This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Receipt and Acceptance of Residential Mortgage Loan Commitment

Description

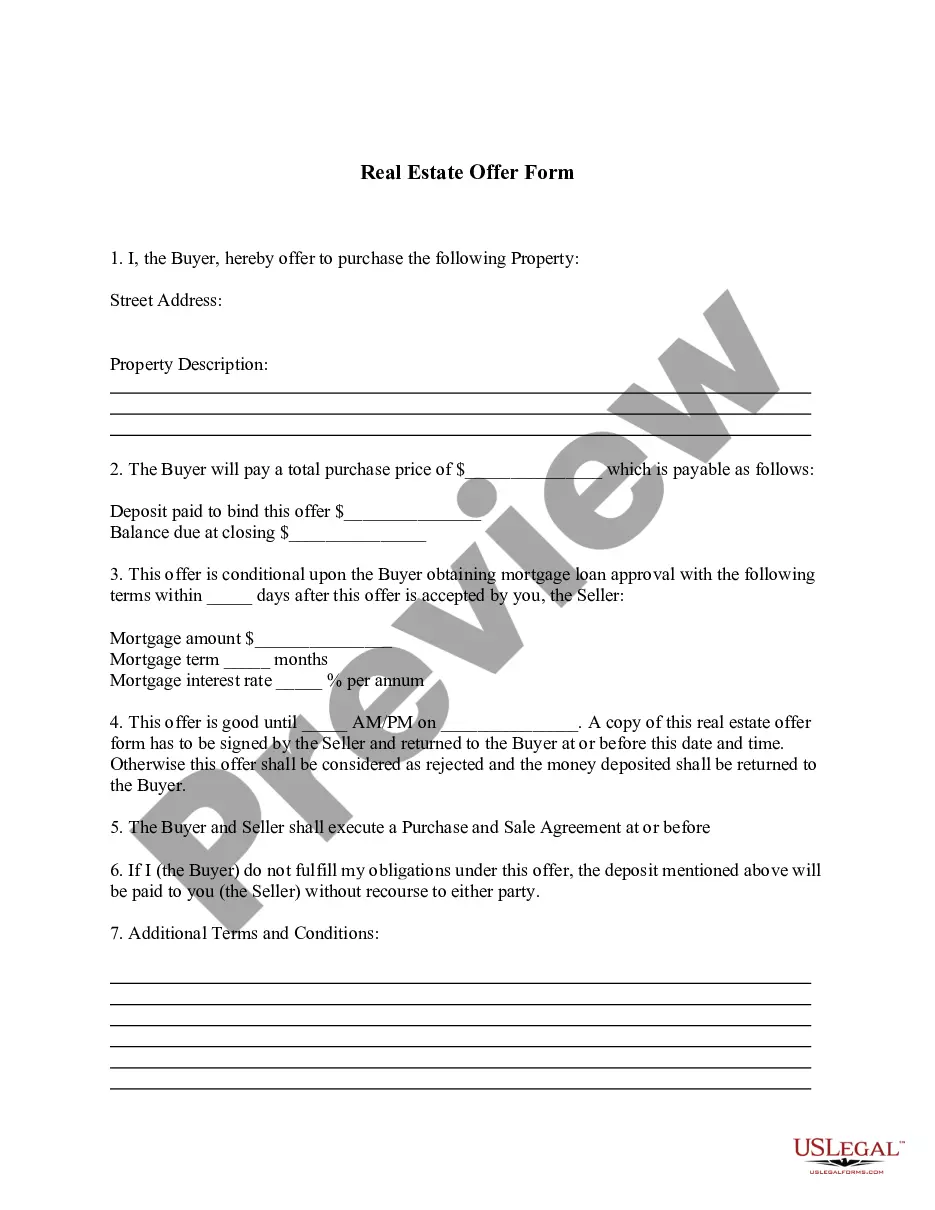

How to fill out Receipt And Acceptance Of Residential Mortgage Loan Commitment?

Are you presently in a place the place you need to have paperwork for either business or person purposes nearly every day time? There are tons of legitimate document layouts available online, but finding types you can trust isn`t straightforward. US Legal Forms provides thousands of develop layouts, such as the Pennsylvania Receipt and Acceptance of Residential Mortgage Loan Commitment, which can be published to meet state and federal demands.

When you are currently familiar with US Legal Forms website and get a free account, just log in. Next, you can obtain the Pennsylvania Receipt and Acceptance of Residential Mortgage Loan Commitment format.

If you do not have an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Get the develop you will need and ensure it is to the correct area/area.

- Take advantage of the Preview key to check the shape.

- See the information to ensure that you have selected the right develop.

- When the develop isn`t what you`re seeking, take advantage of the Research field to obtain the develop that suits you and demands.

- Whenever you get the correct develop, click on Get now.

- Opt for the costs program you would like, fill out the necessary details to generate your money, and buy the order using your PayPal or charge card.

- Pick a handy data file structure and obtain your version.

