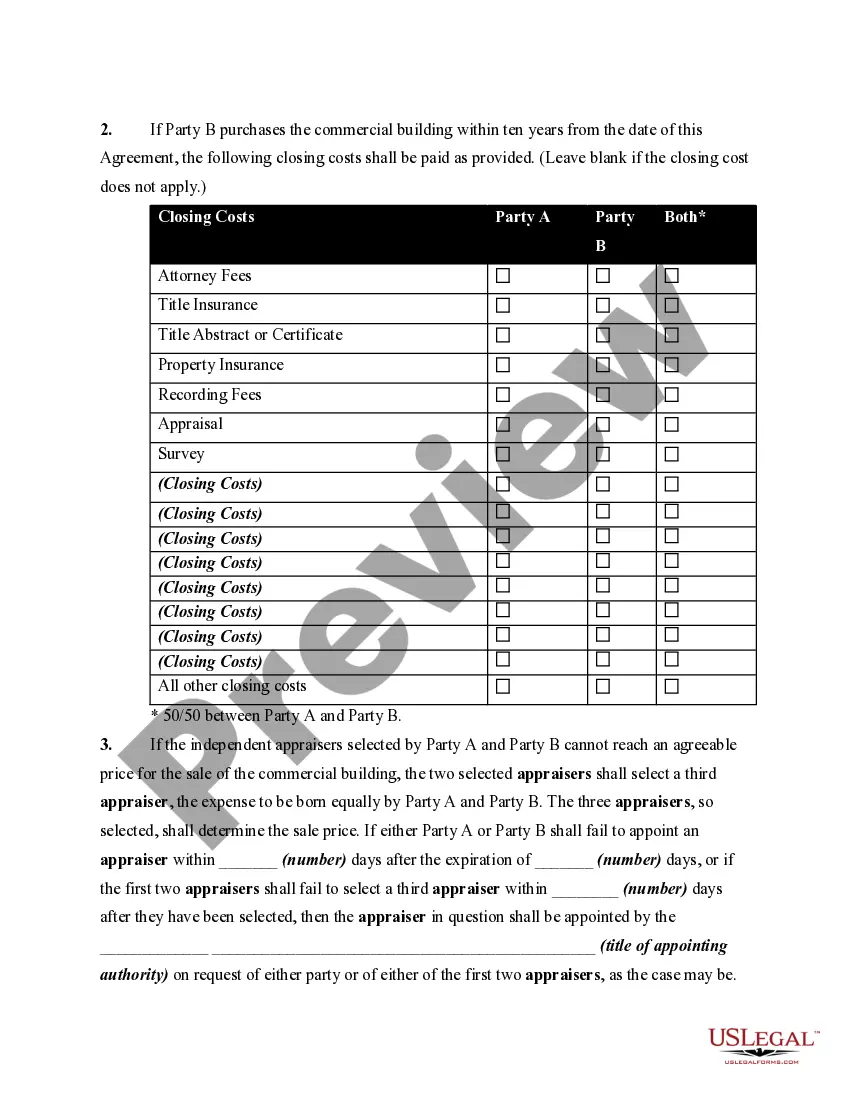

This Agreement between Partners for Future Sale of Commercial Building is used to provide for the future sale of a commercial building by giving one party the opportunity to purchase the commercial building any time in the next ten years from the date of this agreement, or by both parties agreeing to sell the commercial building outright to a third party and equally splitting the proceeds at the end of the ten-year period.

A Pennsylvania Agreement between Partners for Future Sale of Commercial Building is a legal document that outlines the terms and conditions agreed upon by partners regarding the future sale of a commercial building in the state of Pennsylvania. This agreement is designed to protect the interests of all partners involved and provide clarity on the responsibilities and obligations each partner holds. This type of agreement typically includes the following key provisions: 1. Parties involved: This section identifies all the partners involved in the agreement, including their names, addresses, and roles within the partnership. 2. Property details: Here, the vital details of the commercial building are outlined, including the address, legal description, and any special considerations or restrictions related to the property. 3. Future sale terms: The agreement delineates the terms and conditions related to the future sale of the commercial building. It includes provisions for determining the sale price, the method for valuing the property, and any agreed-upon timelines for the sale process. 4. Partners' interests and responsibilities: This section specifies the percentage or share of ownership that each partner holds in the commercial building. It also outlines the responsibilities and contributions of each partner during the ownership period up until the sale. This may include obligations for maintaining the property, paying taxes, or making improvements. 5. Decision-making process: The agreement establishes a decision-making process for significant matters relating to the commercial building, such as major renovations, lease agreements, or the method of sale. It may require unanimous consent or define a majority vote threshold for these decisions. 6. Dispute resolution: In case of any disputes or disagreements between partners, this section outlines the steps to be taken to resolve them. It may include mediation or arbitration provisions and specify the jurisdiction and venue for any legal proceedings. 7. Dissolution guidelines: This section defines the procedures for dissolving the partnership if the partners decide to end their business relationship before the sale of the commercial building. It outlines the responsibilities for dividing assets, liabilities, and any other considerations related to the dissolution. Different types of Pennsylvania Agreements between Partners for Future Sale of Commercial Building may exist depending on the specific circumstances and needs of the partners involved. These could include Partnership Agreements for Joint Venture Partnerships, Limited Liability Partnerships (LLP), Limited Partnerships (LP), or general partnerships among others. Each type of agreement may have additional clauses or provisions tailored to the particular partnership structure. In conclusion, a Pennsylvania Agreement between Partners for Future Sale of Commercial Building is a comprehensive legal document that outlines the terms and conditions related to the future sale of a commercial property. It is essential for partners to carefully negotiate and draft such an agreement to protect their interests and ensure a smooth sale process.