Pennsylvania Sample Letter for Binding First Security Interest

Description

How to fill out Sample Letter For Binding First Security Interest?

You may spend hrs on-line attempting to find the legitimate papers design that fits the state and federal specifications you need. US Legal Forms offers thousands of legitimate forms which can be evaluated by professionals. It is possible to down load or print the Pennsylvania Sample Letter for Binding First Security Interest from your assistance.

If you have a US Legal Forms profile, you can log in and click on the Down load button. Afterward, you can total, edit, print, or sign the Pennsylvania Sample Letter for Binding First Security Interest. Every single legitimate papers design you acquire is your own forever. To acquire one more version of the bought type, check out the My Forms tab and click on the related button.

If you work with the US Legal Forms website initially, follow the basic guidelines under:

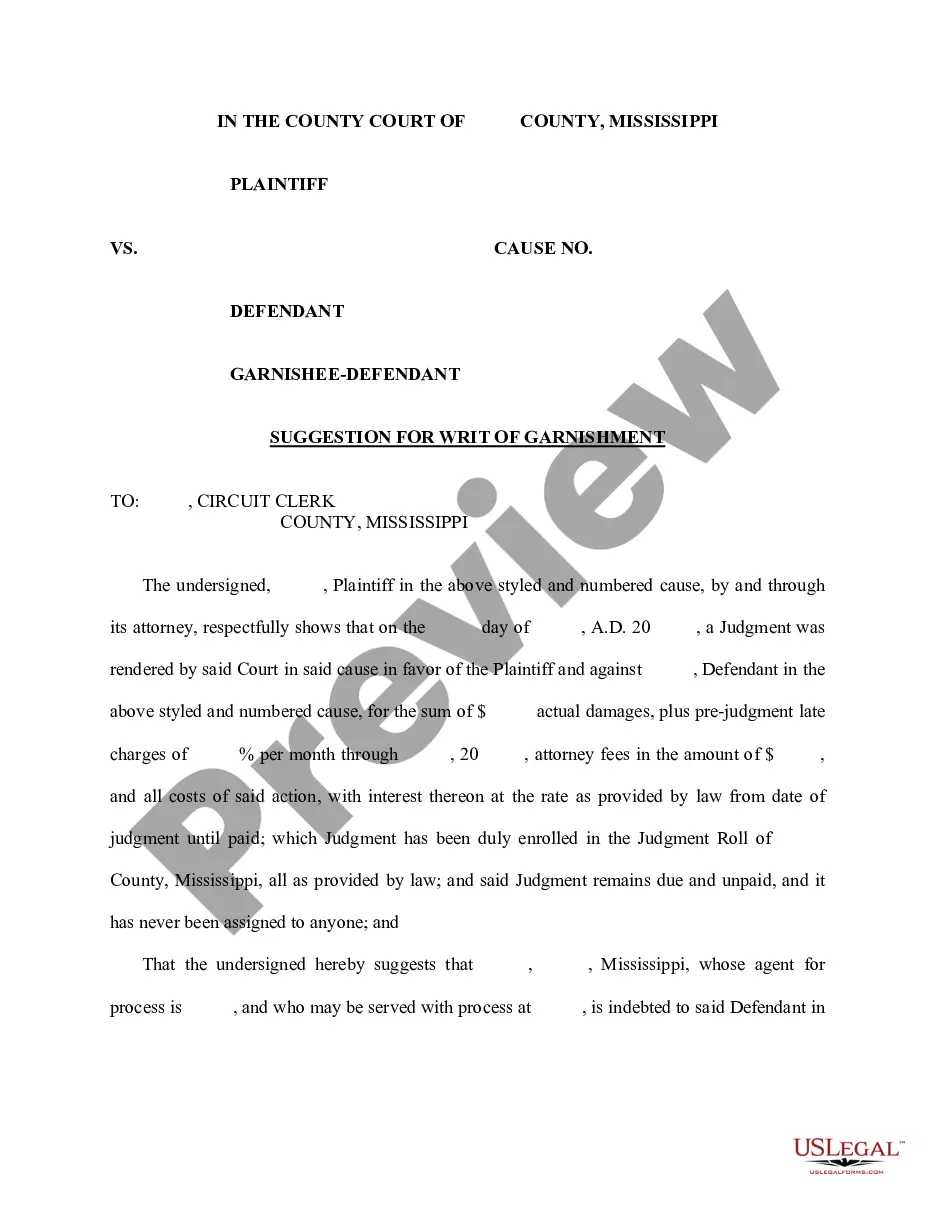

- First, make certain you have selected the correct papers design for the region/metropolis of your liking. See the type information to make sure you have picked the right type. If available, make use of the Review button to look throughout the papers design also.

- If you wish to find one more edition in the type, make use of the Look for industry to get the design that fits your needs and specifications.

- Upon having discovered the design you would like, just click Purchase now to carry on.

- Find the costs plan you would like, type your qualifications, and register for your account on US Legal Forms.

- Full the purchase. You should use your Visa or Mastercard or PayPal profile to purchase the legitimate type.

- Find the structure in the papers and down load it to the gadget.

- Make adjustments to the papers if necessary. You may total, edit and sign and print Pennsylvania Sample Letter for Binding First Security Interest.

Down load and print thousands of papers web templates while using US Legal Forms website, that offers the biggest assortment of legitimate forms. Use skilled and condition-distinct web templates to take on your organization or person requirements.