Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering is a legal document that is specific to investment offerings within the state of Pennsylvania. This letter is typically used by companies or individuals seeking to raise capital through an intrastate offering while ensuring compliance with state securities laws. The purpose of this letter is to formally declare the intent of the issuer to remain within the boundaries of the exemption for intrastate offerings as outlined by Pennsylvania securities regulations. By signing this letter, the issuer acknowledges their understanding of the exemption and their commitment to adhere to the relevant requirements and restrictions. Some relevant keywords associated with the Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering include: 1. Pennsylvania's securities laws: Refers to the specific set of regulations and laws governing securities offerings and transactions within the state of Pennsylvania. 2. Intrastate offering: The sale of securities exclusively to individuals within the same state where the company is located, while complying with the respective state's exemption requirements. 3. Securities exemptions: Exemptions granted to certain offerings from the full registration requirements imposed by federal or state securities laws. 4. Pennsylvania Investment Letter: A formal written document designed specifically for investment offerings in Pennsylvania, outlining the issuer's intent to comply with the exemption criteria. 5. Compliance: The act of ensuring that all legal and regulatory requirements are met when conducting securities offerings or transactions. 6. Capital raising: The process of obtaining funds from investors to finance business activities or projects. 7. Issuer: The company or individual offering the securities for sale to investors. 8. Declaration of intent: A formal statement made by the issuer, confirming their commitment to adhere to specific regulations or requirements. It's important to note that there may be variations or specific types of Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering, depending on the nature of the securities offering or the specific circumstances of the issuer. For example, a letter specifically tailored for a real estate offering might have additional clauses or provisions. However, the core purpose of the letter remains consistent — to affirm the issuer's intent to comply with the intrastate offering exemption under Pennsylvania securities laws.

Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering

Description

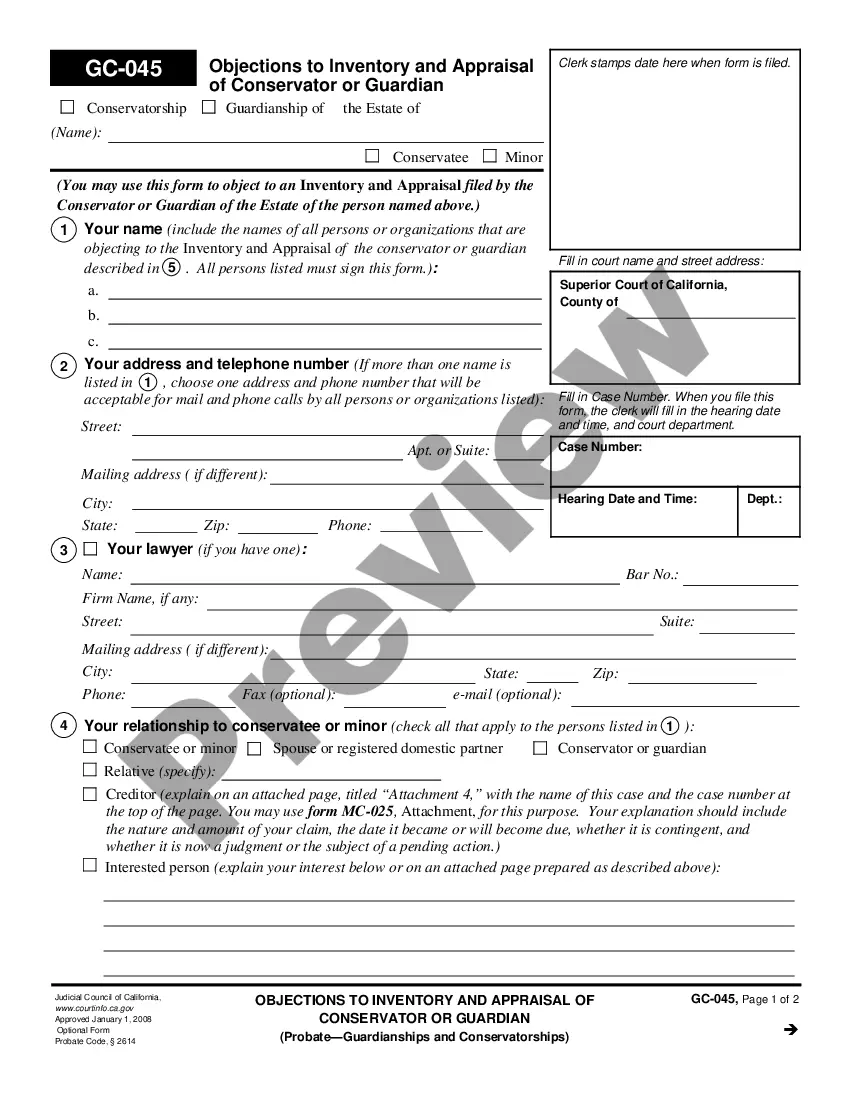

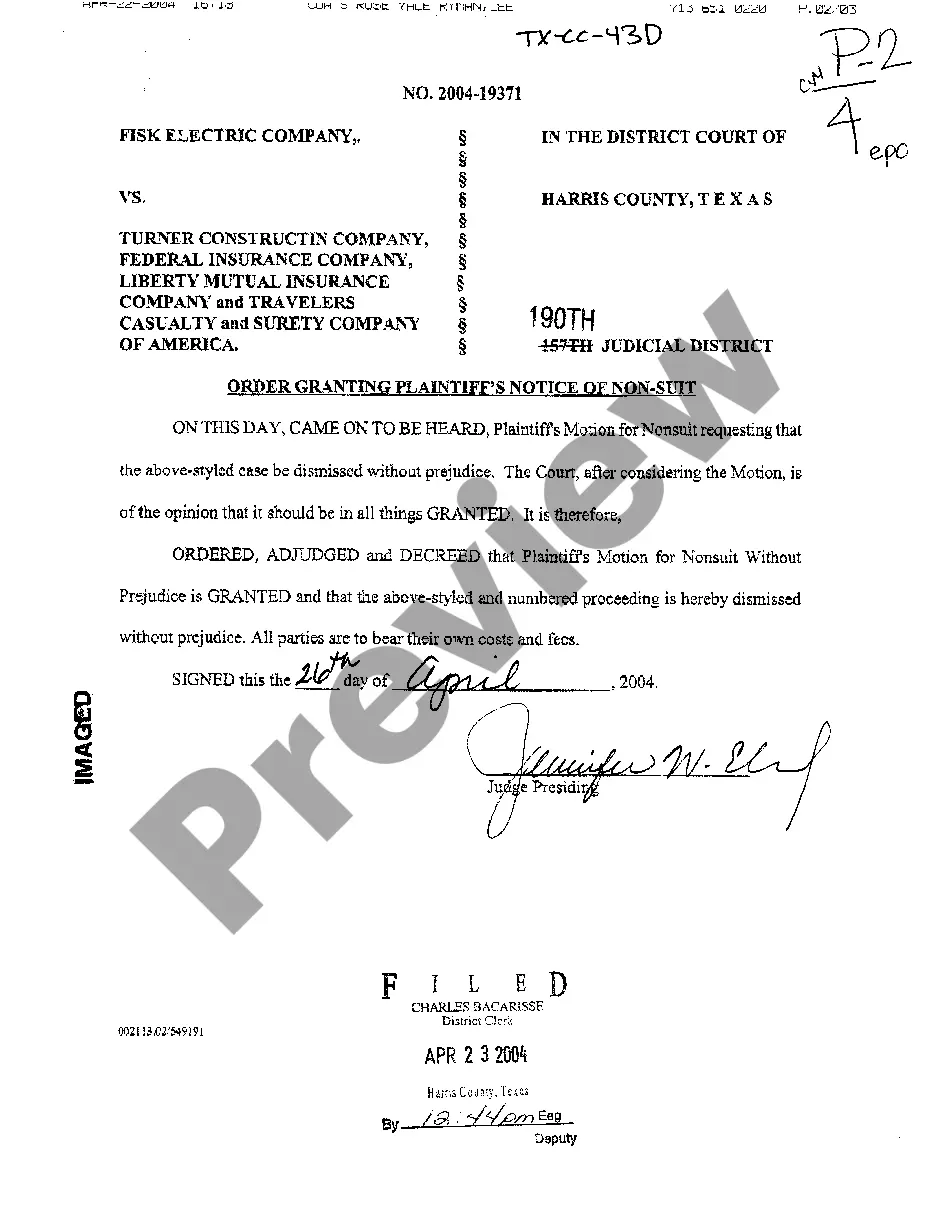

How to fill out Pennsylvania Investment Letter Promising Not To Violate Exemption Of Intrastate Offering?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a broad selection of legal documents that you can obtain or print.

