In today's tax system, estate and gift taxes may be levied every time assets change hands from one generation to the next. Dynasty trusts avoided those taxes by creating a second estate that could outlive most of the family members, and continue providing for future generations. Dynasty trusts are long-term trusts created specifically for descendants of all generations. Dynasty trusts can survive 21 years beyond the death of the last beneficiary alive when the trust was written.

Pennsylvania Irrevocable Generation Skipping or Dynasty Trust Agreement For Benefit of Trustor's Children and Grandchildren

Description

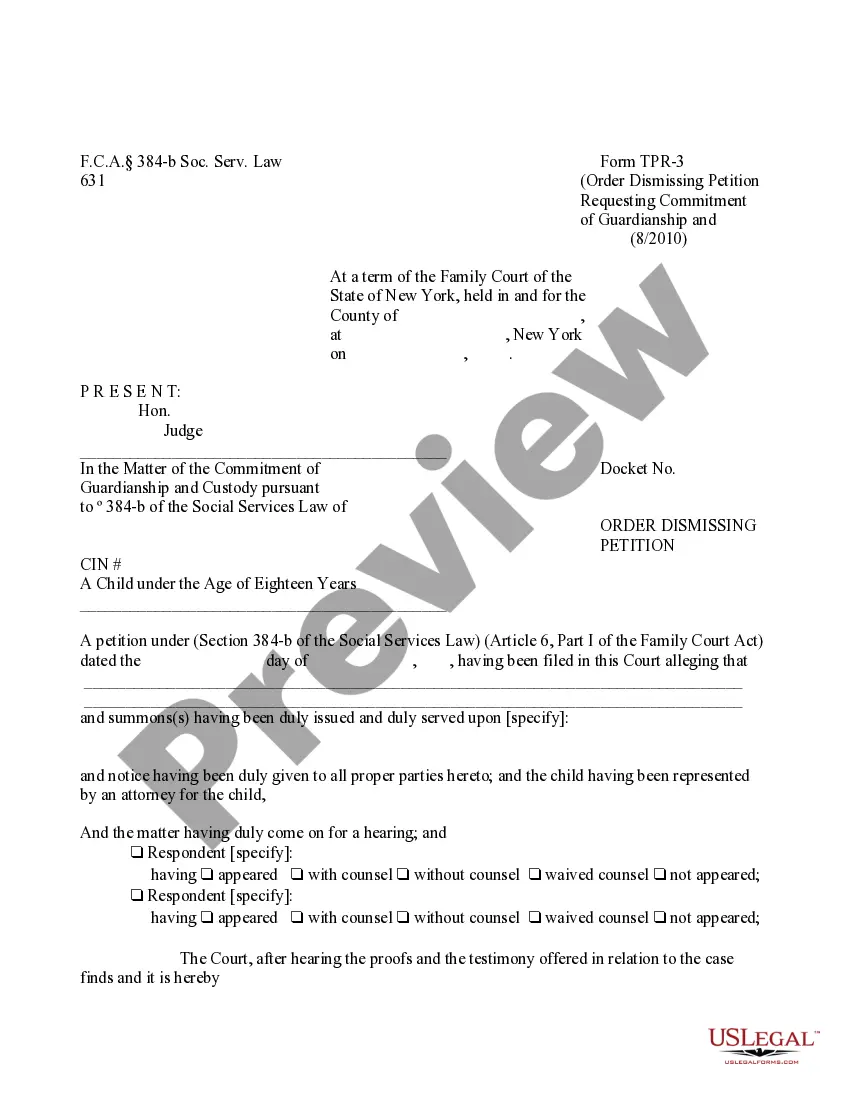

How to fill out Irrevocable Generation Skipping Or Dynasty Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

If you wish to acquire, download, or print legal document templates, utilize US Legal Forms, the largest variety of legal forms available online.

Take advantage of the site's simple and straightforward search feature to find the documents you require.

Numerous templates for business and personal needs are organized by categories and jurisdictions, or by keywords.

Step 4. After locating the form you need, click the Get now button. Select the payment plan you prefer and enter your information to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to access the Pennsylvania Irrevocable Generation Skipping or Dynasty Trust Agreement For Benefit of Trustor's Children and Grandchildren in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to get the Pennsylvania Irrevocable Generation Skipping or Dynasty Trust Agreement For Benefit of Trustor's Children and Grandchildren.

- You can also retrieve forms you have previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for the correct jurisdiction.

- Step 2. Use the Preview option to review the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A generation skipping trust is an irrevocable trust. This type of trust cannot be changed or revoked.

However, many states are doing away with this rule in its entirety. For example, a dynasty trust can last up to 365 years in Nevada, and 90 years in California.

A dynasty trust is a great option for families that are seeking to transfer wealth from generation to generation. If you have a sizable estate and wish to transfer wealth without triggering certain estate-planning taxes, a dynasty trust could be a great option. As a reminder, dynasty trusts are irrevocable.

Pennsylvania is one state where there is no time limit a dynasty trust can last forever. You can specify an end date or state that the trust ends upon the death of the last grandchild, or it can remain in perpetuity.

So, wealthy people from across the United States can open dynasty trusts in these states with the help of a qualified estate planning attorney. These are just a few reasons why a dynasty trust can range from $3,000 to more than $30,000 in cost to set up.

A dynasty trust is an irrevocable trust but may also be known as an irrevocable life insurance trust or disclaimer trust. A dynasty trust is designed to avoid the GST tax and any other death taxes that may affect an estate. A dynasty trust can even include language used to establish a special needs trust.

A dynasty trust is a long-term trust created to pass wealth from generation to generation without incurring transfer taxessuch as the gift tax, estate tax, or generation-skipping transfer tax (GSTT)for as long as assets remain in the trust. The dynasty trust's defining characteristic is its duration.

A dynasty trust allows wealth to be available to each generation while never being reduced by transfer taxes. In 2020, the generation-skipping transfer tax exemption amount is $11,580,000 per person and is the same as the lifetime gift and estate tax exemption amount.

A generation-skipping trust is a type of trust that designates a grandchild, great-niece or great-nephew or any person who is at least 37 ½ years younger than the settlor as the beneficiary of the trust.

Individuals with taxable estates should consider tools to reduce and eliminate transfer taxes for them and for future generations. Family business owners are great candidates for dynasty trust planning.