This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Agreement to Sell and Purchase Customer Accounts

Description

How to fill out Agreement To Sell And Purchase Customer Accounts?

Selecting the appropriate legal document template may be challenging.

Clearly, there are numerous templates accessible online, but how can you find the legal category you need.

Use the US Legal Forms website. The platform offers a wide array of templates, such as the Pennsylvania Agreement to Sell and Purchase Customer Accounts, suitable for both business and personal requirements.

You can review the form using the Review button and examine the form details to confirm it is the right one for you.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Pennsylvania Agreement to Sell and Purchase Customer Accounts.

- Utilize your account to browse the legal documents you have acquired previously.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new US Legal Forms user, here are straightforward steps to follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

Types of purchase agreements. There are four primary types of purchase orders: standard, planned, blanket, and contract. The difference between them depends on the amount of information known when the order is made. Beyond these four categories, your purchase agreement can be as unique as your transaction or project.

Can a buyer back out of a purchase agreement? Yes -- but the wording of the purchase agreement makes a difference. Purchase agreements usually include contingencies or situations in which you can back out of the contract without penalty.

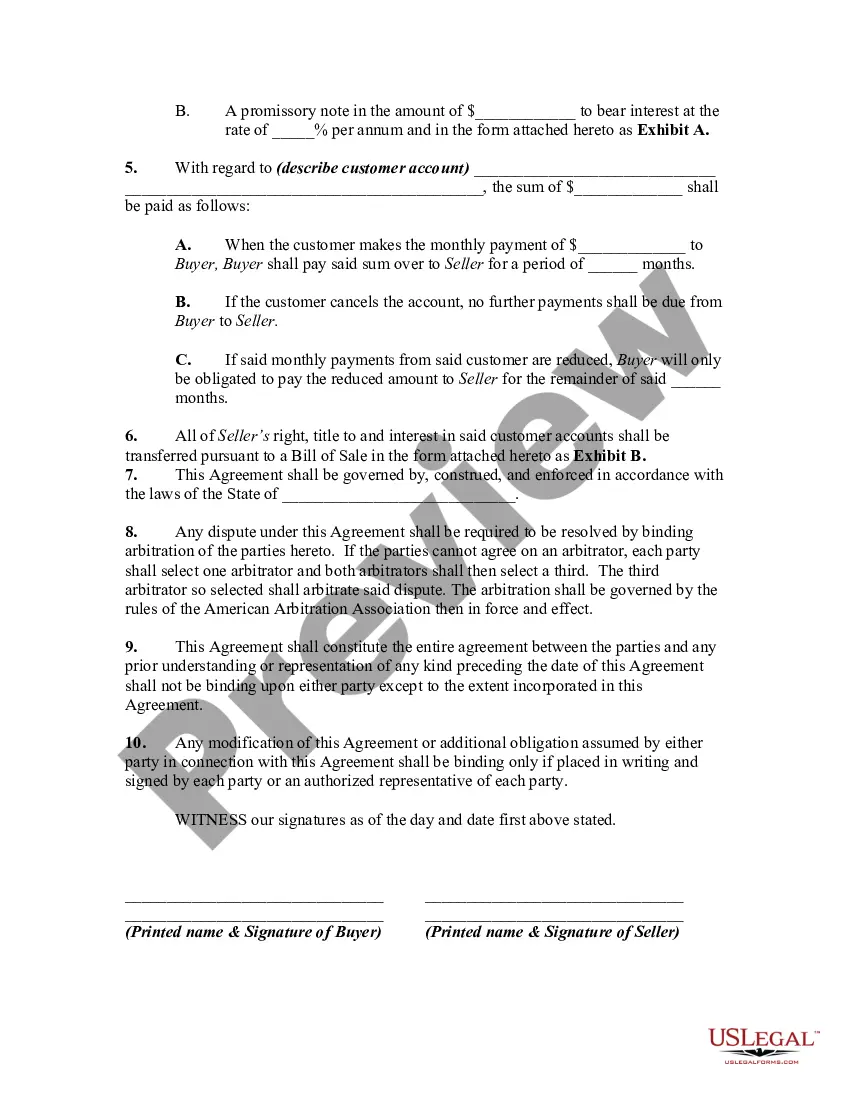

A purchase agreement is a legally binding contract between a buyer and seller. These agreements usually relate to the buying and selling of goods instead of services, and they can cover transactions for just about any type of product.

As discussed above, a purchase agreement should contain buyer and seller information, a legal description of the property, closing dates, earnest money deposit amounts, contingencies and other important information for the sale.

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

A customer agreement is a legally binding company contract between your company and customers, specifying the terms and conditions for using your products and services.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

A sale and purchase agreement provides certainty to you and the seller about what will happen when. To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.