A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to add property to the trust. This form is a sample of a trustor amending the trust agreement in order to add property to the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

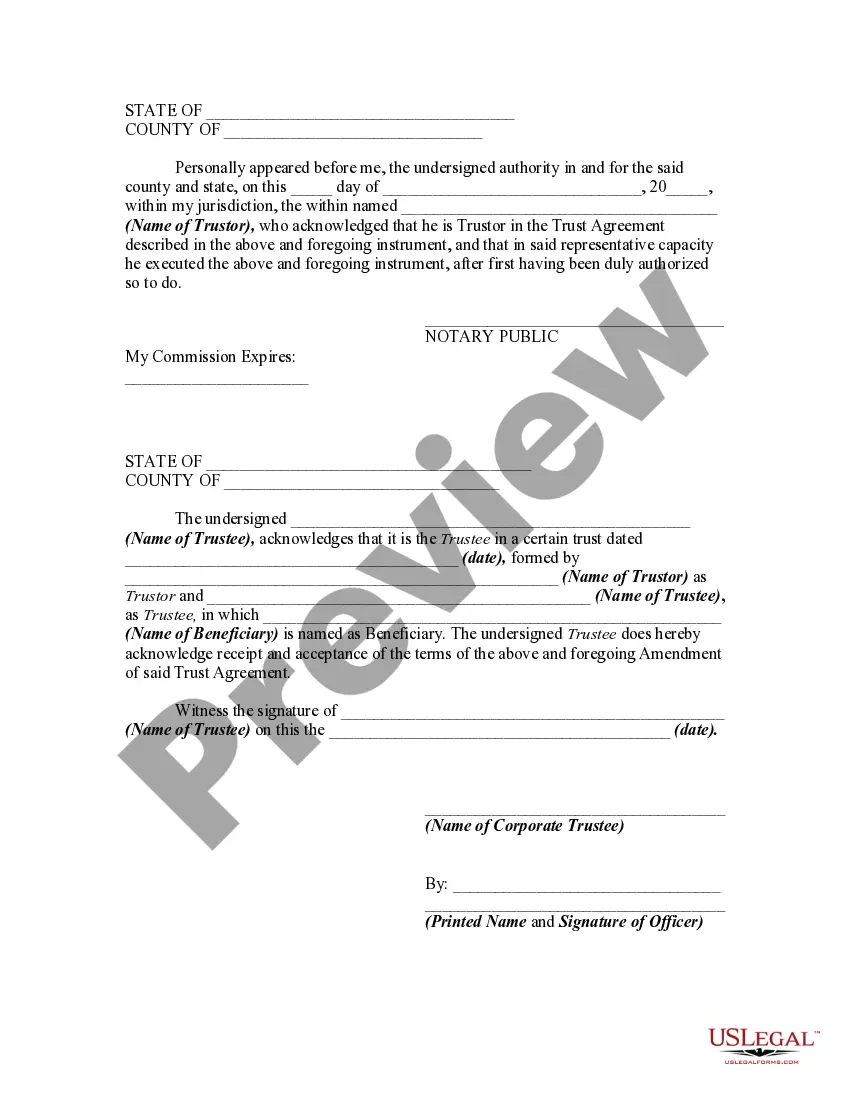

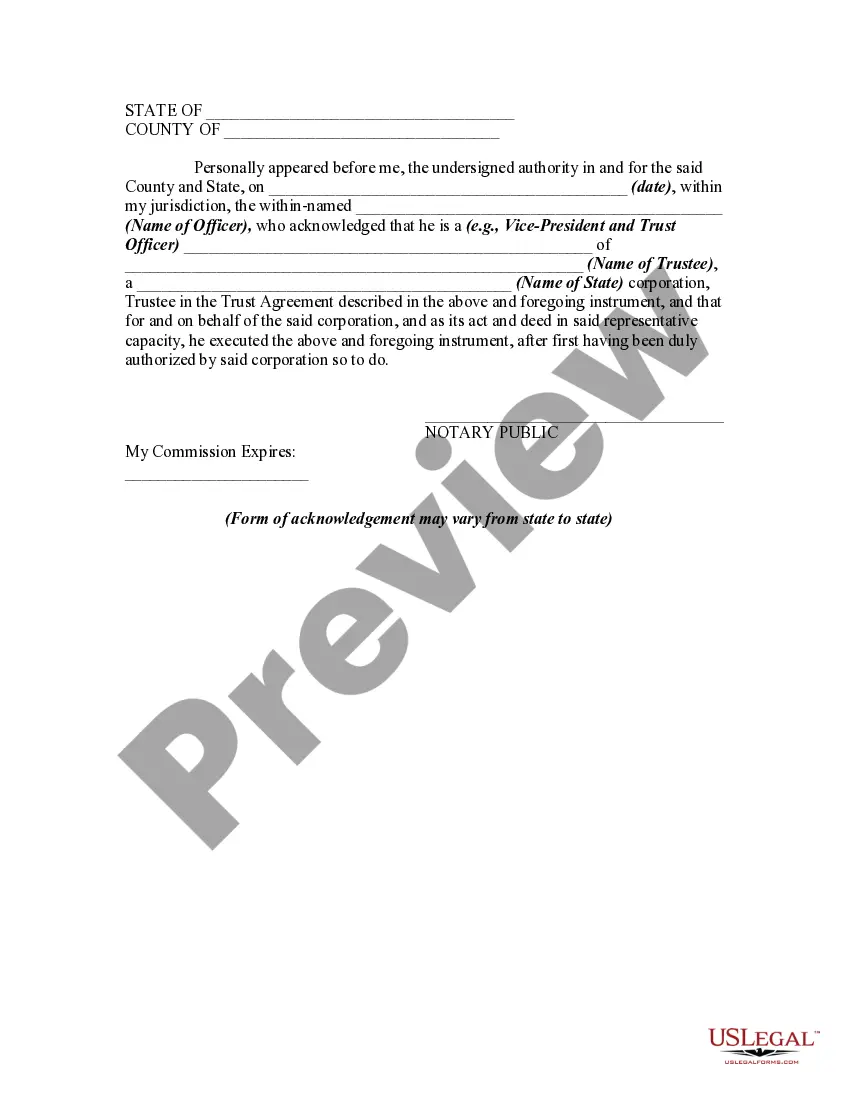

Title: Pennsylvania Amendment to Trust Agreement: Adding Property from an Inter Vivos Trust and Consent of Trustee Introduction: A Pennsylvania Amendment to Trust Agreement is a legal document used to modify or update an existing trust agreement by adding property from an inter vivos trust. This amendment ensures that all relevant provisions, powers, and terms are properly reflected and controlled within the trust. Additionally, the consent of the trustee is required to execute such changes. This article provides a detailed description of the Pennsylvania Amendment to Trust Agreement related to adding property from an inter vivos trust and obtaining the consent of the trustee. Types of Pennsylvania Amendments to Trust Agreement in Order to Add Property from Inter Vivos Trust: 1. Pennsylvania Amendment to Trust Agreement — Succession Planning: This type of amendment is utilized when the settler of an inter vivos trust wishes to include additional assets, such as real estate, stocks, or other forms of property, into the trust. The amendment ensures the smooth transition of ownership and control of these assets upon the death of the settler, ensuring alignment with their estate planning objectives. 2. Pennsylvania Amendment to Trust Agreement — Diversification of Assets: This type of amendment allows the inclusion of additional assets within an inter vivos trust as a means to diversify the portfolio. By adding various types of assets, such as mutual funds, stocks, bonds, or real estate, the trust's investment risk can be spread across different asset classes, thereby reducing potential losses and increasing potential gains. 3. Pennsylvania Amendment to Trust Agreement — Wealth PreservationShowcasesesettlearrer odor may choose to transfer significant financial assets into an inter vivos trust to protect their wealth. This type of amendment aims to safeguard assets against creditors, potential lawsuits, or divorce proceedings. By adding property through this amendment, the trustee gains control over these assets, providing enhanced security for the beneficiaries. The Process of a Pennsylvania Amendment to Trust Agreement: 1. Legal Consultation: Before initiating the amendment, it is prudent to consult with a qualified attorney specializing in trusts and estates. The attorney will review the existing trust agreement, evaluate the proposed changes, and guide the settler on the appropriate legal steps required to execute the amendment. 