Discover each of the document layouts you may have bought in the My Forms menus. You can aquire a extra version of Pennsylvania Receipt and Acceptance of Residential Mortgage Loan Commitment any time, if needed. Just go through the required develop to obtain or print the document format.

Use US Legal Forms, one of the most extensive variety of legitimate types, to save lots of some time and prevent blunders. The support provides professionally made legitimate document layouts that you can use for a variety of purposes. Generate a free account on US Legal Forms and start creating your way of life easier.

Form popularity

FAQ

A deed of reconveyance is issued to borrowers once a mortgage loan has been paid in full. The document is created by the lender, is notarized, includes a legal description of the property, and is recorded in the county where the property is located.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame.

Section 404 - Right to cure a default (a) Notwithstanding the provisions of any other law, after a notice of intention to foreclose has been given pursuant to section 403 of this act, at any time at least one hour prior to the commencement of bidding at a sheriff sale or other judicial sale on a residential mortgage ...

The promissory note is paper evidence of the debt that the borrower has incurred. It outlines the amount of the loan, the interest rate to be paid, and either the date when it needs to be paid in full or the repayment schedule. ?Basically, a promissory note is a promise to pay back money.

To obtain a conditional or final commitment letter, you'll need to go through your chosen lender's mortgage preapproval process. Doing so may require you to provide documentation such as pay stubs, bank statements, and other materials that provide proof of employment and earnings.

Note or Mortgage Note: The contract a borrower signs agreeing to repay a sum of money at a specific interest rate over a particular time.

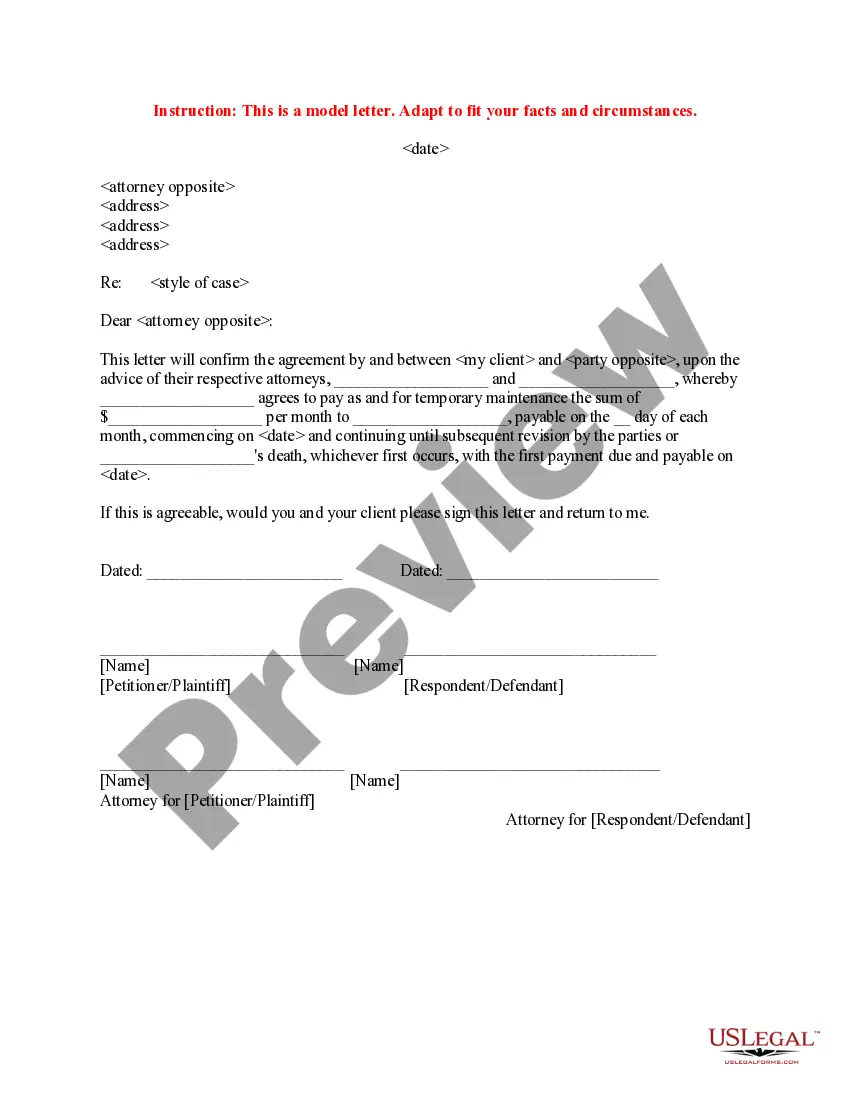

A loan commitment is an agreement by a commercial bank or other financial institution to lend a business or individual a specified sum of money. A loan commitment is useful for consumers looking to buy a home or a business planning to make a major purchase.

If you've made an offer on a home, you may wonder how long you have to wait from the appraisal to closing. If all goes well, the homebuying process ? including getting a home appraised and obtaining final financing approval from your lender ? can take about 30 to 45 days.