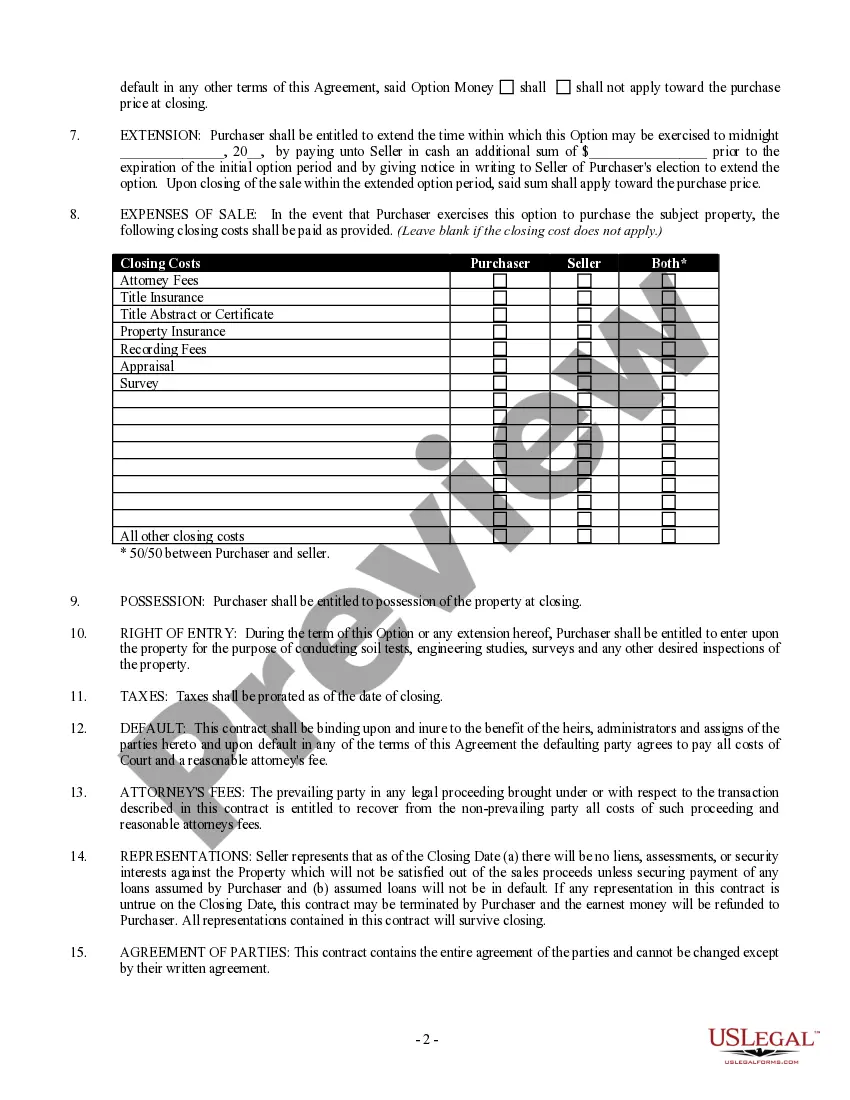

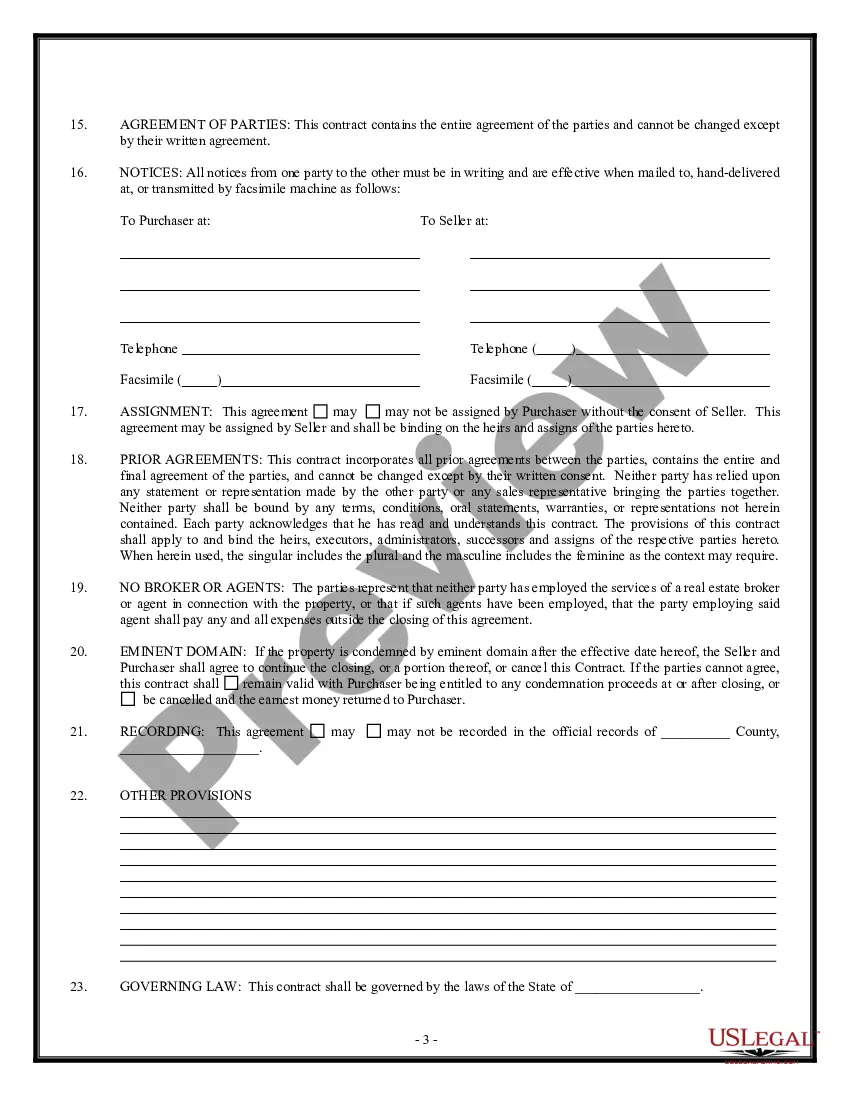

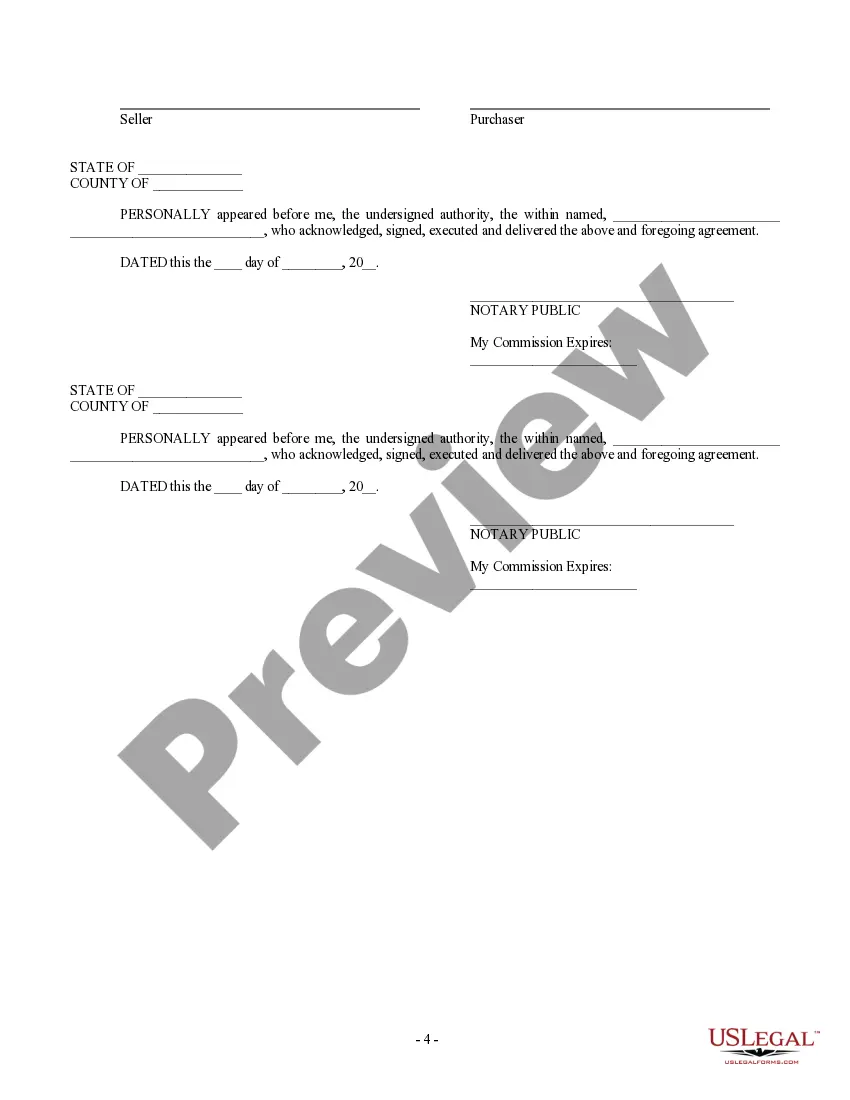

Pennsylvania Option for the Sale and Purchase of Real Estate — Farm Land: A Comprehensive Guide Introduction: The Pennsylvania Option for the Sale and Purchase of Real Estate — Farm Land is a legally binding agreement that provides buyers with the opportunity to secure the right to purchase a specific piece of farmland within a predetermined timeframe. This option agreement allows potential buyers to conduct due diligence on the property, secure financing, and make informed decisions before committing to the purchase. In this article, we will explore the different types of Pennsylvania Option for the Sale and Purchase of Real Estate — Farm Land. Key Terms and Conditions: 1. Option Fee: The buyer pays a predetermined fee to the seller to secure the option. This fee is typically non-refundable and serves as consideration for the seller to take the property off the market during the option period. 2. Option Period: The agreed-upon timeframe within which the buyer can exercise the option to purchase the farm land. This period allows the buyer to conduct inspections, environmental assessments, and any necessary due diligence before committing to the purchase. 