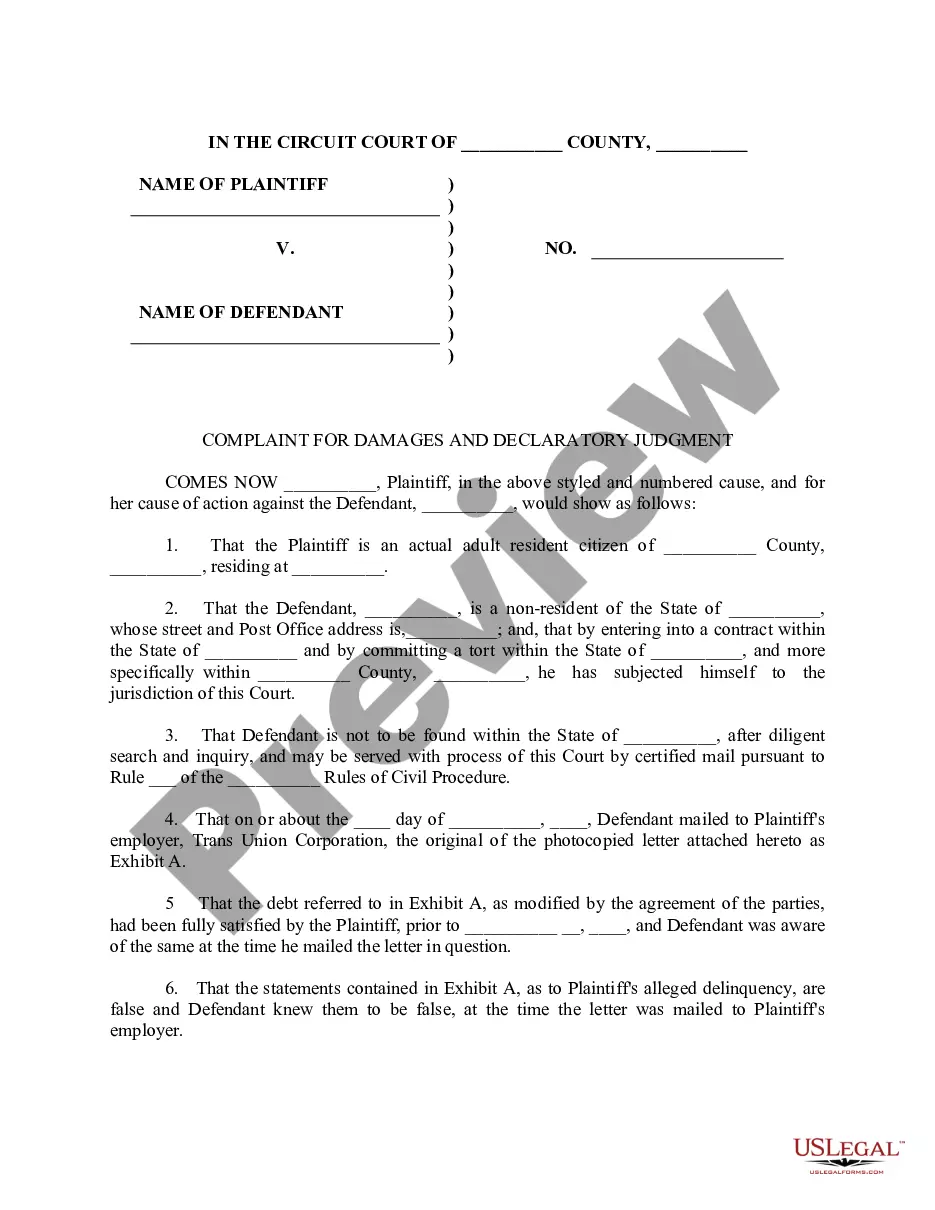

The tort of conversion occurs when personal property is taken by a defendant and kept from its true owner without permission of the owner. Conversion is the civil side of the crime of theft. In an action for conversion, the taking of the property may be lawful, but the retaining of the property is unlawful. To succeed in such an action, the plaintiff must prove that he or she demanded the property returned and the defendant refused to do so.

This form is a generic complaint and adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Pennsylvania Complaint for Wrongful Repossession of Automobile and Impairment of Credit: Types, Procedures, and Key Considerations Introduction: Pennsylvania complaint for wrongful repossession of an automobile and impairment of credit is a legal process initiated by a borrower who believes their vehicle was unlawfully repossessed, resulting in credit damage. This comprehensive guide provides an in-depth analysis of the various types of Pennsylvania complaints related to wrongful repossession and credit impairment, highlighting relevant keywords to aid understanding. Types of Pennsylvania Complaints for Wrongful Repossession of Automobile and Impairment of Credit: 1. Unlawful Repossession Claim: This type of complaint revolves around alleging that the repossession of the vehicle was carried out in violation of Pennsylvania laws. It may include scenarios where the repo agent unlawfully entered private property or breached the peace during repossession, or where the lender did not follow proper notification procedures. 2. Breach of Contract Claim: In certain cases, the borrower might claim that the lender breached the terms of the financing contract. This complaint could be based on issues like lack of notice before repossession, failure to provide a legally-required grace period, or non-compliance with the lender's own policies. 3. Defamation Claim: When a creditor wrongly reports the vehicle repossession to credit reporting agencies, resulting in negative credit scores for the borrower, a defamation claim may be pursued. This complaint asserts that the inaccurate credit reporting caused substantial harm to the borrower's creditworthiness and reputation. Procedure and Key Considerations: 1. Consultation with Attorney: If considering a complaint, it is crucial to consult with an experienced attorney who specializes in consumer protection or automobile repossession laws in Pennsylvania. They can evaluate the case, gather evidence, and provide guidance throughout the legal process. 2. Gathering Evidence: To support the complaint, gather relevant evidence such as contracts, repossession notices, communication records with the lender, and any other documentation demonstrating wrongful repossession or credit impairment. 3. Statute of Limitations: Be aware of Pennsylvania's statute of limitations for filing a complaint. Generally, this period is within four years from the date of repossession or when the harm to credit is discovered. Failing to file within this timeframe may result in the claim being dismissed. 4. Damages and Relief: Clearly identify the damages suffered due to wrongful repossession and credit impairment. These may include loss of the vehicle, damage to creditworthiness, emotional distress, and associated financial costs. Seek appropriate relief, which may include compensation, credit restoration, and punitive damages. Keywords: Pennsylvania, complaint, wrongful repossession, automobile, impairment of credit, types, unlawful repossession claim, breach of contract claim, defamation claim, procedure, consultation with attorney, gathering evidence, statute of limitations, damages, relief. Conclusion: Pennsylvania complaints for wrongful repossession of an automobile and impairment of credit are legal avenues designed to protect borrowers from unjust repossession and subsequent credit damage. Understanding the types of complaints, respective procedures, and key considerations enables individuals to navigate this complex legal process and seek appropriate relief. Consultation with a knowledgeable attorney is crucial in addressing these claims effectively.