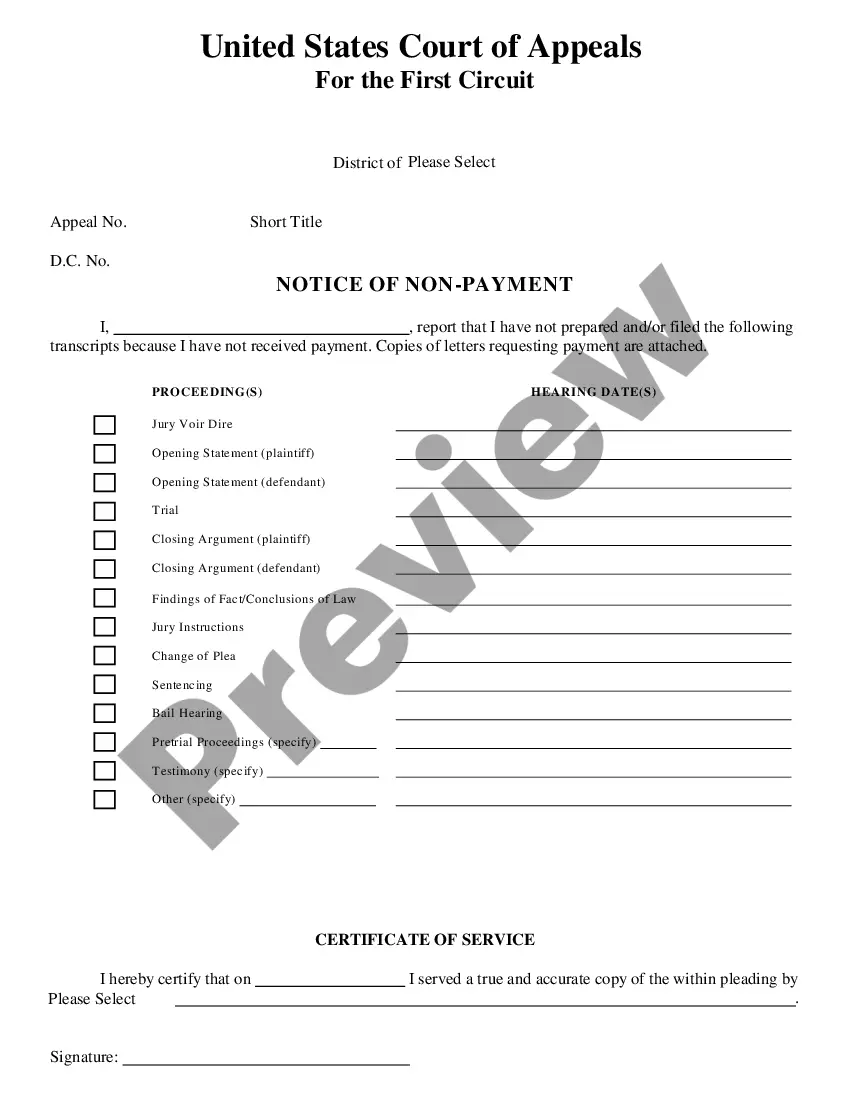

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Pennsylvania Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

Locating the appropriate legal document template can be challenging. Naturally, there are many templates accessible online, but how can you find the legal form you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Pennsylvania Notice of Default in Payment Due on Promissory Note, suitable for both business and personal purposes. All the forms are verified by experts and comply with state and federal regulations.

If you are already enrolled, Log In to your account and click the Acquire button to obtain the Pennsylvania Notice of Default in Payment Due on Promissory Note. Use your account to browse the legal forms you have previously purchased. Visit the My documents tab of your account and download another copy of the document you need.

