Title: Understanding Pennsylvania Letter to Creditors Notifying Them of Identity Theft Introduction: Identity theft is a serious crime that can wreak havoc on an individual's financial wellbeing and creditworthiness. In the state of Pennsylvania, victims of identity theft must notify their creditors to prevent further harm. Writing a Pennsylvania Letter to Creditors notifying them of identity theft is essential in restoring one's financial security. This article provides in-depth information on the process, key elements, and different types of Pennsylvania letters for notifying creditors about identity theft. 1. Understanding Pennsylvania Letter to Creditors Notifying Them of Identity Theft: — Overview: A Pennsylvania Letter to Creditors for Identity Theft serves as official communication, informing creditors about the fraudulent activities associated with an individual's account. — Intent: The primary goal of the letter is to alert creditors about unauthorized transactions, providing them with necessary information and documentation to take appropriate action. — Legal Obligation: By notifying creditors of identity theft, victims are fulfilling their legal responsibility and invoking the rights offered by various federal and state laws, such as the Fair Credit Reporting Act (FCRA) and the Pennsylvania Fair Credit Extension Uniformity Act (PFC EUA). 2. Key Elements of a Pennsylvania Letter to Creditors Notifying Them of Identity Theft: — Contact Information: Begin the letter with your name, address, phone number, and email, ensuring creditors can reach you easily. — Statement of Identity Theft: Clearly state that you are a victim of identity theft and provide a concise summary of the fraudulent activities associated with your account. — Request for Action: Explicitly ask creditors to investigate the matter, freeze your account, make corrections, and include any specific records or evidence you possess. — Supporting Documents: Enclose copies of any relevant documentation, such as police reports, identity theft affidavits, and dispute letters already sent to credit bureaus. — Timeframe: Specify a reasonable deadline for the creditor to respond and take appropriate action, usually within 30 days. — Legal Rights: Mention your rights under relevant laws, such as the FCRA and the PFC EUA, to ensure creditors acknowledge their obligations. 3. Types of Pennsylvania Letters to Creditors Notifying Them of Identity Theft: — Initial Notification Letter: This is the first letter you send to creditors when you discover the identity theft. It outlines the situation, provides details of fraudulent activities, and requests immediate action. — Follow-Up Letters: These letters are sent when creditors fail to respond to the initial notification or if further information or actions are required. It emphasizes the urgency and reiterates the victim's rights and expectations. — Final Warning Letter: If creditors still fail to address the identity theft issue or correct fraudulent information, this letter serves as a final warning, indicating the victim's intention to pursue legal remedies if necessary. Conclusion: Writing a Pennsylvania Letter to Creditors notifying them of identity theft is an essential step in recovering from this crime. By effectively communicating the details of the fraudulent activity and requesting prompt action, victims can protect their reputation, creditworthiness, and financial stability. It is crucial to know your rights and responsibilities, seeking guidance from legal professionals or consumer protection agencies to ensure the letter conforms to applicable laws and regulations.

