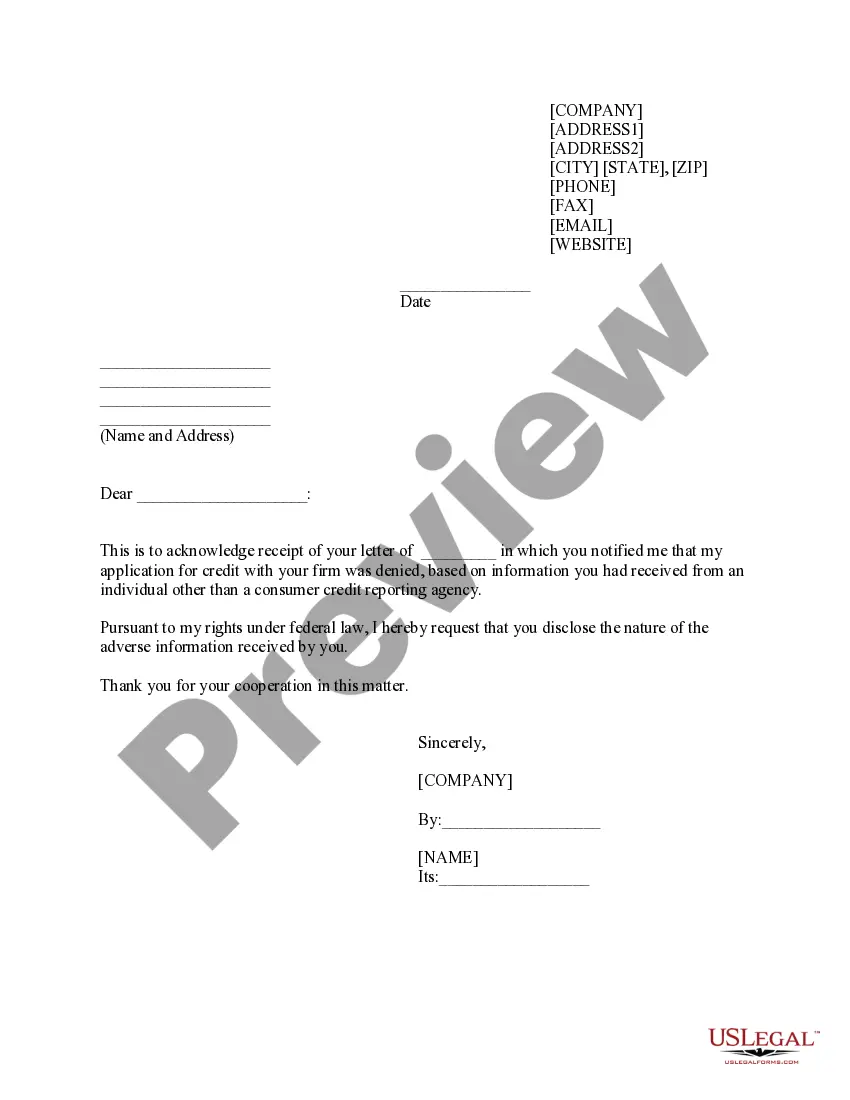

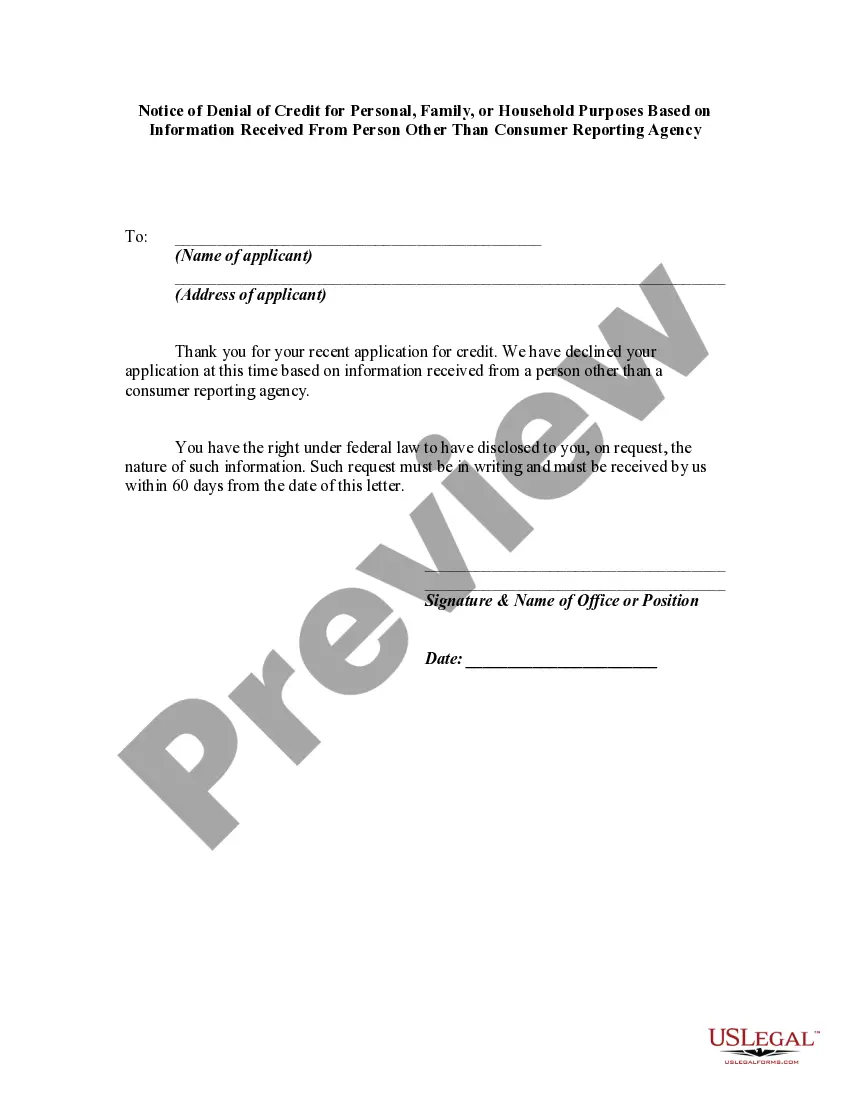

Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information.

Pennsylvania Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency

Description

How to fill out Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency?

You are able to spend time on the Internet trying to find the legitimate record design which fits the state and federal needs you will need. US Legal Forms offers 1000s of legitimate varieties which can be reviewed by pros. You can easily obtain or print out the Pennsylvania Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency from my assistance.

If you currently have a US Legal Forms profile, you may log in and then click the Down load option. Afterward, you may full, edit, print out, or indication the Pennsylvania Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency. Every single legitimate record design you buy is the one you have for a long time. To get another copy associated with a obtained type, proceed to the My Forms tab and then click the related option.

If you are using the US Legal Forms web site the first time, follow the simple recommendations under:

- Initially, be sure that you have chosen the proper record design to the county/town of your choice. Read the type outline to make sure you have picked the appropriate type. If available, utilize the Preview option to check with the record design as well.

- If you want to get another model of the type, utilize the Lookup field to obtain the design that fits your needs and needs.

- Once you have discovered the design you desire, simply click Acquire now to carry on.

- Find the pricing strategy you desire, type in your references, and register for your account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your credit card or PayPal profile to fund the legitimate type.

- Find the format of the record and obtain it to the system.

- Make alterations to the record if necessary. You are able to full, edit and indication and print out Pennsylvania Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency.

Down load and print out 1000s of record themes making use of the US Legal Forms Internet site, that provides the biggest assortment of legitimate varieties. Use specialist and condition-distinct themes to deal with your organization or individual needs.

Form popularity

FAQ

Some examples of violations include: failing to report that a debt was discharged in bankruptcy. reporting old debts as new or re-aged.

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.

If the disputed information is wrong or can't be verified, the company is required by law to delete or change the information. It also has to notify all of the credit reporting companies to which it provided the wrong information, so the credit reporting companies can update their files with the correct information.

1. Timing of notice - when an application is complete. Once a creditor has obtained all the information it normally considers in making a credit decision, the application is complete and the creditor has 30 days in which to notify the applicant of the credit decision.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the credit reporting industry. It allows you to dispute credit report errors and limits how your credit reports can be used. Companies that violate the FCRA are liable for damages, attorneys' fees, and costs.

In the credit score exception notices, creditors are required to disclose the distribution of credit scores among consumers who are scored under the same scoring model that is used to generate the consumer's credit score using the same scale as that of the credit score provided to the consumer.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).