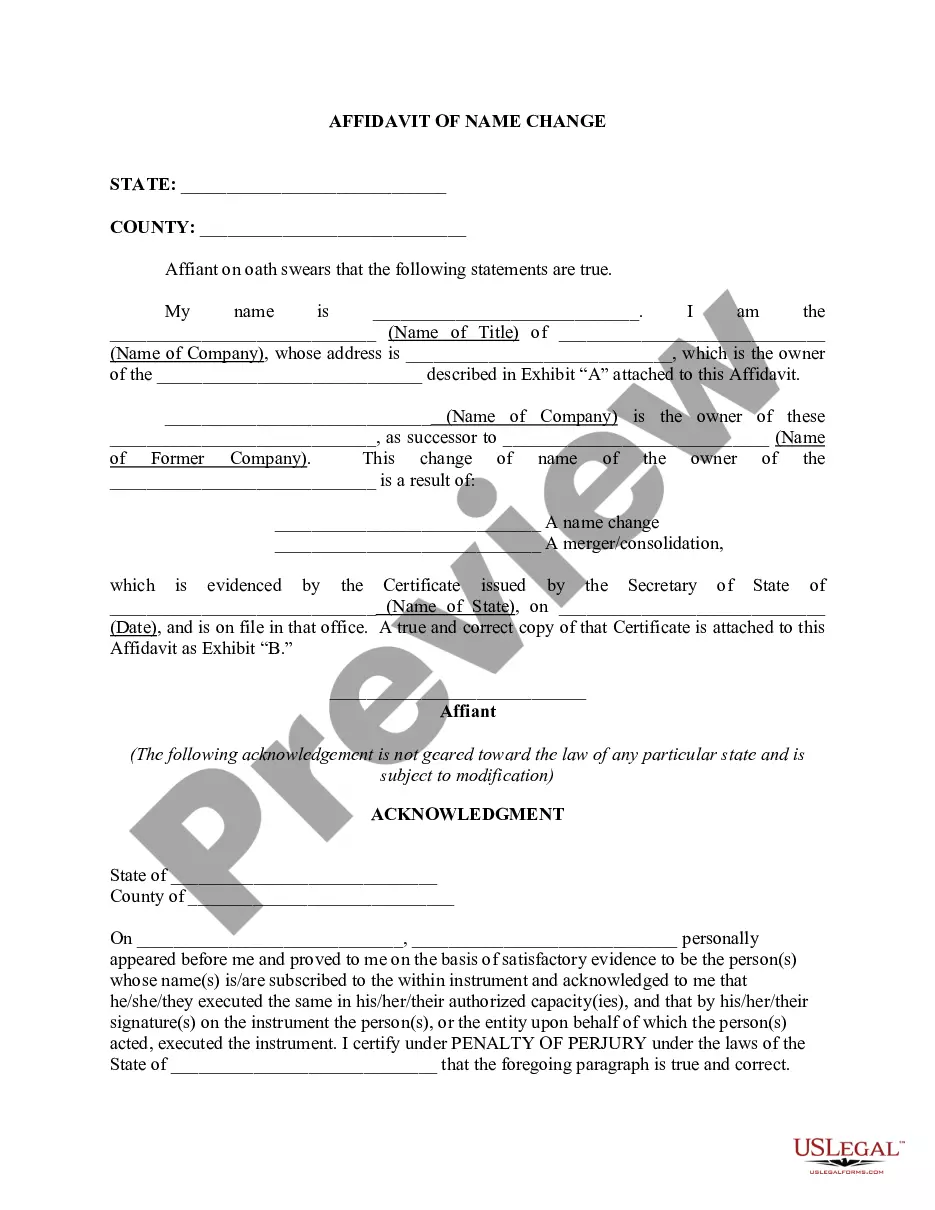

If you are a new user of US Legal Forms, here are some simple steps you should follow: First, make sure you have selected the correct form for your area/state. You can review the form using the Preview button and read the form description to ensure it is the right one for you. If the form does not meet your needs, use the Search field to find the correct form. Once you are sure that the form is suitable, click the Get now button to obtain the form. Choose the payment plan you prefer and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the format and download the legal document template to your device. Complete, edit, print, and sign the downloaded Pennsylvania Notice of Default in Payment Due on Promissory Note.