Pennsylvania Letter to Creditors notifying them of Identity Theft

Description

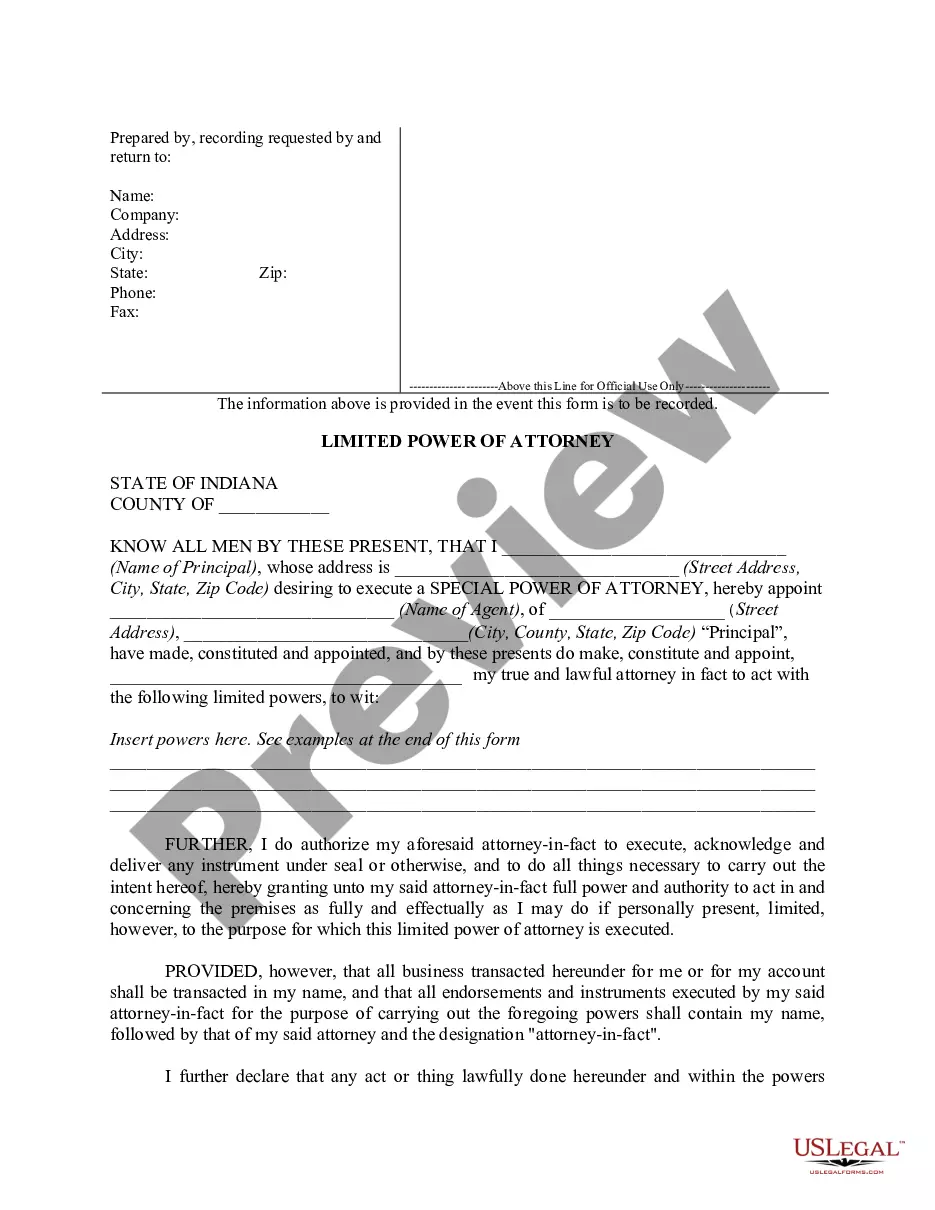

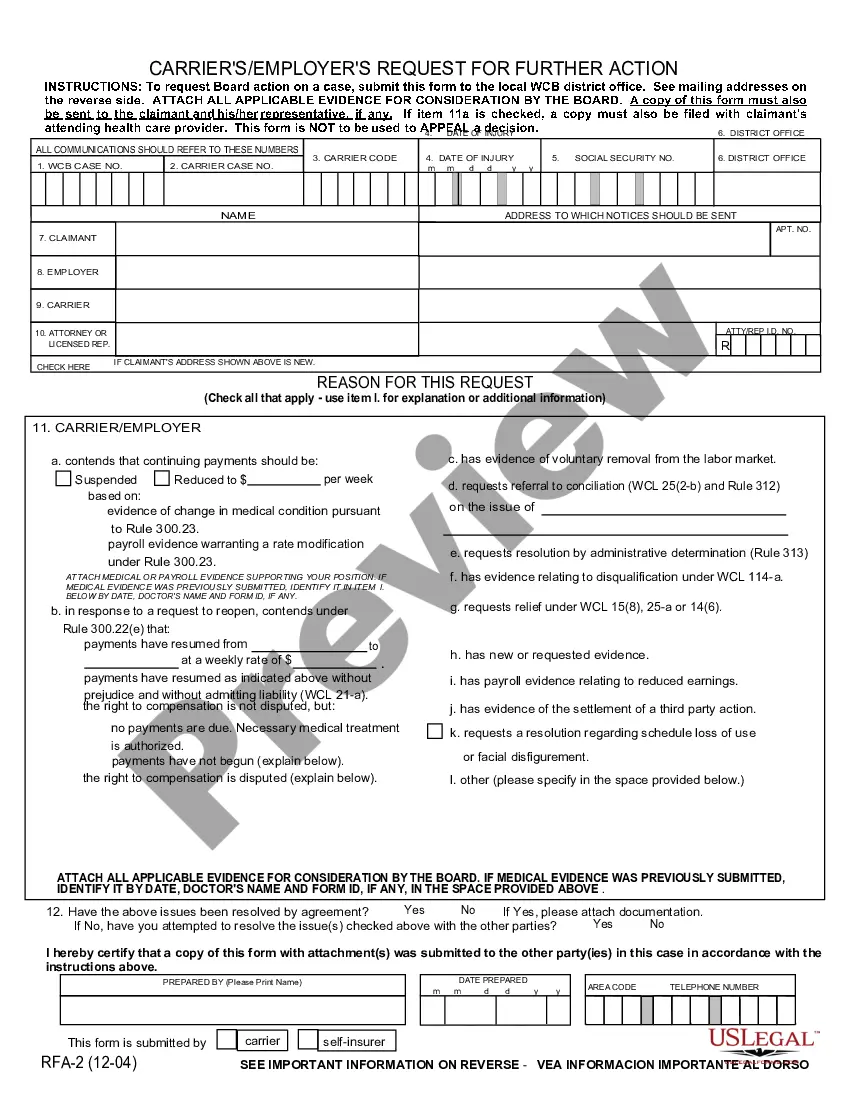

How to fill out Pennsylvania Letter To Creditors Notifying Them Of Identity Theft?

If you wish to full, acquire, or printing lawful document themes, use US Legal Forms, the biggest variety of lawful forms, which can be found online. Make use of the site`s simple and convenient research to discover the paperwork you need. Various themes for organization and individual uses are categorized by groups and suggests, or keywords. Use US Legal Forms to discover the Pennsylvania Letter to Creditors notifying them of Identity Theft within a couple of click throughs.

In case you are already a US Legal Forms consumer, log in in your account and click on the Acquire key to obtain the Pennsylvania Letter to Creditors notifying them of Identity Theft. Also you can entry forms you earlier downloaded within the My Forms tab of the account.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the form for that proper town/land.

- Step 2. Make use of the Review method to check out the form`s information. Do not overlook to see the outline.

- Step 3. In case you are unhappy with all the form, make use of the Search field near the top of the screen to get other variations of your lawful form template.

- Step 4. Upon having located the form you need, go through the Acquire now key. Opt for the costs strategy you choose and put your qualifications to sign up on an account.

- Step 5. Procedure the transaction. You can use your charge card or PayPal account to perform the transaction.

- Step 6. Find the format of your lawful form and acquire it on the system.

- Step 7. Complete, modify and printing or sign the Pennsylvania Letter to Creditors notifying them of Identity Theft.

Every single lawful document template you get is yours for a long time. You possess acces to each form you downloaded inside your acccount. Click the My Forms section and select a form to printing or acquire once again.

Compete and acquire, and printing the Pennsylvania Letter to Creditors notifying them of Identity Theft with US Legal Forms. There are many skilled and condition-distinct forms you may use for the organization or individual requires.

Form popularity

FAQ

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

With regard to Pennsylvania law, the relevant statute is 18 Pa. C.S. § 4120, which states that a person commits identify theft if they obtain or use someone else's personal identifying information without permission or consent, and the information is then used for an illegal or unlawful purpose.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).