2. Drafting the Amendment: Based on the attorney's guidance, a Pennsylvania Amendment to Trust Agreement is prepared. This document specifically identifies the inter vivos trust from which property is being added, outlines the nature of the properties to be included, and clearly describes how the amended trust agreement will continue to operate. 3. Consent of Trustee: Obtaining the consent of the trustee is crucial for implementing the amendment. The trustee, who holds management and control over the trust, must review and approve the proposed changes. The trustee's consent ensures compliance with the terms of the original trust agreement and helps facilitate a smooth transition. 4. Execution and Notarization: Once the amendment is reviewed and approved by the trustee, it is executed by all relevant parties, including the settler, trustee, and beneficiaries, where necessary. The document should be notarized to ensure its legality and validity. Conclusion: A Pennsylvania Amendment to Trust Agreement is a legal instrument that allows the addition of property from an inter vivos trust, subject to the consent of the trustee. By making this amendment, settlers can adapt their trust to changing circumstances, diversify their assets, safeguard their wealth, and ensure the realization of their estate planning goals under Pennsylvania law. Seeking professional advice from experienced attorneys specializing in trusts and estates is essential to ensure compliance with relevant legal regulations throughout this process.Title: Pennsylvania Amendment to Trust Agreement: Adding Property from an Inter Vivos Trust and Consent of Trustee Introduction: A Pennsylvania Amendment to Trust Agreement is a legal document used to modify or update an existing trust agreement by adding property from an inter vivos trust. This amendment ensures that all relevant provisions, powers, and terms are properly reflected and controlled within the trust. Additionally, the consent of the trustee is required to execute such changes. This article provides a detailed description of the Pennsylvania Amendment to Trust Agreement related to adding property from an inter vivos trust and obtaining the consent of the trustee. Types of Pennsylvania Amendments to Trust Agreement in Order to Add Property from Inter Vivos Trust: 1. Pennsylvania Amendment to Trust Agreement — Succession Planning: This type of amendment is utilized when the settler of an inter vivos trust wishes to include additional assets, such as real estate, stocks, or other forms of property, into the trust. The amendment ensures the smooth transition of ownership and control of these assets upon the death of the settler, ensuring alignment with their estate planning objectives. 