This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

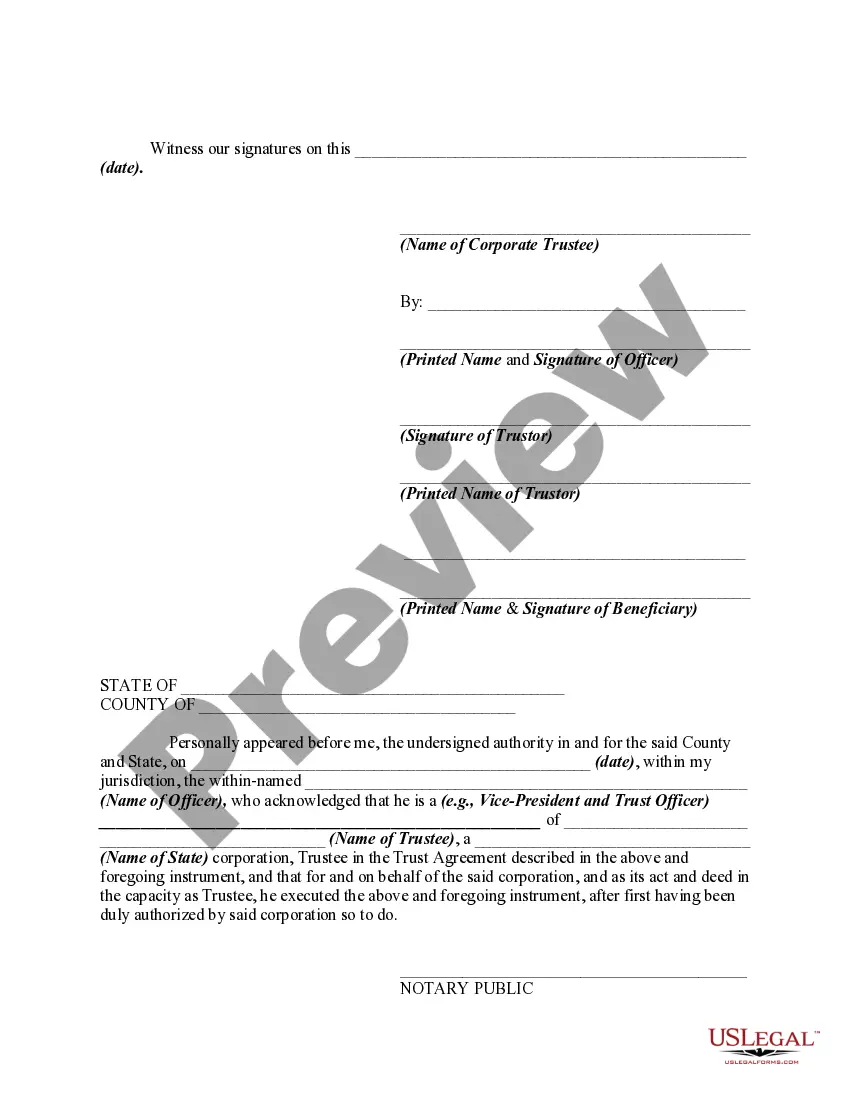

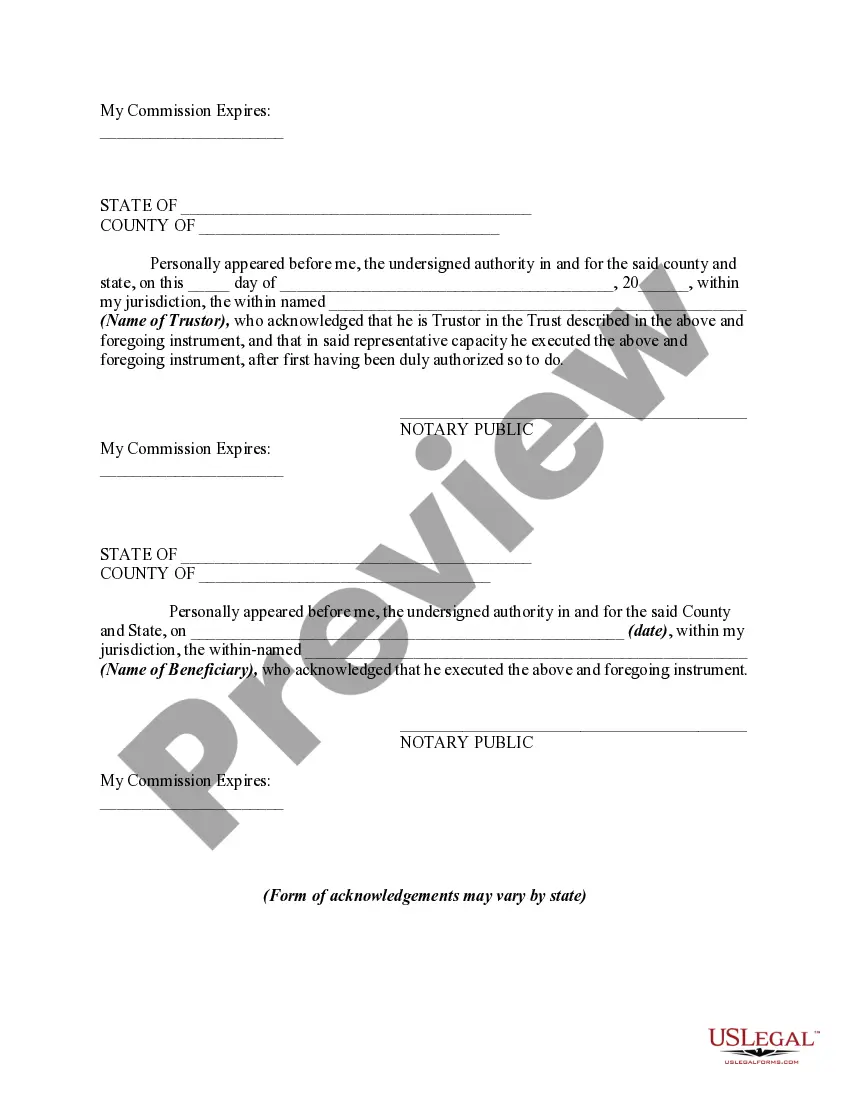

Pennsylvania Agreement to Renew Trust Agreement is a legally binding contract that outlines the process of renewing a trust agreement in the state of Pennsylvania. It ensures that the trust's terms, conditions, and objectives are reviewed and updated periodically to meet the changing needs and goals of the trust beneficiaries. The purpose of the Pennsylvania Agreement to Renew Trust Agreement is to provide a systematic approach for the trust or and the trustee to evaluate the trust's performance and make any necessary modifications or amendments to align it with the current financial, legal, or familial circumstances. This agreement offers protection to all parties involved and helps maintain the integrity and validity of the trust. Various types of Pennsylvania Agreement to Renew Trust Agreement may exist depending on the specific requirements and preferences of the trust or and beneficiaries. Some common types include: 1. Irrevocable Trust Renewal Agreement: This type of agreement applies to trusts that are irrevocable, meaning that the trust or cannot modify or terminate the trust without the consent of the beneficiaries or a court order. An irrevocable trust renewal agreement ensures that the trust's terms are updated while preserving the overall structure and objectives of the original trust. 2. Revocable Trust Renewal Agreement: A revocable trust renewal agreement pertains to trusts that the trust or is allowed to modify, amend, or revoke at any time during their lifetime. This agreement allows the trust or to review and renew the trust's terms periodically, ensuring it continues to reflect their intentions accurately. 3. Testamentary Trust Renewal Agreement: This type of agreement relates to trusts that are established under a will and come into effect upon the trust or's death. A testamentary trust renewal agreement is crucial as it allows the trust administrator or trustee to review and renew the terms of the trust to ensure it complies with current laws and regulations. Regardless of the type, the Pennsylvania Agreement to Renew Trust Agreement typically involves a thorough examination of the trust's provisions, including asset distribution, appointment of successor trustees or beneficiaries, tax planning strategies, and other relevant considerations. It may require the involvement of legal professionals to ensure compliance with state laws and regulations. In summary, Pennsylvania Agreement to Renew Trust Agreement is an essential legal document that allows trustees and trustees to renew and update the terms of a trust according to the evolving needs and goals of the beneficiaries. Its various types address different types of trusts, such as irrevocable, revocable, and testamentary trusts. By utilizing this agreement, individuals can ensure that their trust remains effective, efficient, and aligned with their intentions throughout its lifespan.