Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

If you need to total, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Use the site's straightforward and user-friendly search feature to find the documents you require.

Numerous templates for businesses and specific applications are categorized by types and titles, or keywords.

Every legal document template you download is yours permanently. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the Pennsylvania Bartering Contract or Exchange Agreement with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to get the Pennsylvania Bartering Contract or Exchange Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to download the Pennsylvania Bartering Contract or Exchange Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the contents of the form. Make sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other templates in the legal form database.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Pennsylvania Bartering Contract or Exchange Agreement.

Form popularity

FAQ

An example of a barter contract is an arrangement where an artist agrees to provide paintings in return for a car repair service. Such contracts formalize the terms of exchange, detailing the services and items involved. To ensure that both parties are protected and understand their obligations, it is wise to use a Pennsylvania Bartering Contract or Exchange Agreement template.

A contract of barter can take many forms; one example might be a written document where a graphic designer agrees to create a logo in exchange for a website hosting service. This mutual exchange is documented to protect both parties involved. Utilizing a Pennsylvania Bartering Contract or Exchange Agreement can formalize this type of arrangement and enhance its legitimacy.

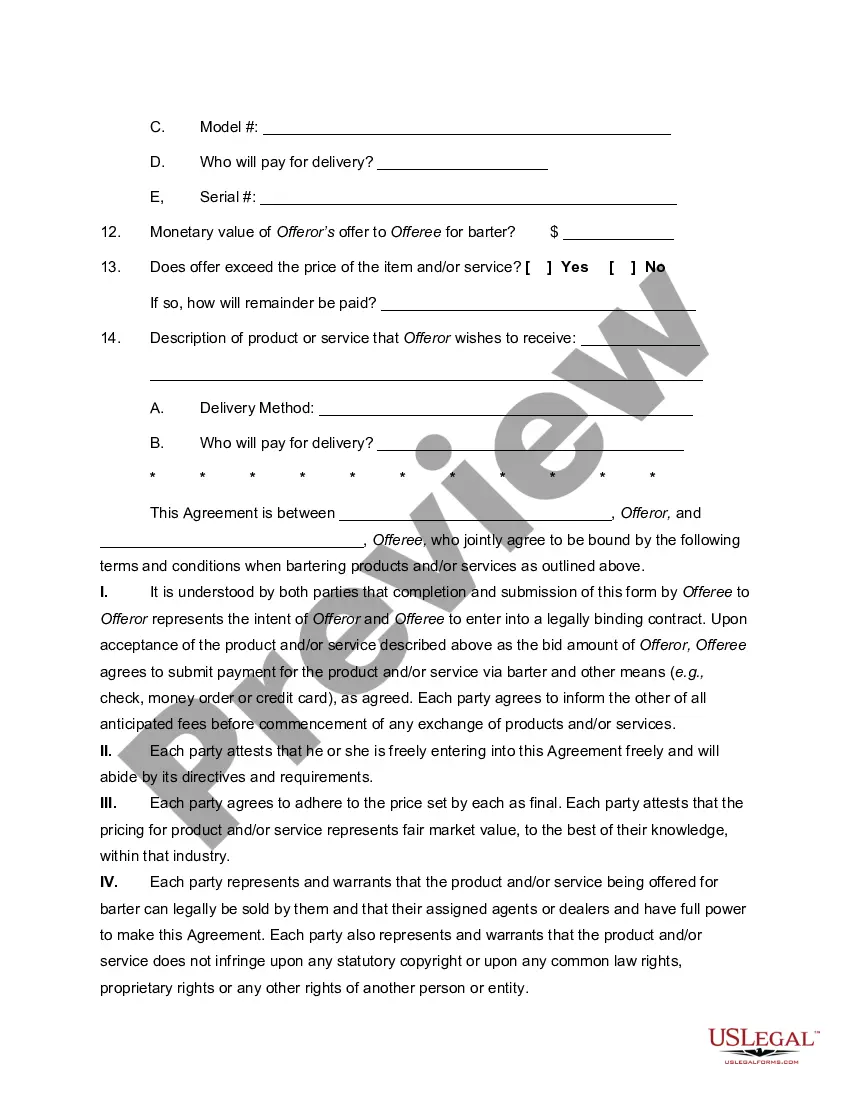

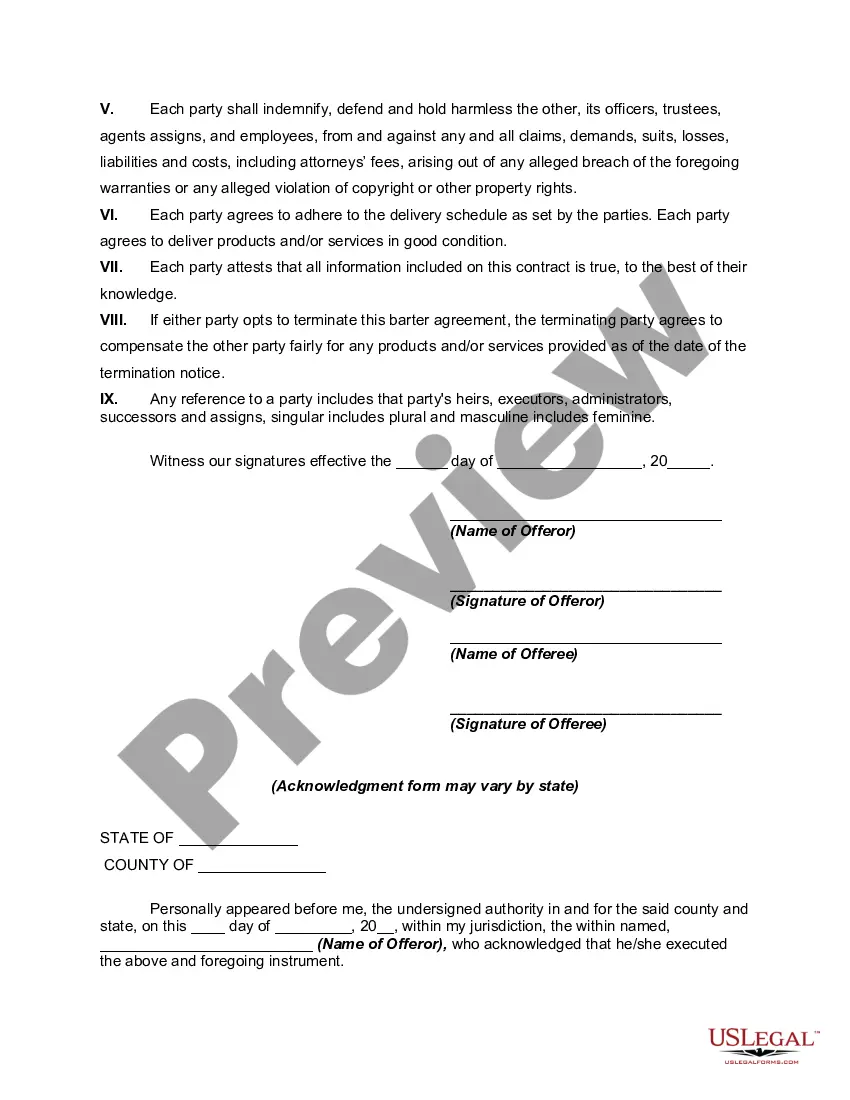

Writing a barter agreement requires clearly defining the terms, including what goods or services each party will provide. Both parties should outline the value of the items being exchanged to prevent misunderstandings. Utilizing a Pennsylvania Bartering Contract or Exchange Agreement template can simplify the process and help ensure that all essential details are included.

