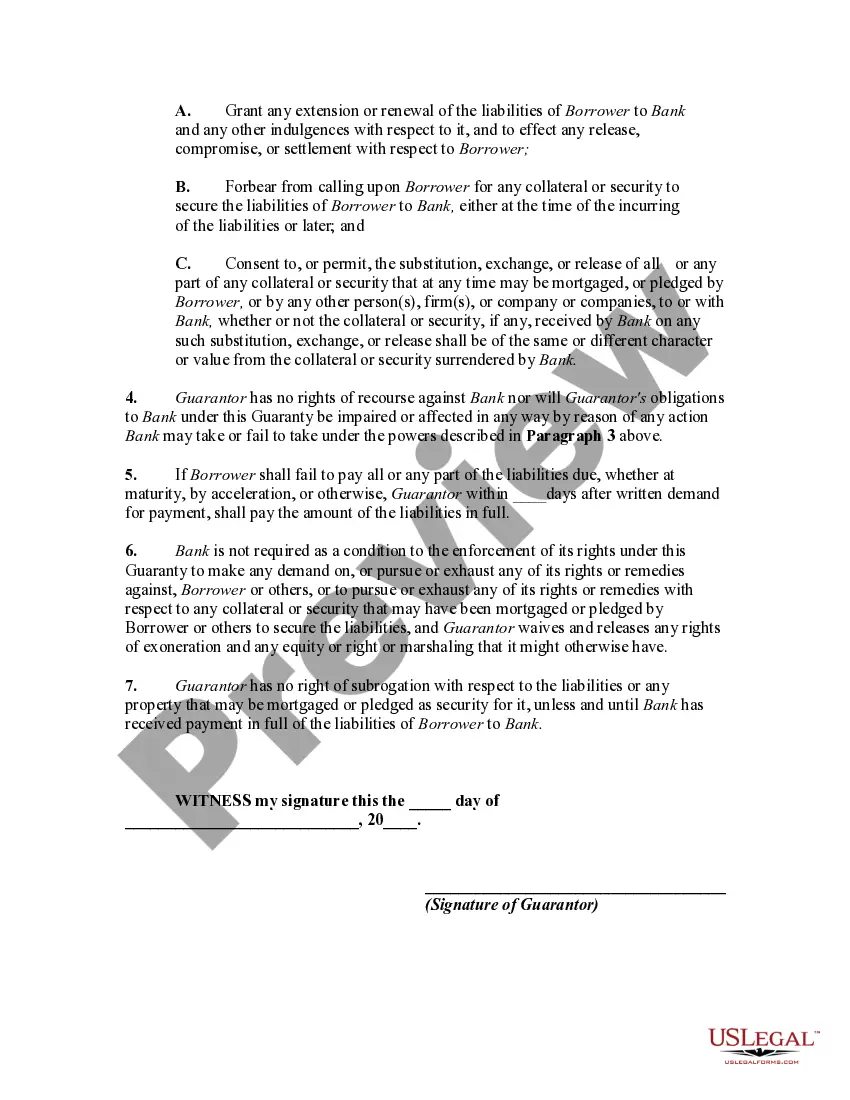

A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor.

The contract of guaranty may be absolute or it may be conditional. An absolute guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A line of credit is an arrangement in which a lender extends a specified amount of credit to borrower for a specified time period.