Using the website, you can access thousands of documents for professional and personal purposes, organized by types, states, or keywords. You can acquire the latest forms such as the Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering in just a few moments.

If you already have an account, Log In and access the Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously purchased documents from the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to process the payment.

Select the format and download the document to your device. Make edits. Fill out, amend, and print and sign the acquired Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering. Every template you added to your account has no expiration date and belongs to you indefinitely. Thus, if you want to obtain or print another copy, simply visit the My documents section and click on the document you need. Access the Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering with US Legal Forms, the most extensive collection of legal document templates. Utilize numerous professional and state-specific templates that cater to your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct document for your city/region.

- Click the Review button to examine the content of the document.

- Read the document description to confirm you have chosen the right one.

- If the document does not meet your needs, use the Search box at the top of the page to find one that does.

- Once you are happy with the document, finalize your choice by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Section 147 establishes guidelines for businesses that want to offer securities only to residents within their state, thereby promoting local investment. This rule is significant for companies looking to create a Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering, which ensures compliance with state regulations. By following the stipulations laid out in Section 147, companies can secure funding safely and successfully connect with local investors. Thus, understanding this rule can enhance the growth opportunities for businesses operating in Pennsylvania.

The 147 rule in study is primarily concerned with the parameters surrounding intrastate offerings and investments within Pennsylvania. It aims to facilitate local investment opportunities while keeping regulatory pitfalls at bay. When a company issues a Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering, it highlights its commitment to adhere to the conditions outlined in Rule 147. This builds trust and encourages participation from local investors.

Rule 147 focuses on intrastate offerings, enabling companies to raise funds within their own state, while Rule 144 deals with the resale of restricted securities and allows investors to sell securities after a designated holding period. Understanding the distinctions is crucial, especially when planning a Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering. Companies must adhere to Rule 147's guidelines to maintain compliance and ensure successful funding without federal complications.

Tax Rule 147 refers to a regulation established to help companies raise funds through intrastate offerings. It allows businesses in Pennsylvania to solicit investments without registering with the SEC, provided they meet specific state-based requirements. A Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering is often used to formally state compliance with these requirements. This approach simplifies the investment process for local businesses and investors alike.

Intrastate offerings refer to securities offerings that take place wholly within a single state. These offerings are specifically targeted at local investors and come with simplified regulatory requirements. When you opt for a Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering, you position yourself to effectively leverage these local opportunities, enhancing your capital-raising efforts.

Rule 147 is a regulation that provides an exemption for intrastate offerings, allowing businesses to offer securities within their home state without full SEC registration. This rule is beneficial for local companies seeking to raise capital easily while minimizing regulatory hurdles. Utilizing a Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering aligns your strategy with this rule, ensuring you take full advantage of its benefits.

To qualify for an exempt offering under Rule 147, issuers must meet certain conditions, such as conducting business within the state, offering securities only to state residents, and using 80% of the offering proceeds within the state. Fulfilling these requirements is essential to ensure compliance. Therefore, incorporating a Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering can be part of your compliance efforts for a successful offering.

The intrastate exemption allows issuers to offer and sell securities exclusively to residents of their state. This exemption simplifies the process and reduces the regulatory burden for smaller issuers. When defining your offering strategy, consider a Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering as a key element to remain compliant while attracting local investors.

Yes, intrastate offerings can be exempt from federal registration under the Securities Act, particularly through Rule 147. This exemption enables issuers to offer and sell securities within their state without extensive federal requirements. By securing a Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering, issuers can benefit from significant advantages in accessing local capital.

Certain entities can avoid registering with the SEC under regulations such as Rule 147. These include businesses that offer securities exclusively within their home state and meet specific criteria. Thus, if you are utilizing a Pennsylvania Investment Letter Promising not to Violate Exemption of Intrastate Offering, you may qualify as exempt, provided you adhere to all applicable rules and conditions.