- US Legal Forms is the largest repository of legal forms where you can find numerous document templates.

- Utilize the service to download professionally created documents that meet state requirements.

Form popularity

FAQ

Yes, a handwritten promissory note is generally legal as long as it contains all necessary elements, such as the names of the borrower and lender, the amount borrowed, and the repayment terms. It is crucial to make sure that it is signed by both parties to validate the agreement. However, for clarity and professionalism, you might want to utilize a formal template from platforms like US Legal Forms. This ensures that your Pennsylvania Notice of Default in Payment Due on Promissory Note meets all legal requirements.

To write a notice of default, start by clearly indicating the parties involved, including the lender and borrower. Next, mention the specific promissory note, including the date it was signed and the amount owed. Clearly state the default issue, typically relating to missed payments, and provide a deadline for remedying the situation. If you want to ensure validity and proper format, consider using resources like US Legal Forms for guidance while crafting your Pennsylvania Notice of Default in Payment Due on Promissory Note.

If you default on a promissory note, the lender may begin collection efforts, which can include court proceedings. A Pennsylvania Notice of Default in Payment Due on Promissory Note often precedes these actions, acting as an initial step toward legal remedies. It's important to understand your options and consider solutions like restructuring payment terms or consulting with financial experts. Addressing the default early can help mitigate severe consequences.

Yes, a promissory note generally holds up in court, provided it meets legal requirements. Courts recognize these documents as binding contracts, assuming they are properly executed. If there is a dispute, a Pennsylvania Notice of Default in Payment Due on Promissory Note can serve as crucial evidence in legal proceedings. Consider legal help to ensure your rights are protected.

When a borrower defaults on a promissory note, legal repercussions can follow, including the potential for the lender to file a claim. This often leads to actions like seizing collateral or initiating a lawsuit to recover the owed amount. Consequently, a Pennsylvania Notice of Default in Payment Due on Promissory Note may be issued, indicating the seriousness of the situation. It's crucial to seek guidance to navigate this challenging process.

Defaulting on a promissory note means failing to meet the repayment terms outlined in the document. For instance, if the borrower does not make scheduled payments, they are considered in default. This situation can trigger a Pennsylvania Notice of Default in Payment Due on Promissory Note, which serves as an official warning regarding the overdue payment. You should address this matter quickly to avoid further complications.

You can find a notice of default template online, particularly through legal document services like US Legal Forms. They provide various templates tailored to your needs, including the Pennsylvania Notice of Default in Payment Due on Promissory Note. Using a professional template ensures that you include all necessary legal information. This can help you communicate the default status effectively to the borrower.

If someone defaults on a promissory note, begin by reviewing your legal options and the specific terms of the agreement. Start by issuing a notice of default, such as a Pennsylvania Notice of Default in Payment Due on Promissory Note, to formally notify the borrower. This document outlines the default and next steps. If the borrower does not respond or rectify the situation, you may need to seek legal assistance for further action.

A notice of default on a promissory note is a formal declaration that the borrower has failed to make payments as agreed in the note. This document informs the borrower of their default status and typically outlines the consequences of continued non-payment. Issuing a Pennsylvania Notice of Default in Payment Due on Promissory Note is an essential step in initiating the enforcement process. It provides the borrower with an opportunity to rectify the situation before further legal actions are taken.

Generally, defaulting on a promissory note does not result in jail time, as it is a civil matter rather than a criminal offense. However, failing to comply with court orders related to the note, such as concerning payments, could potentially lead to severe legal consequences. It is vital to handle a Pennsylvania Notice of Default in Payment Due on Promissory Note properly, as ignoring the issue can escalate the situation. Consulting with a legal expert can help you navigate these circumstances.