3. Purchase Price: The predetermined price at which the buyer can purchase the farm land within the option period. This amount is usually negotiated at the time of entering into the option agreement. 4. Rights and Responsibilities: The rights and responsibilities of both the buyer and the seller during the option period, including maintenance, rental payments (if applicable), and compliance with zoning and land use regulations. Types of Pennsylvania Option for the Sale and Purchase of Real Estate — Farm Land: 1. Traditional Option: This type of option agreement allows the buyer to secure the right to purchase the farm land within the option period. During this time, the buyer can investigate the property, secure financing, and assess the suitability for agricultural purposes. If the buyer decides to proceed with the purchase, the option fee is credited towards the purchase price. 2. Lease with Option to Buy: In this arrangement, the buyer enters into a lease agreement with the seller, allowing for immediate use and possession of the farm land. The lease period provides the buyer an opportunity to evaluate the property while making rental payments. The buyer has the option to exercise their right to purchase the property within the option period, with a portion of the rent applied as credit toward the purchase price. 3. Reverse Option: This type of option agreement caters to sellers who are uncertain about selling their farm land and wish to explore potential buyers' interest. The seller grants the buyer the exclusive right to sell the property within the option period. The buyer acts as an agent for the seller and, upon finding a willing buyer, earns a commission from the sale. Conclusion: The Pennsylvania Option for the Sale and Purchase of Real Estate — Farm Land provides buyers and sellers with flexibility, time, and security during the purchase process. Depending on the specific circumstances and preferences of the parties involved, various types of option agreements, such as the Traditional Option, Lease with Option to Buy, or Reverse Option, can be used. It is important for both buyers and sellers to seek legal advice and carefully consider the terms and conditions before entering into an option agreement to ensure a smooth transaction process.

