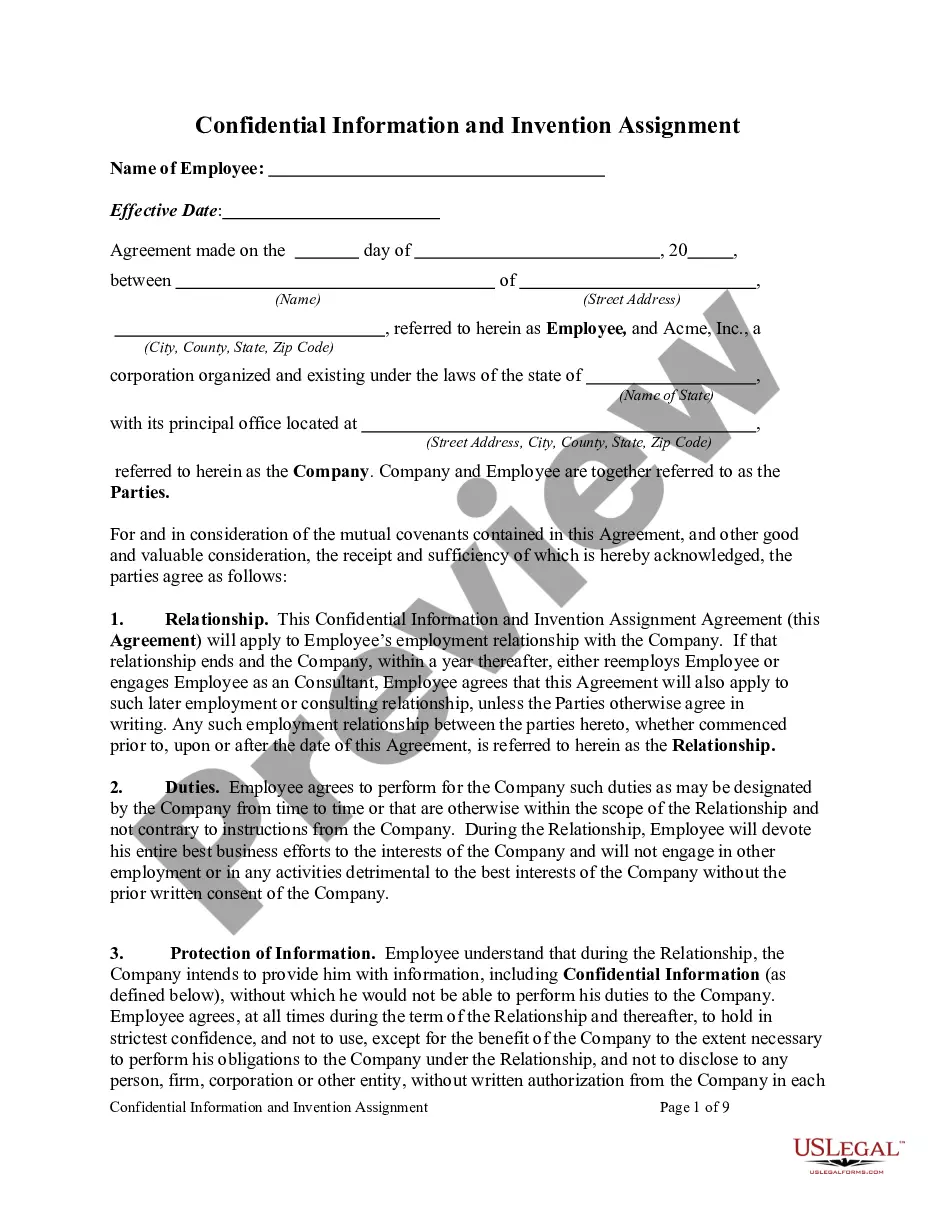

The Pennsylvania Bill of Transfer to a Trust is a legal document used to transfer ownership of assets or property to a trust. This legal instrument plays an important role in estate planning, allowing individuals to manage and protect their assets during their lifetime and ensuring a smooth transition of ownership to beneficiaries upon their death. The Pennsylvania Bill of Transfer to a Trust serves as evidence of the transfer of assets and enables the trust to hold legal title to the property. It outlines the details of the transfer, such as the description of the assets being transferred, the name of the trust, and the names of the granter (person transferring the assets) and trustee (person responsible for managing the trust). There are several types of Pennsylvania Bills of Transfer to a Trust, including: 1. Revocable Living Trust Transfer: This type of transfer allows individuals to maintain control over their assets during their lifetime. They can make changes or revoke the trust if circumstances change. It offers flexibility and the ability to avoid probate, ensuring privacy and efficient asset distribution upon the granter's death. 2. Irrevocable Asset Protection Trust Transfer: In this type of transfer, assets are permanently placed in an irrevocable trust, providing protection against creditors, lawsuits, and estate taxes. This transfer is often used for high-net-worth individuals or those seeking asset protection and Medicaid planning. 3. Testamentary Trust Transfer: This type of transfer is created through a will, allowing assets to be transferred to a trust upon the granter's death. It provides the opportunity to designate how assets will be distributed and managed after death, ensuring continuity and meeting specific beneficiaries' needs. 4. Special Needs Trust Transfer: This type of transfer is designed for beneficiaries with disabilities, allowing them to receive assets without losing eligibility for government benefits. It provides financial support, supplemental resources, and protection for individuals with special needs throughout their lifetime. Pennsylvania's residents considering estate planning can benefit from a Pennsylvania Bill of Transfer to a Trust. Properly executed trusts can help avoid probate, minimize estate taxes, protect assets, and ensure a smooth transfer of property to designated beneficiaries. Seeking the advice of an experienced estate planning attorney is advisable to create a tailored trust that meets individual needs and complies with Pennsylvania laws.