Bartering is governed by both federal and state laws, which generally treat it as a legitimate form of trade. In Pennsylvania, specific rules apply to these transactions, primarily around taxation and contract law. Creating a Pennsylvania Bartering Contract or Exchange Agreement helps outline the terms and conditions of your exchange, offering clarity and legal protection. This ensures both parties understand their obligations and can avoid disputes.

Yes, bartering does count as income under federal tax law. When you exchange goods or services, the fair market value of what you receive must be reported as income. For this reason, it's crucial to properly document your exchanges in a Pennsylvania Bartering Contract or Exchange Agreement. Doing so helps you maintain accurate records for tax purposes and ensures you meet all legal requirements.

Bartering is generally legal in the United States, including under Pennsylvania law. However, both parties involved in a bartering transaction should ensure they comply with relevant regulations. It's important to create a clear Pennsylvania Bartering Contract or Exchange Agreement to protect your interests. By documenting the transaction, you can avoid potential legal issues down the line.

To claim bartering on your taxes, report the fair market value of the goods or services received as income. Both parties must include this value on their tax returns. Using a Pennsylvania Bartering Contract or Exchange Agreement can help you document the transaction clearly, facilitating a smoother tax reporting process.

A contract of barter or exchange is a legal document that outlines the terms of the trade between two parties. It specifies what each party is exchanging, the value of those exchanges, and any conditions attached. A Pennsylvania Bartering Contract or Exchange Agreement is a great way to create this document and ensure clarity.

Bartering is not illegal in the U.S.; however, it must comply with local laws and regulations. Participants should ensure that their transactions are legitimate and accurately documented. A Pennsylvania Bartering Contract or Exchange Agreement can provide the structure necessary to conduct lawful bartering.

Yes, the IRS allows bartering, but transactions must still be reported as taxable income. Both parties should declare the fair market value of the items exchanged. To simplify this process, using a Pennsylvania Bartering Contract or Exchange Agreement provides documentation that can help with due diligence for tax purposes.