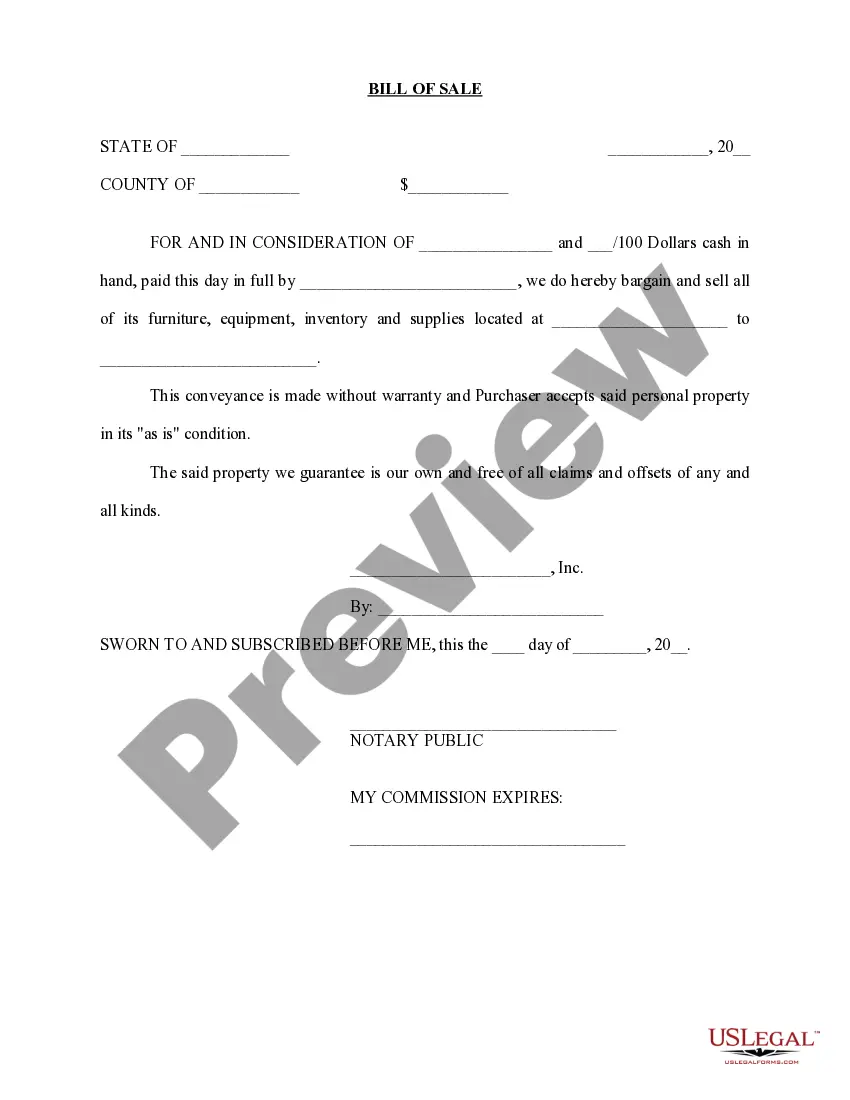

Title: Pennsylvania Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction Keywords: Pennsylvania sale of business, bill of sale, personal assets, asset purchase transaction, legal document, types of bill of sale Introduction: A Pennsylvania Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a vital legal document used in the state of Pennsylvania to facilitate the transfer of personal assets in the sale of a business. This comprehensive document outlines the terms and conditions of the transaction, ensuring a smooth and transparent transfer of ownership. Types of Pennsylvania Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction: 1. All-Inclusive Asset Purchase Agreement: This type of bill of sale includes a detailed inventory of all personal assets being sold within the business, such as equipment, machinery, furniture, inventory, trademarks, patents, licenses, and goodwill. It encompasses an extensive range of assets and provides a comprehensive view of the transaction. 2. Specific Asset Purchase Agreement: In cases where the buyer is interested in only specific assets rather than acquiring the entire business, a specific asset purchase agreement is utilized. This document identifies the particular assets being transferred, ensuring a clear understanding between the buyer and the seller. 3. Intellectual Property Asset Purchase Agreement: For businesses where intellectual property rights hold significant value, an intellectual property asset purchase agreement is employed. It primarily outlines the transfer of patents, trademarks, copyrights, trade secrets, or other intangible assets. 4. Goodwill Agreement: In transactions where goodwill plays a crucial role, such as professional practices, service-oriented businesses, or retail establishments with established customer bases, a goodwill agreement is executed separately. This type of agreement focuses specifically on the transfer of intangible assets like the business name, reputation, customer lists, and business relationships. 5. Real Estate Asset Purchase Agreement: If the sale of the business includes the transfer of real estate property, a separate real estate asset purchase agreement is required. This agreement outlines the terms and conditions for the transfer of the property, including legal property descriptions, purchase price, conditions for inspection, and transfer of ownership. Conclusion: The Pennsylvania Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a critical legal document that ensures the smooth and well-defined transfer of ownership of personal assets. By selecting the appropriate type of bill of sale based on the specific assets involved in the transaction, both the buyer and the seller can execute a legally sound and transparent transfer, protecting their respective interests. It is advisable to consult with legal professionals or attorneys to ensure all legal requirements are met and the business sale proceeds accordingly.

Pennsylvania Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

How to fill out Pennsylvania Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

Choosing the right authorized file template could be a battle. Naturally, there are a lot of templates available online, but how do you discover the authorized form you need? Take advantage of the US Legal Forms internet site. The support provides a large number of templates, such as the Pennsylvania Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction, which you can use for enterprise and private requires. Every one of the kinds are checked out by experts and meet federal and state specifications.

In case you are already registered, log in to the account and click on the Obtain option to get the Pennsylvania Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction. Make use of your account to check throughout the authorized kinds you might have ordered formerly. Visit the My Forms tab of your own account and obtain yet another version from the file you need.

In case you are a whole new end user of US Legal Forms, allow me to share straightforward guidelines so that you can stick to:

- Initial, be sure you have selected the right form for your city/area. You are able to look over the form making use of the Review option and study the form explanation to make sure this is basically the best for you.

- In case the form fails to meet your requirements, use the Seach area to discover the appropriate form.

- Once you are certain the form is proper, select the Purchase now option to get the form.

- Select the costs plan you would like and enter the required info. Make your account and pay for the order utilizing your PayPal account or charge card.

- Select the data file formatting and down load the authorized file template to the device.

- Complete, modify and print out and sign the obtained Pennsylvania Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction.

US Legal Forms will be the largest local library of authorized kinds for which you can find a variety of file templates. Take advantage of the service to down load skillfully-made paperwork that stick to status specifications.