2. Pennsylvania Amendment to Trust Agreement — Diversification of Assets: This type of amendment allows the inclusion of additional assets within an inter vivos trust as a means to diversify the portfolio. By adding various types of assets, such as mutual funds, stocks, bonds, or real estate, the trust's investment risk can be spread across different asset classes, thereby reducing potential losses and increasing potential gains. 3. Pennsylvania Amendment to Trust Agreement — Wealth PreservationShowcasesesettlearrer odor may choose to transfer significant financial assets into an inter vivos trust to protect their wealth. This type of amendment aims to safeguard assets against creditors, potential lawsuits, or divorce proceedings. By adding property through this amendment, the trustee gains control over these assets, providing enhanced security for the beneficiaries. The Process of a Pennsylvania Amendment to Trust Agreement: 1. Legal Consultation: Before initiating the amendment, it is prudent to consult with a qualified attorney specializing in trusts and estates. The attorney will review the existing trust agreement, evaluate the proposed changes, and guide the settler on the appropriate legal steps required to execute the amendment. 2. Drafting the Amendment: Based on the attorney's guidance, a Pennsylvania Amendment to Trust Agreement is prepared. This document specifically identifies the inter vivos trust from which property is being added, outlines the nature of the properties to be included, and clearly describes how the amended trust agreement will continue to operate. 3. Consent of Trustee: Obtaining the consent of the trustee is crucial for implementing the amendment. The trustee, who holds management and control over the trust, must review and approve the proposed changes. The trustee's consent ensures compliance with the terms of the original trust agreement and helps facilitate a smooth transition. 4. Execution and Notarization: Once the amendment is reviewed and approved by the trustee, it is executed by all relevant parties, including the settler, trustee, and beneficiaries, where necessary. The document should be notarized to ensure its legality and validity. Conclusion: A Pennsylvania Amendment to Trust Agreement is a legal instrument that allows the addition of property from an inter vivos trust, subject to the consent of the trustee. By making this amendment, settlers can adapt their trust to changing circumstances, diversify their assets, safeguard their wealth, and ensure the realization of their estate planning goals under Pennsylvania law. Seeking professional advice from experienced attorneys specializing in trusts and estates is essential to ensure compliance with relevant legal regulations throughout this process.