Pennsylvania Bill of Transfer to a Trust

Description

How to fill out Pennsylvania Bill Of Transfer To A Trust?

Are you presently in the situation where you need to have documents for sometimes business or individual purposes just about every day? There are a variety of legitimate document themes available online, but finding types you can depend on is not simple. US Legal Forms offers 1000s of develop themes, much like the Pennsylvania Bill of Transfer to a Trust, that are written in order to meet state and federal specifications.

In case you are presently acquainted with US Legal Forms internet site and have a free account, merely log in. Next, you can download the Pennsylvania Bill of Transfer to a Trust web template.

Unless you provide an accounts and wish to start using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is for that appropriate town/region.

- Utilize the Review option to analyze the form.

- Look at the information to ensure that you have chosen the proper develop.

- If the develop is not what you are trying to find, make use of the Look for discipline to obtain the develop that fits your needs and specifications.

- Once you obtain the appropriate develop, click on Purchase now.

- Opt for the rates program you need, complete the necessary info to produce your bank account, and purchase the transaction making use of your PayPal or credit card.

- Pick a convenient file formatting and download your version.

Locate all of the document themes you may have bought in the My Forms menu. You can obtain a extra version of Pennsylvania Bill of Transfer to a Trust any time, if possible. Just click the essential develop to download or produce the document web template.

Use US Legal Forms, the most considerable variety of legitimate types, to conserve efforts and avoid faults. The service offers professionally manufactured legitimate document themes which you can use for a variety of purposes. Produce a free account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

The PA 41 form must be filed by estates and trusts that have generated income during the tax year in Pennsylvania. This includes those that established a trust using the Pennsylvania Bill of Transfer to a Trust. Understanding your filing obligations can be complex, but platforms like uslegalforms can provide the guidance you need to navigate this process effectively.

Placing bank accounts in a trust can be a wise decision, depending on your financial situation. This strategy offers benefits such as avoiding probate and ensuring your funds are readily available to your beneficiaries. By adopting the Pennsylvania Bill of Transfer to a Trust, you simplify the process of transferring your bank accounts, thus enhancing control over your assets.

A bill of transfer in a trust is a legal document that facilitates the movement of assets into a trust. This document outlines the specific assets being transferred and the terms of the transfer. Utilizing the Pennsylvania Bill of Transfer to a Trust can streamline this process, helping you establish a trust that aligns with your financial and estate planning objectives.

One of the biggest mistakes parents make when establishing a trust fund is not clearly defining their intentions and beneficiaries. This can lead to confusion and conflict among family members. To avoid this pitfall, consider using the Pennsylvania Bill of Transfer to a Trust as a way to effectively communicate your wishes and ensure that your assets are managed according to your goals.

PA Code 91.156 A provides specific guidelines regarding the administration of trusts in Pennsylvania. It addresses how properties can be transferred and stipulates legal requirements for maintaining the trust’s integrity. Understanding this code is crucial when setting up a trust under the Pennsylvania Bill of Transfer to a Trust. Consulting a legal expert can help clarify how these regulations affect your estate planning.

Yes, you can place your home in a trust in Pennsylvania. This action can facilitate smoother asset management and provide protection for your property. The Pennsylvania Bill of Transfer to a Trust allows homeowners to structure their estate plan efficiently while ensuring their wishes are carried out. Consider using platforms like USLegalForms to simplify the process and ensure compliance with state regulations.

The choice between transfer on death (TOD) and a trust often depends on specific needs and goals. While a TOD designation allows assets to pass directly to beneficiaries without probate, a trust provides more control over asset distribution and management, as outlined in the Pennsylvania Bill of Transfer to a Trust. Trusts can also help avoid the lengthy probate process and manage assets if you become incapacitated. Evaluating the benefits of each with a legal expert can provide valuable insights.

After an individual passes away, transferring assets to a trust can be initiated through the probate process. The Pennsylvania Bill of Transfer to a Trust outlines that an executor or personal representative manages the distribution of assets according to the trust's terms. It’s important to ensure all assets are clearly designated and the trust is properly funded. Using a service like USLegalForms can streamline this process, offering clarity and guidance.

When considering the Pennsylvania Bill of Transfer to a Trust, it's essential to understand what assets are best suited for a trust. Generally, assets such as retirement accounts, health savings accounts, and certain types of life insurance policies are better left outside a trust due to tax implications or restrictions. Additionally, personal items like cars and collectibles may not benefit from being placed in a trust. Always consult with a professional to determine the best approach for your assets.

To transfer items into a trust, start by identifying the assets you wish to include, such as real estate, vehicles, or personal property. You will need to create a Pennsylvania Bill of Transfer to a Trust for each asset, clearly stating the new ownership under the trust. Once you complete these documents, present them to the necessary authorities or institutions to finalize the transfer. Using a platform like US Legal Forms can help simplify this process with clear templates and guidance.