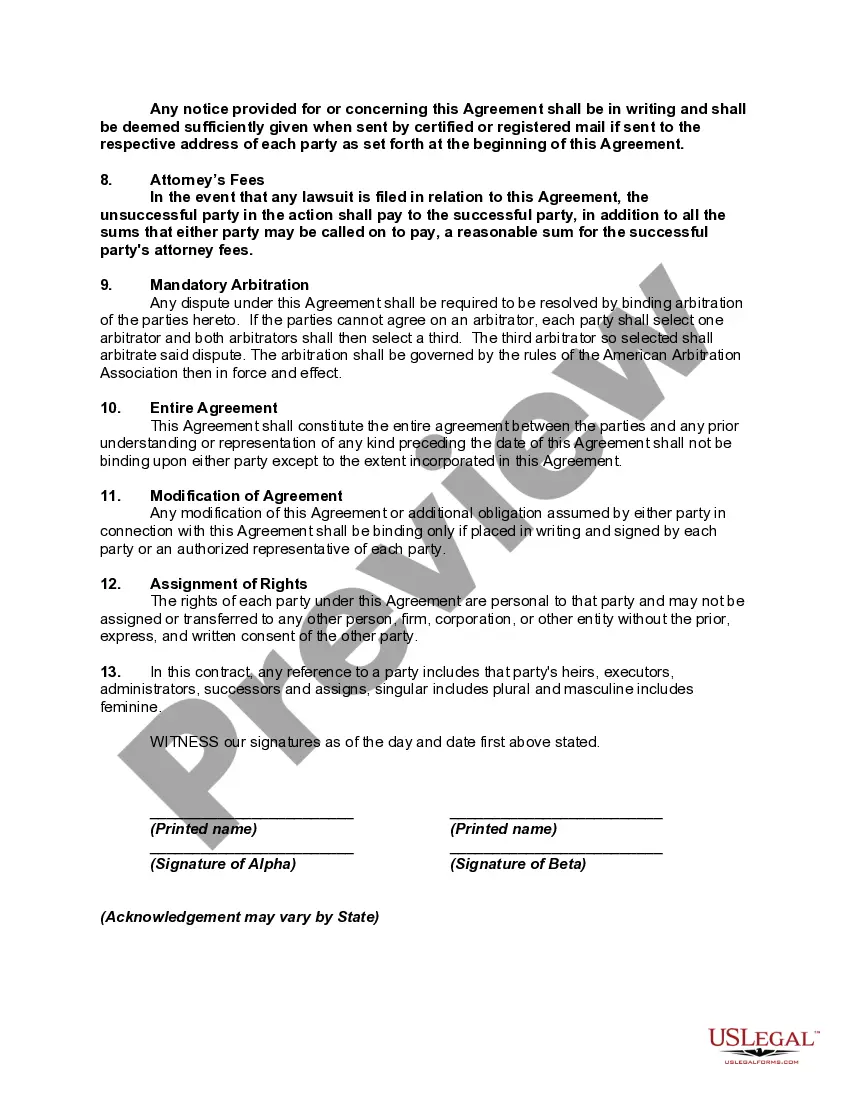

Bartering are agreements for the exchange of personal and real property are subject to the general rules of law applicable to contracts, and particularly to the rules applicable to sales of personal and real property. A binding exchange agreement is formed if an offer to make an exchange is unconditionally accepted before the offer has been revoked. Federal tax aspects of exchanges of personal property should be considered carefully in the preparation of an exchange agreement.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

In Pennsylvania, a Contract or Agreement to Make Exchange or Barter of Real Property for Business and Personal Property is a legally binding document that facilitates the transfer of ownership between parties involved in a real property transaction. This agreement outlines the terms and conditions governing the exchange or barter of real property for both business and personal purposes. This type of contract can be classified into several variations based on the nature and purpose of the transaction. Some notable types of Pennsylvania contracts or agreements for the exchange or barter of real property include: 1. Residential Real Estate Contract: This contract is used when individuals intend to exchange their residential properties, such as houses or apartments. It lays out the details of the exchange, including the legal description of the properties, purchase price, financing conditions, contingencies, and closing date. 2. Commercial Real Estate Contract: Designed for business purposes, this contract allows for the exchange or barter of commercial properties such as office buildings, retail spaces, or industrial facilities. It typically includes clauses specific to commercial transactions, like tenant agreements, zoning regulations, environmental assessments, and any other pertinent commercial considerations. 3. Land Contract or Agreement: If the exchange involves raw land or undeveloped property, a land contract may come into play. This agreement outlines the terms for transferring ownership of the land, including any existing structures or improvements. It may also specify provisions related to land development, zoning restrictions, access rights, and any potential future obligations. 4. Business Asset Exchange Agreement: In instances where the exchange involves a combination of real property and other business assets, a Business Asset Exchange Agreement is employed. This contract outlines the transfer of both tangible and intangible assets like equipment, inventory, client lists, intellectual property rights, goodwill, and real estate. It covers vital transactional details, such as valuations, warranties, representations, and any financial considerations involved. Regardless of the specific type, a Pennsylvania Contract or Agreement to Make Exchange or Barter of Real Property for Business and Personal Property should have certain common elements. These include the identification and legal description of the properties involved, the names and contact information of all parties, the agreed-upon price or compensation, the terms and conditions for the transaction, any contingencies or conditions precedent to the exchange, and the closing details. It is crucial to consult with a qualified real estate attorney or professional familiar with Pennsylvania real estate laws to ensure that the contract accurately reflects the intentions and protects the interests of all parties involved.