Pennsylvania Option For the Sale and Purchase of Real Estate - Farm Land

Description

How to fill out Pennsylvania Option For The Sale And Purchase Of Real Estate - Farm Land?

Selecting the optimal legal document template can be a challenge.

Certainly, there are numerous templates available online, but how can you acquire the legal document you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Pennsylvania Option For the Sale and Purchase of Real Estate - Farm Land, suitable for both business and personal needs.

If the form does not meet your requirements, use the Search box to find the correct form. Once you are confident that the form is accurate, click the Buy now button to purchase it. Select your desired pricing plan and input the necessary information. Create your account and complete the payment using your PayPal account or credit card. Then submit the order and download the legal document template to your device. Complete, modify, and print the Pennsylvania Option For the Sale and Purchase of Real Estate - Farm Land and sign it. US Legal Forms is the largest catalog of legal forms from which you can obtain a variety of document templates. Utilize the service to download professionally crafted documents that adhere to state standards.

- All forms are verified by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Obtain button to retrieve the Pennsylvania Option For the Sale and Purchase of Real Estate - Farm Land.

- You can use your account to view all the legal forms you have previously purchased.

- Navigate to the My documents section of your account to get another copy of the document you need.

- If you are a first-time user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have chosen the correct form for your area. You can preview the form by using the Preview button and review the form details to confirm it is the right one for you.

Form popularity

FAQ

In 2020 the Karnataka government removed limitations on non-agriculturists for buying and selling agricultural plots, thereby repealing a decades-old rule.

Outline any rules related to use of farmland for non-agricultural uses. Agricultural land in India is governed by state legislature as enshrined under article 246 of the Constitution. Land rights and their ownership are a state subject owing to its inclusion in the State List.

Pennsylvania's average cash rental rate is $94 per acre, while New York state's average cash rental rate is $69 per acre.

The number of and function of the house you want to build means the difference between getting your building approved or not if you can prove that the building is for farming purposes (like living on-site to tend to crops or livestock), you'll likely get permission to build your house on agricultural land.

Non-exclusive agricultural zoning allows non-farm (residential) dwellings, but strictly limits the number of such dwellings. In addition, non-exclusive zoning often allows the construction of conditional uses if these uses are located on land of low quality for farming.

12 best farmland bargainsWest-Central Texas. $600/acre. Annual land payment: $50/acre.Central Wisconsin. $5,000/acre.South-Central Florida. $10,000/acre.Northern Missouri. $1,400/acre.Eastern Ohio. $5,000/acre.Southwest Iowa. $4,000/acre.Southeastern Wyoming. $4,000/acre (irrigation in place)Eastern North Dakota. $5,000/acre.More items...?

7 Tips Before Selling a Farm Get the Price RIGHT! In order to make a quick sale on your property, price your farm no more than 5 to 10% over market price. Make the Place Presentable Tidy Up. Consider Dividing the Property. Get a Survey. Decide: Auction or Listing? Use Technology. Call a Professional.

Over the last 20 years, the price of farmland per acre in pennsylvania has risen by an average of 4.4% per year to $7,100 per acre as of 2019. This represents an increase of $3,920 per acre of farmland over this time period.

Bill Gates now owns the most farmland of anyone in the United States, according to a recent report from The Land Report. The outlet reported this week that Gates, 65, owns 268,984 acres of land combined across 19 states.

Farms in Pennsylvania The average price of farms for sale in Pennsylvania is $878,312.