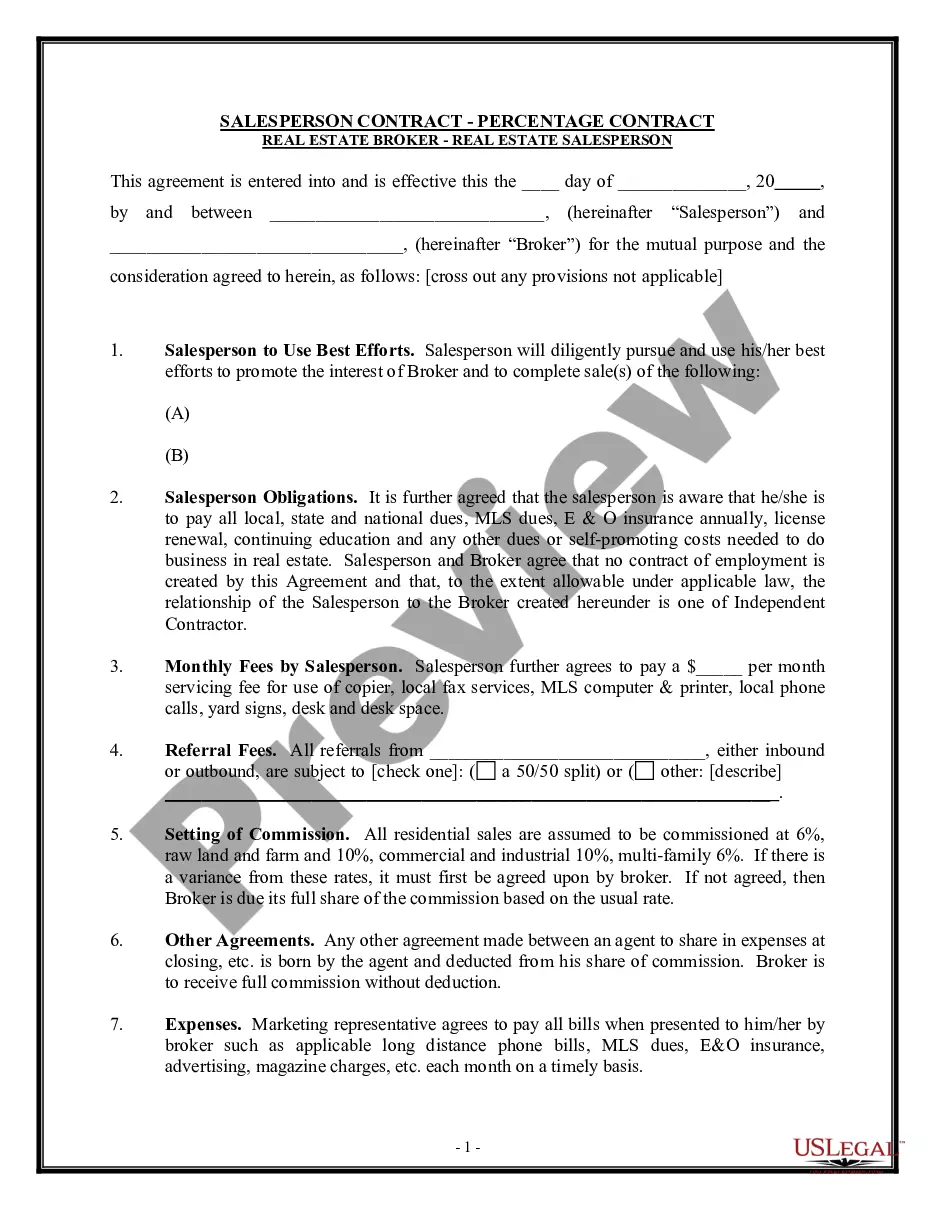

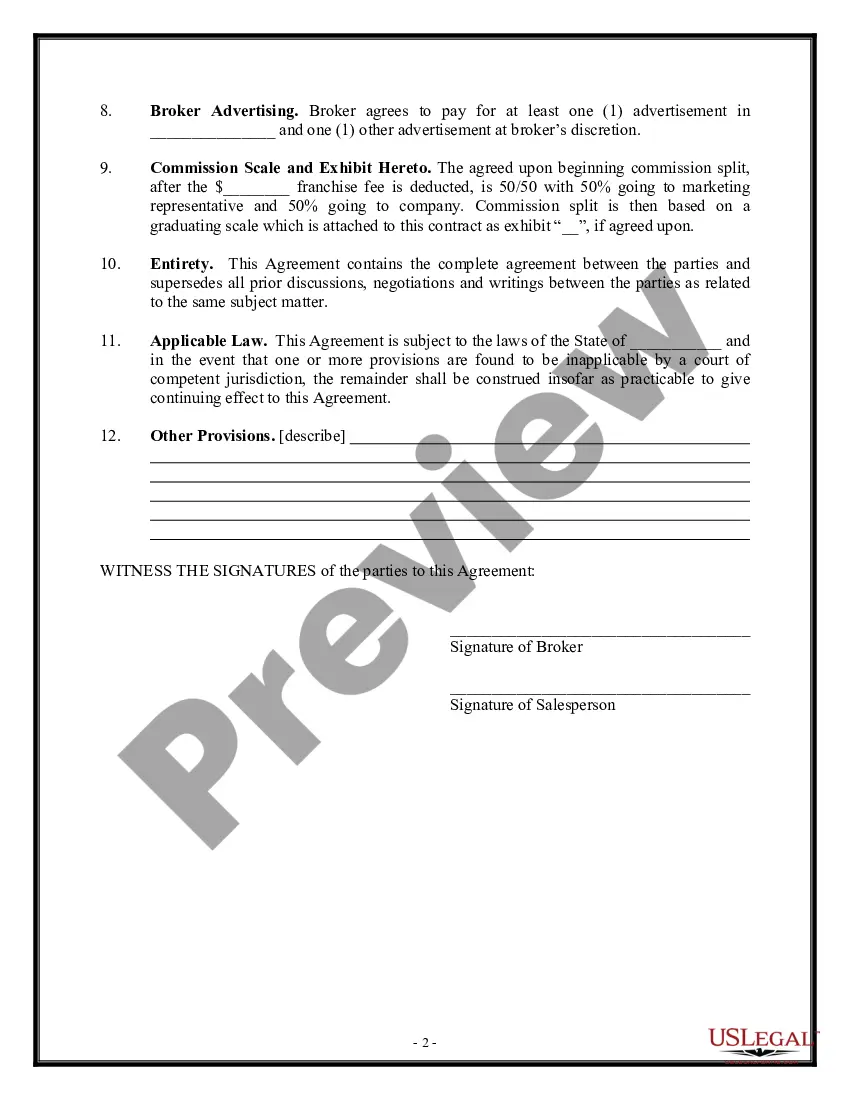

A Pennsylvania Salesperson Contract is a legally binding agreement that outlines the terms and conditions between a salesperson and a company in Pennsylvania. This contract specifies the rights, responsibilities, and obligations of both parties involved in a sales agreement. A Percentage Contract is a type of salesperson contract where the salesperson receives a percentage of the sales revenue generated as their compensation. This percentage is negotiated and agreed upon by both parties and typically reflects the salesperson's performance and contribution to the company's overall sales. On the other hand, an Asset Purchase Transaction refers to a type of business acquisition where a buyer purchases the assets of a company rather than its stock or shares. This transaction involves the transfer of specific assets, such as inventory, equipment, intellectual property, and customer contracts, from the seller to the buyer. In the context of a Pennsylvania Salesperson Contract, an Asset Purchase Transaction could refer to a scenario where a salesperson is involved in the purchase or sale of assets related to their sales activities. For example, if a salesperson has established customer relationships or owns a territory, they may enter into an asset purchase agreement with another salesperson or company to transfer those assets. Different types of Pennsylvania Salesperson Contracts include: 1. Commission-only Contract: This type of contract specifies that the salesperson's compensation will solely be based on a commission structure rather than a fixed salary or base pay. The commission is calculated as a percentage of the sales revenue generated by the salesperson. 2. Exclusive Sales Contract: An exclusive sales contract grants exclusive rights to a salesperson to sell a company's products or services within a specific territory or market. This contract prohibits the company from appointing other sales representatives or agents within the designated area. 3. Independent Contractor Agreement: This agreement outlines the terms for engaging a salesperson as an independent contractor rather than an employee. It clarifies that the salesperson is responsible for their own taxes, expenses, and insurance, and typically grants them more flexibility in terms of working hours and methods. 4. Non-Compete Agreement: A non-compete agreement restricts the salesperson from engaging in similar sales activities with a competitor or within a specific geographic area for a designated period of time. This contract aims to protect the company's confidential information, customer relationships, and trade secrets. In conclusion, a Pennsylvania Salesperson Contract — PercentagContractac— - Asset Purchase Transaction refers to a detailed agreement between a salesperson and a company in Pennsylvania, specifying the terms and conditions regarding compensation, sales performance, and the transfer of sales-related assets. Various types of contracts mentioned above further define the nature and scope of the agreement based on specific circumstances and business requirements.