Title: Pennsylvania Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit: Overview and Types Introduction: The Pennsylvania Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit is a legal document that ensures the repayment of a line of credit by a guarantor in the state of Pennsylvania. This comprehensive guaranty serves to protect the creditor, and various types of guarantees can be established depending on the specific circumstances of the line of credit. This article will provide a detailed description of this agreement, its importance, and the different types of guarantees commonly observed in Pennsylvania. 1. Pennsylvania Absolute Guaranty of Payment Explained: The Pennsylvania Absolute Guaranty of Payment is a legally binding document wherein the guarantor assumes responsibility for the repayment of a line of credit. It is crucial for creditors to secure this guarantee to mitigate the risks associated with extending a line of credit. 2. Purpose and Importance: — Protection for Creditors: The primary purpose of the Pennsylvania Absolute Guaranty of Payment is to offer a secure layer of protection for the creditor. By having a guarantor who promises to repay the line of credit in case of default, the creditor can ensure the timely receipt of funds. — Confidence in Extending Credit: Having this guarantee in place instills confidence in creditors to extend credit to borrowers. It assures them that there is an extra layer of protection, reducing the apprehension related to potential defaults. — Mitigation of Risks: The guaranty helps mitigate the associated risks of credit extension by shifting the repayment responsibility to the guarantor, ensuring minimal financial losses for the creditor. 3. Types of Pennsylvania Absolute Guaranty of Payment: — Limited Guaranty: This type of guarantee restricts the guarantor's repayment obligation to a predetermined maximum amount. Creditors often use this limitation to protect guarantors from excessive financial obligations. — Continuing Guaranty: With a continuing guaranty, the guarantor's obligation persists despite any changes made to the underlying line of credit, such as alterations to the repayment terms or an increase in the credit limit. — Limited Continuing Guaranty: This type of guaranty combines the features of both limited and continuing guarantees. It sets a capped liability for the guarantor while retaining an ongoing obligation despite changes to the line of credit. 4. Key Provisions in the Guaranty: — Guarantor's Identity and Obligations: Details of the guarantor's identity, contact information, and their absolute promise to repay the line of credit. — Extent of Liability: Clearly defines the guarantor's liability limit, specifying whether it is limited, continuing, or limited continuing. — Default Provisions: Outlines the conditions that constitute a default by the borrower and the subsequent actions liable to be taken by the creditor. — Indemnification: Specifies the guarantor's responsibility to compensate the creditor for any losses incurred due to the borrower's default on the line of credit. Conclusion: The Pennsylvania Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit offers a crucial layer of protection to creditors and greatly influences their decision to extend credit. By having different types of guarantees available, such as limited, continuing, and limited continuing, the creditor can tailor the agreement to specific needs and circumstances. Understanding the legalities involved in these guarantees can help facilitate smooth credit transactions while minimizing risks for both the creditor and the guarantor.Title: Pennsylvania Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit: Overview and Types Introduction: The Pennsylvania Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit is a legal document that ensures the repayment of a line of credit by a guarantor in the state of Pennsylvania. This comprehensive guaranty serves to protect the creditor, and various types of guarantees can be established depending on the specific circumstances of the line of credit. This article will provide a detailed description of this agreement, its importance, and the different types of guarantees commonly observed in Pennsylvania. 1. Pennsylvania Absolute Guaranty of Payment Explained: The Pennsylvania Absolute Guaranty of Payment is a legally binding document wherein the guarantor assumes responsibility for the repayment of a line of credit. It is crucial for creditors to secure this guarantee to mitigate the risks associated with extending a line of credit. 2. Purpose and Importance: — Protection for Creditors: The primary purpose of the Pennsylvania Absolute Guaranty of Payment is to offer a secure layer of protection for the creditor. By having a guarantor who promises to repay the line of credit in case of default, the creditor can ensure the timely receipt of funds. — Confidence in Extending Credit: Having this guarantee in place instills confidence in creditors to extend credit to borrowers. It assures them that there is an extra layer of protection, reducing the apprehension related to potential defaults. — Mitigation of Risks: The guaranty helps mitigate the associated risks of credit extension by shifting the repayment responsibility to the guarantor, ensuring minimal financial losses for the creditor. 3. Types of Pennsylvania Absolute Guaranty of Payment: — Limited Guaranty: This type of guarantee restricts the guarantor's repayment obligation to a predetermined maximum amount. Creditors often use this limitation to protect guarantors from excessive financial obligations. — Continuing Guaranty: With a continuing guaranty, the guarantor's obligation persists despite any changes made to the underlying line of credit, such as alterations to the repayment terms or an increase in the credit limit. — Limited Continuing Guaranty: This type of guaranty combines the features of both limited and continuing guarantees. It sets a capped liability for the guarantor while retaining an ongoing obligation despite changes to the line of credit. 4. Key Provisions in the Guaranty: — Guarantor's Identity and Obligations: Details of the guarantor's identity, contact information, and their absolute promise to repay the line of credit. — Extent of Liability: Clearly defines the guarantor's liability limit, specifying whether it is limited, continuing, or limited continuing. — Default Provisions: Outlines the conditions that constitute a default by the borrower and the subsequent actions liable to be taken by the creditor. — Indemnification: Specifies the guarantor's responsibility to compensate the creditor for any losses incurred due to the borrower's default on the line of credit. Conclusion: The Pennsylvania Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit offers a crucial layer of protection to creditors and greatly influences their decision to extend credit. By having different types of guarantees available, such as limited, continuing, and limited continuing, the creditor can tailor the agreement to specific needs and circumstances. Understanding the legalities involved in these guarantees can help facilitate smooth credit transactions while minimizing risks for both the creditor and the guarantor.