US Legal Forms - one of several most significant libraries of authorized forms in the USA - delivers a wide array of authorized file templates you are able to acquire or print. Using the web site, you can get 1000s of forms for company and specific uses, sorted by classes, suggests, or search phrases.You will discover the most recent versions of forms just like the Pennsylvania Result of Investigation of Disputed Credit Information and Disclosure of Consumer Rights in Event of Continued Dispute in seconds.

If you already have a registration, log in and acquire Pennsylvania Result of Investigation of Disputed Credit Information and Disclosure of Consumer Rights in Event of Continued Dispute through the US Legal Forms library. The Download option will show up on each form you perspective. You get access to all formerly acquired forms within the My Forms tab of your own accounts.

In order to use US Legal Forms the very first time, listed below are easy recommendations to obtain started off:

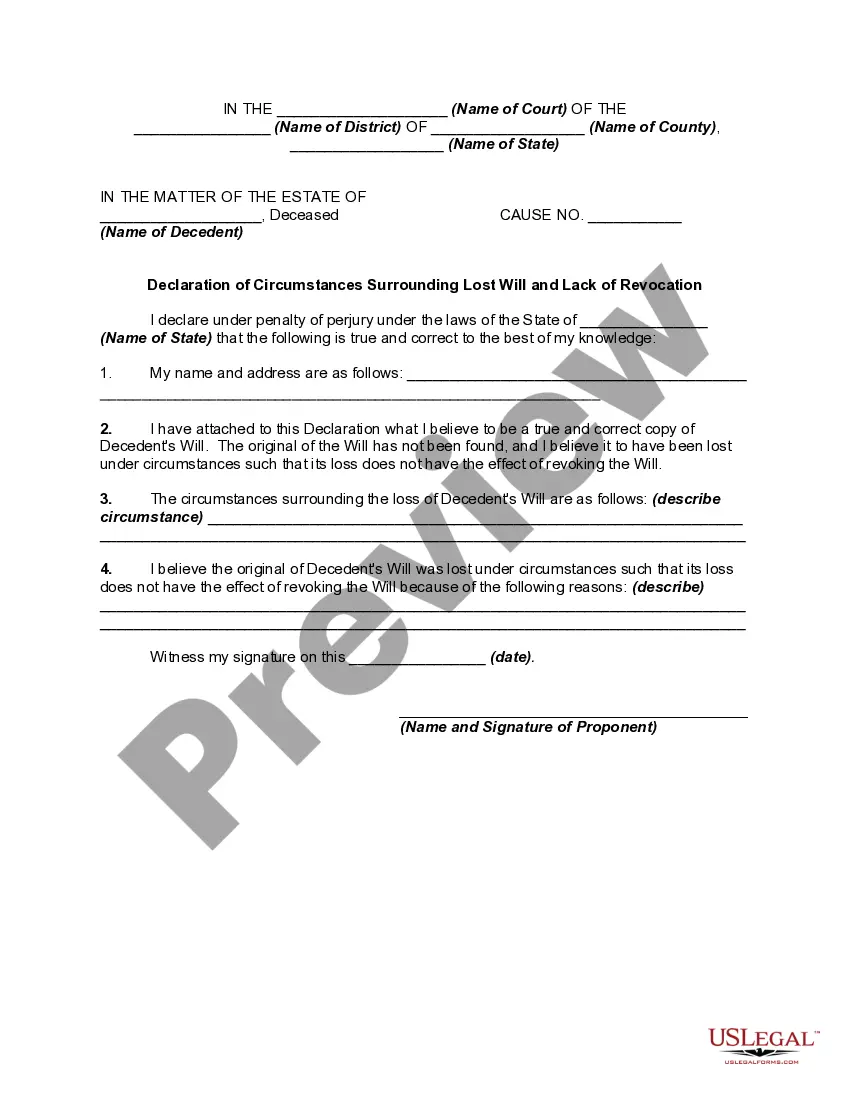

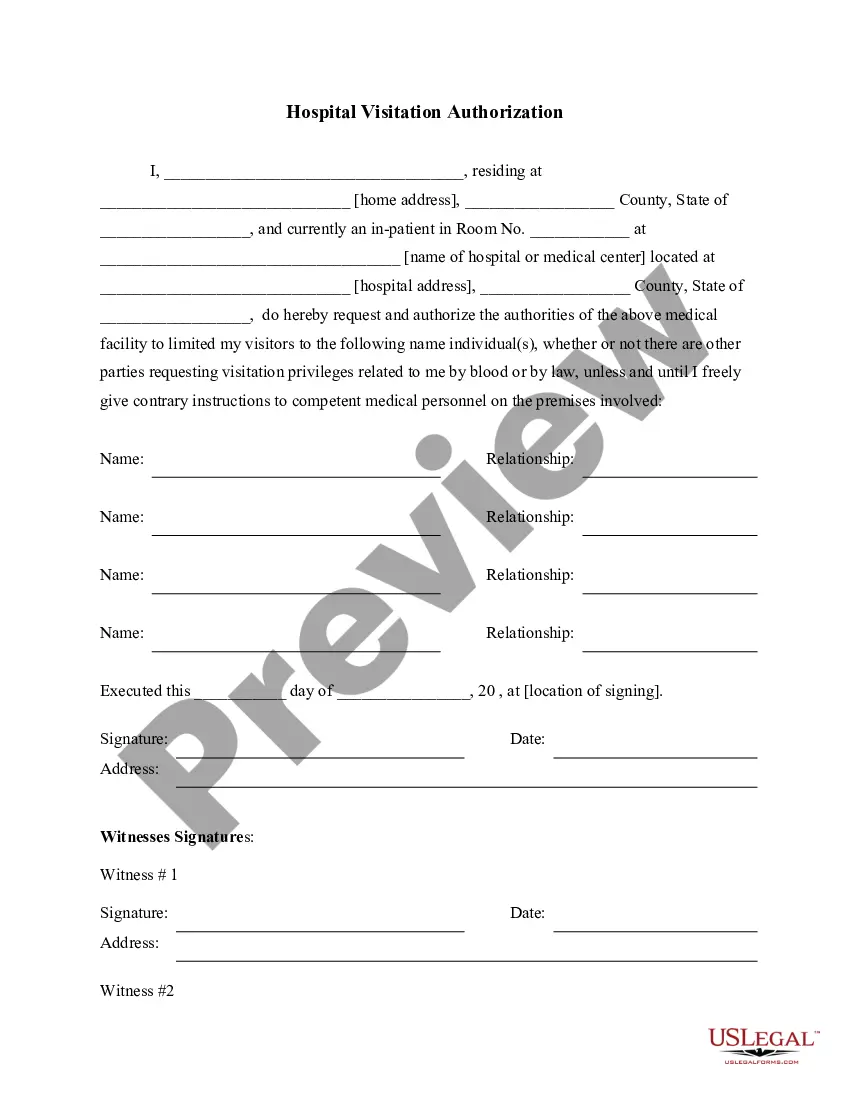

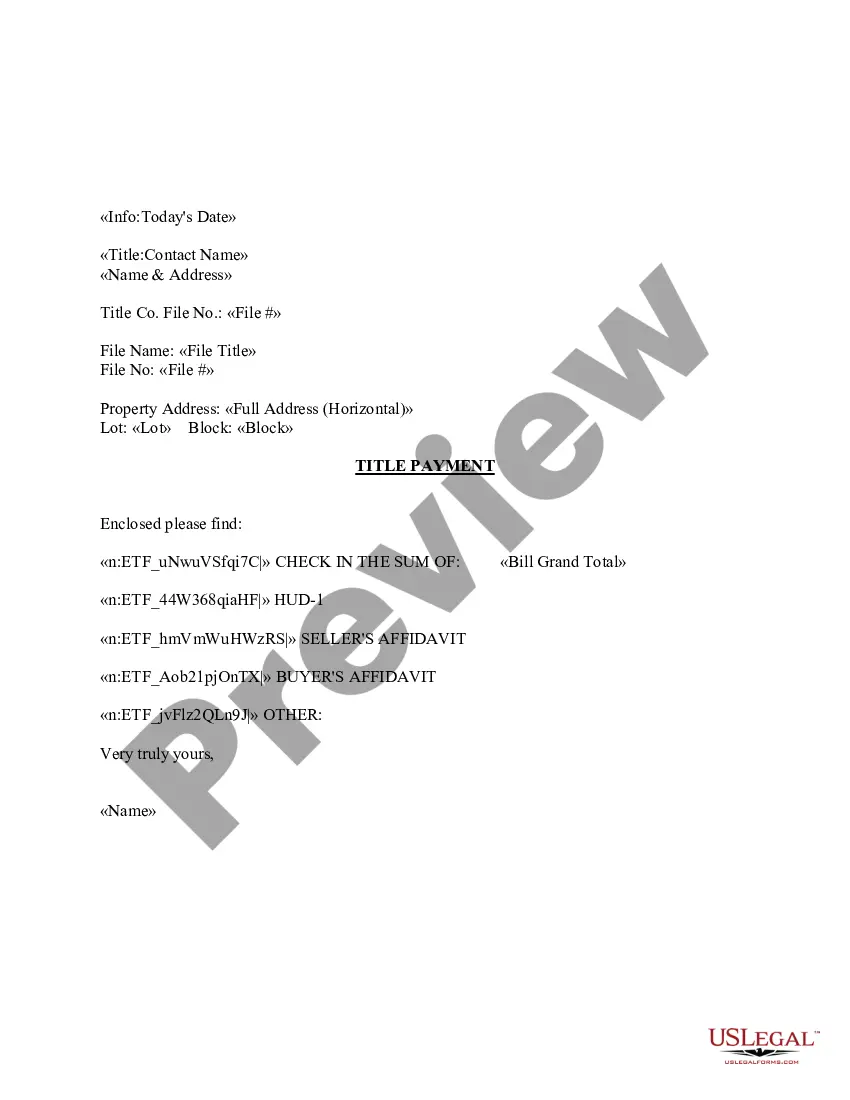

- Be sure to have picked the right form to your area/county. Click the Review option to check the form`s information. See the form explanation to ensure that you have selected the right form.

- In case the form does not fit your requirements, use the Lookup industry towards the top of the monitor to obtain the one that does.

- In case you are happy with the form, confirm your decision by clicking the Buy now option. Then, select the rates program you favor and supply your accreditations to register on an accounts.

- Process the transaction. Make use of charge card or PayPal accounts to accomplish the transaction.

- Choose the file format and acquire the form in your gadget.

- Make alterations. Load, modify and print and sign the acquired Pennsylvania Result of Investigation of Disputed Credit Information and Disclosure of Consumer Rights in Event of Continued Dispute.

Every template you included in your money does not have an expiry date which is your own permanently. So, in order to acquire or print an additional backup, just go to the My Forms segment and then click about the form you need.

Gain access to the Pennsylvania Result of Investigation of Disputed Credit Information and Disclosure of Consumer Rights in Event of Continued Dispute with US Legal Forms, probably the most extensive library of authorized file templates. Use 1000s of specialist and status-specific templates that meet your organization or specific demands and requirements.