Pennsylvania Salesperson Contract - Percentage Contract - Asset Purchase Transaction

Description

How to fill out Pennsylvania Salesperson Contract - Percentage Contract - Asset Purchase Transaction?

US Legal Forms - among the biggest libraries of legitimate varieties in the USA - offers a variety of legitimate papers web templates you can acquire or print. Utilizing the web site, you can find a large number of varieties for enterprise and person reasons, categorized by types, claims, or keywords and phrases.You will find the most up-to-date variations of varieties like the Pennsylvania Salesperson Contract - Percentage Contract - Asset Purchase Transaction within minutes.

If you already have a registration, log in and acquire Pennsylvania Salesperson Contract - Percentage Contract - Asset Purchase Transaction in the US Legal Forms library. The Download button will appear on each form you see. You have access to all previously saved varieties from the My Forms tab of your respective account.

In order to use US Legal Forms the first time, here are simple instructions to get you started out:

- Be sure to have chosen the best form for your area/county. Select the Preview button to check the form`s content. Look at the form outline to actually have selected the correct form.

- In case the form doesn`t satisfy your requirements, utilize the Lookup discipline towards the top of the monitor to discover the one who does.

- In case you are pleased with the form, verify your choice by visiting the Buy now button. Then, opt for the costs plan you like and provide your credentials to sign up for an account.

- Procedure the financial transaction. Utilize your Visa or Mastercard or PayPal account to finish the financial transaction.

- Select the file format and acquire the form on your own product.

- Make changes. Load, modify and print and sign the saved Pennsylvania Salesperson Contract - Percentage Contract - Asset Purchase Transaction.

Each and every design you included with your money lacks an expiration particular date and is your own permanently. So, if you would like acquire or print yet another version, just check out the My Forms segment and then click about the form you require.

Get access to the Pennsylvania Salesperson Contract - Percentage Contract - Asset Purchase Transaction with US Legal Forms, one of the most extensive library of legitimate papers web templates. Use a large number of specialist and state-distinct web templates that meet up with your business or person requires and requirements.