Pennsylvania Owner Financing Contract for Home

Description

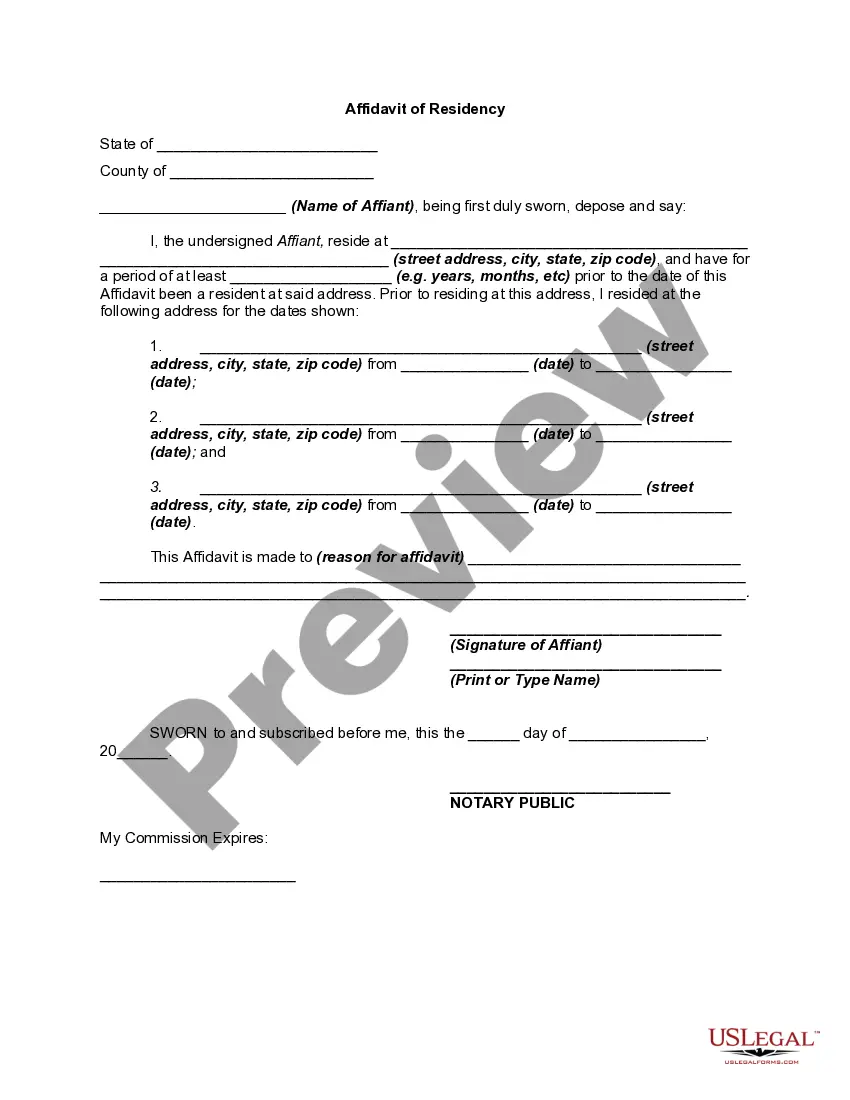

How to fill out Owner Financing Contract For Home?

Selecting the optimal legal document template can be a challenge. Clearly, there are numerous designs accessible online, but how can you locate the legal form you need? Utilize the US Legal Forms website.

This service offers a vast array of templates, including the Pennsylvania Owner Financing Agreement for Residence, which can be utilized for both business and personal purposes. All documents are verified by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and click on the Download button to obtain the Pennsylvania Owner Financing Agreement for Residence. Use your account to browse through the legal forms you have previously purchased. Access the My documents section of your account and obtain an additional copy of the document you need.

Complete, modify, and print and sign the acquired Pennsylvania Owner Financing Agreement for Residence. US Legal Forms is the largest collection of legal forms where you can discover a wide variety of document templates. Utilize the service to obtain professionally crafted documents that meet state requirements.

- First, confirm that you have selected the correct document for your specific city/region. You can review the document using the Preview button and read the document description to ensure it is appropriate for you.

- If the document does not fulfill your requirements, utilize the Search field to find the correct document.

- Once you are confident that the document is suitable, click the Download now button to acquire the document.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and complete the payment via your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

While owner financing offers flexibility, it comes with potential downsides. Sellers may face risks such as the buyer defaulting on payments, which can complicate the ownership transfer process. Additionally, buyers might encounter higher interest rates compared to traditional financing. It’s crucial to consider these factors carefully when negotiating your Pennsylvania Owner Financing Contract for Home.

To set up owner financing, start by discussing terms with the property seller, including payment amounts and timelines. Next, create a Pennsylvania Owner Financing Contract for Home that outlines all agreed-upon terms. It’s wise to engage a legal expert to review the agreement and ensure it complies with Pennsylvania laws. Such careful planning helps prevent misunderstandings and protects both parties.

While many states offer favorable owner financing conditions, Pennsylvania stands out for its flexible regulations. The Pennsylvania Owner Financing Contract for Home allows sellers and buyers to tailor agreements based on their needs. However, what may be 'best' largely depends on individual seller or buyer circumstances. Therefore, it is essential to review options in various states to find what works for you.

In owner financing agreements, the seller typically retains the deed until the buyer fulfills the terms of the contract. This arrangement provides security for the seller while the buyer makes regular payments. Once the buyer pays off the agreed amount, the seller transfers the deed, completing the Pennsylvania Owner Financing Contract for Home. This process protects both parties' interests during the transaction.

Owner financing is set up by the property seller and the buyer agreeing on specific terms. Sellers often work with a real estate professional or attorney to draft the Pennsylvania Owner Financing Contract for Home. This collaboration helps clarify expectations and responsibilities, ultimately making the process smoother. Thus, both parties can enter into the arrangement with confidence.

The criteria for owner financing is typically established by the seller of the property. Sellers determine the terms based on their financial goals and risk tolerance. Additionally, state laws, such as those in Pennsylvania, can influence the requirements for a Pennsylvania Owner Financing Contract for Home. It is advisable for both buyers and sellers to consult legal professionals to ensure compliance with regional regulations.

The IRS has specific rules regarding a Pennsylvania Owner Financing Contract for Home, primarily revolving around the reporting of interest income. Sellers must report the interest received as income on their tax returns, while buyers may potentially deduct mortgage interest. Understanding these rules ensures compliance and helps both parties manage their tax liabilities effectively.

If the buyer defaults on a Pennsylvania Owner Financing Contract for Home, the seller has various options outlined in the contract. Typically, the seller may initiate foreclosure proceedings to reclaim the property, just as a traditional lender would. It's crucial for both parties to understand the implications of default when entering into this agreement, as it can lead to the loss of the home for the buyer.

In seller financing arrangements, such as a Pennsylvania Owner Financing Contract for Home, the seller retains ownership of the deed until the buyer pays off the obligation. The buyer assumes the responsibility of making payments but does not gain legal ownership until they meet the terms of the contract. This setup protects the seller by providing a secure way to retain a claim on the property until full payment is received.

In a Pennsylvania Owner Financing Contract for Home, the lender typically does not hold the deed. Instead, the seller retains the deed while the buyer makes payments directly to them. This system allows the seller to possess the property until the buyer fulfills the financing terms. Ultimately, the deed transfers to the buyer once they complete the payment obligations.