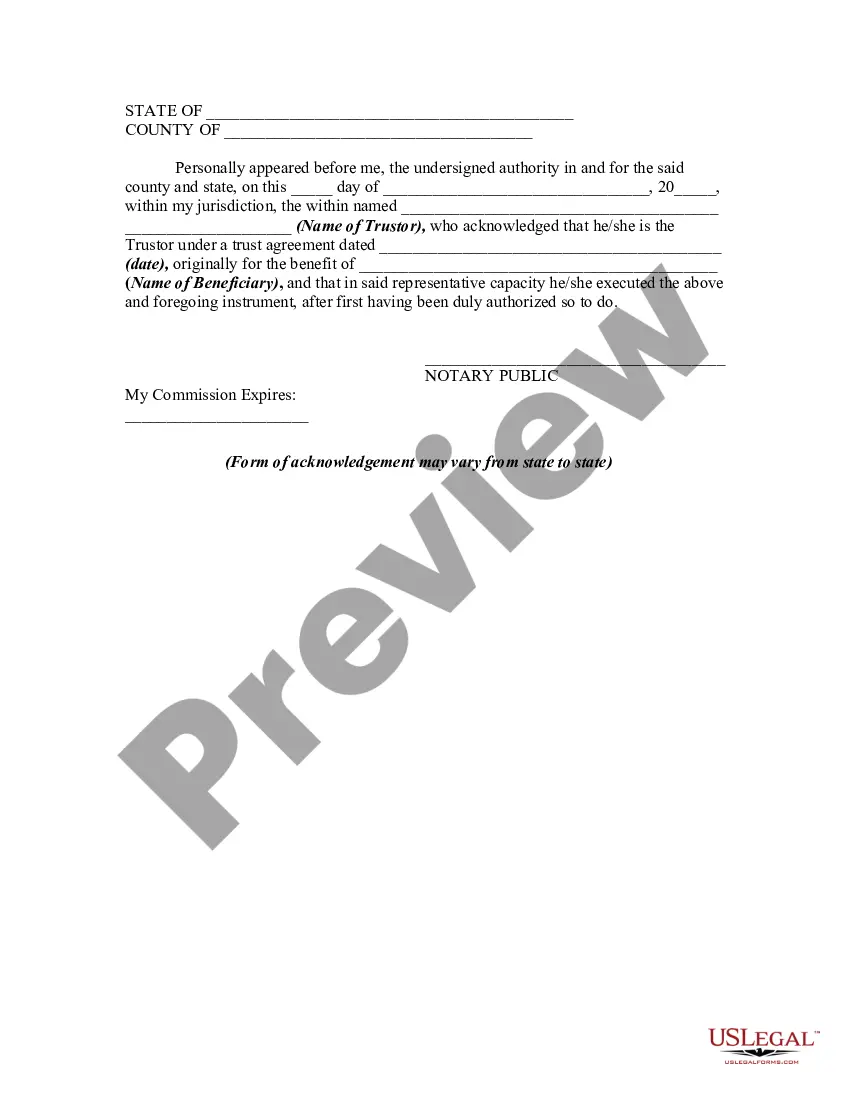

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Pennsylvania Amendment to Trust Agreement in Order to Change Beneficiaries is a legal document used to modify the terms of a trust and update the designated beneficiaries. This amendment is particularly useful when there is a change in circumstances that renders the current beneficiaries ineligible or outdated. By using this agreement, individuals can ensure that their assets are distributed according to their latest wishes, thus maintaining control over their estate plans. Pennsylvania recognizes various types of Amendment to Trust Agreement in Order to Change Beneficiaries, each tailored to specific circumstances: 1. Pennsylvania Testamentary Trust Amendment: This type of amendment is utilized when modifications need to be made to a trust that only becomes effective upon the granter's death. It enables the granter to change the intended beneficiaries, adjust the distribution percentages, or even add or remove particular assets from the trust. 2. Pennsylvania Revocable Living Trust Amendment: Revocable living trusts allow individuals to manage and control their assets during their lifetime while still designating beneficiaries to inherit these assets upon their death. The Pennsylvania Revocable Living Trust Amendment permits individuals to alter the beneficiaries, trustees, or any other relevant provisions outlined in the trust. 3. Pennsylvania Irrevocable Trust Amendment: Contrary to a revocable trust, an irrevocable trust typically cannot be modified without the consent of all involved parties. However, Pennsylvania law provides options to modify certain provisions of an irrevocable trust by way of an amendment, including changes to beneficiaries, distribution plans, or trustee appointments. 4. Pennsylvania Special Needs Trust Amendment: A special needs trust is established to provide ongoing financial support and care for individuals with disabilities or special needs. This type of amendment allows granters to make alterations to the trust's provisions, such as updating beneficiaries, modifying disbursement conditions, or changing the allocation of trust assets. Utilizing a Pennsylvania Amendment to Trust Agreement in Order to Change Beneficiaries is crucial to ensure the trust aligns with an individual's evolving intentions and circumstances. It provides the flexibility needed to adapt to life's changes while safeguarding the assets and benefits intended for the trust's beneficiaries. Seek the advice of an experienced attorney to guide you through the process and ensure compliance with relevant Pennsylvania laws.The Pennsylvania Amendment to Trust Agreement in Order to Change Beneficiaries is a legal document used to modify the terms of a trust and update the designated beneficiaries. This amendment is particularly useful when there is a change in circumstances that renders the current beneficiaries ineligible or outdated. By using this agreement, individuals can ensure that their assets are distributed according to their latest wishes, thus maintaining control over their estate plans. Pennsylvania recognizes various types of Amendment to Trust Agreement in Order to Change Beneficiaries, each tailored to specific circumstances: 1. Pennsylvania Testamentary Trust Amendment: This type of amendment is utilized when modifications need to be made to a trust that only becomes effective upon the granter's death. It enables the granter to change the intended beneficiaries, adjust the distribution percentages, or even add or remove particular assets from the trust. 2. Pennsylvania Revocable Living Trust Amendment: Revocable living trusts allow individuals to manage and control their assets during their lifetime while still designating beneficiaries to inherit these assets upon their death. The Pennsylvania Revocable Living Trust Amendment permits individuals to alter the beneficiaries, trustees, or any other relevant provisions outlined in the trust. 3. Pennsylvania Irrevocable Trust Amendment: Contrary to a revocable trust, an irrevocable trust typically cannot be modified without the consent of all involved parties. However, Pennsylvania law provides options to modify certain provisions of an irrevocable trust by way of an amendment, including changes to beneficiaries, distribution plans, or trustee appointments. 4. Pennsylvania Special Needs Trust Amendment: A special needs trust is established to provide ongoing financial support and care for individuals with disabilities or special needs. This type of amendment allows granters to make alterations to the trust's provisions, such as updating beneficiaries, modifying disbursement conditions, or changing the allocation of trust assets. Utilizing a Pennsylvania Amendment to Trust Agreement in Order to Change Beneficiaries is crucial to ensure the trust aligns with an individual's evolving intentions and circumstances. It provides the flexibility needed to adapt to life's changes while safeguarding the assets and benefits intended for the trust's beneficiaries. Seek the advice of an experienced attorney to guide you through the process and ensure compliance with relevant Pennsylvania laws.