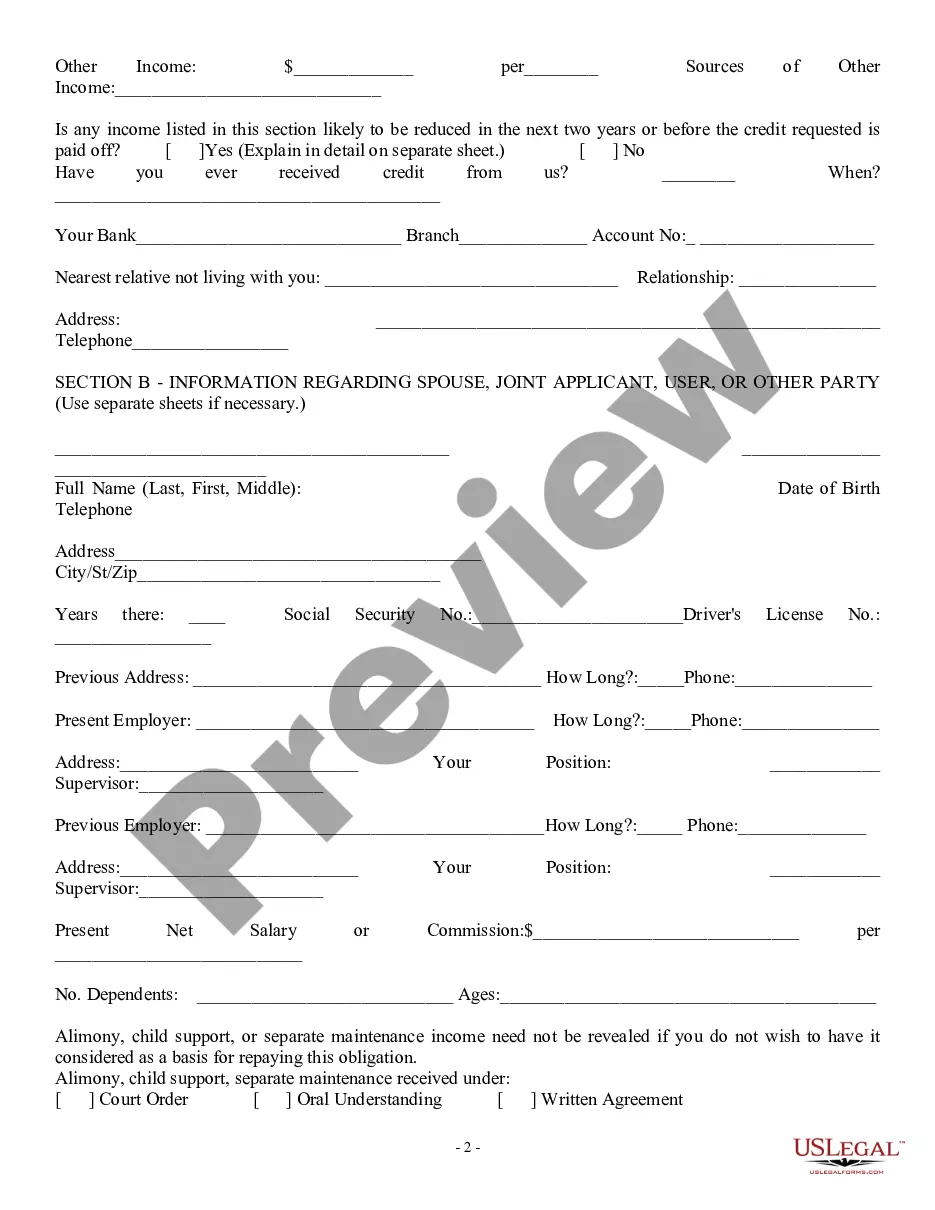

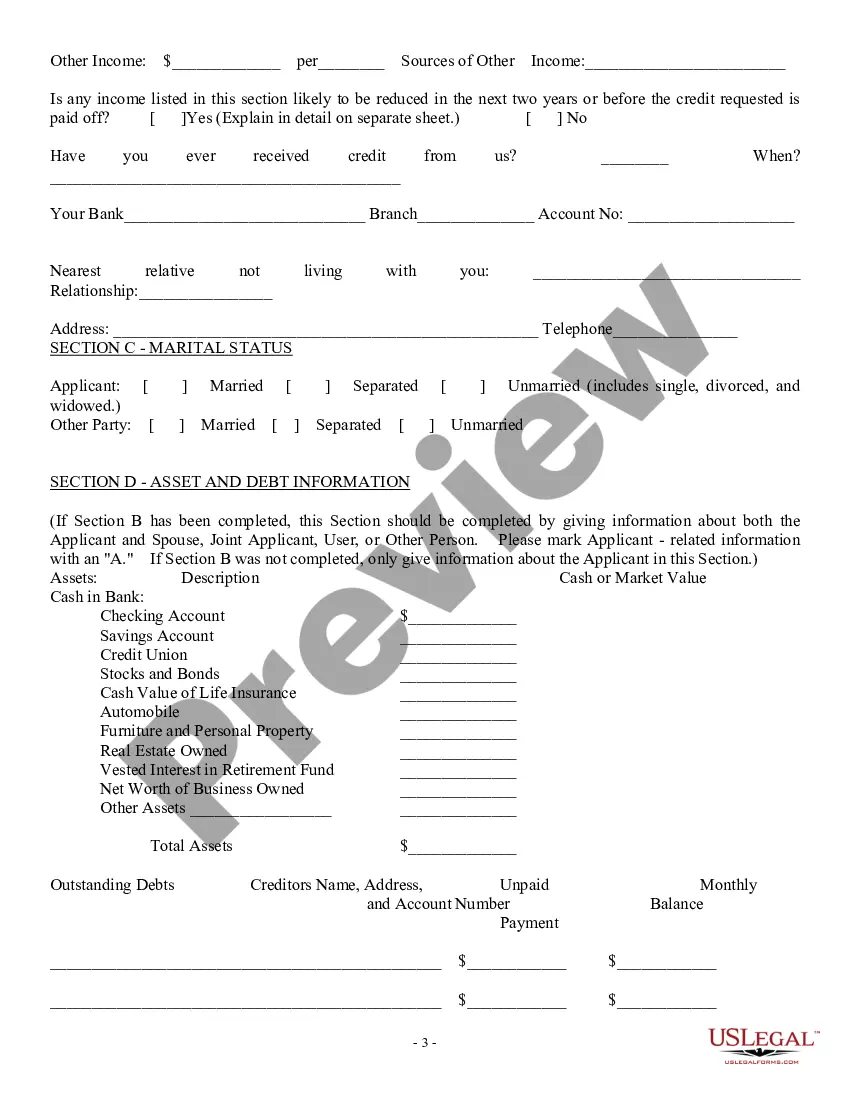

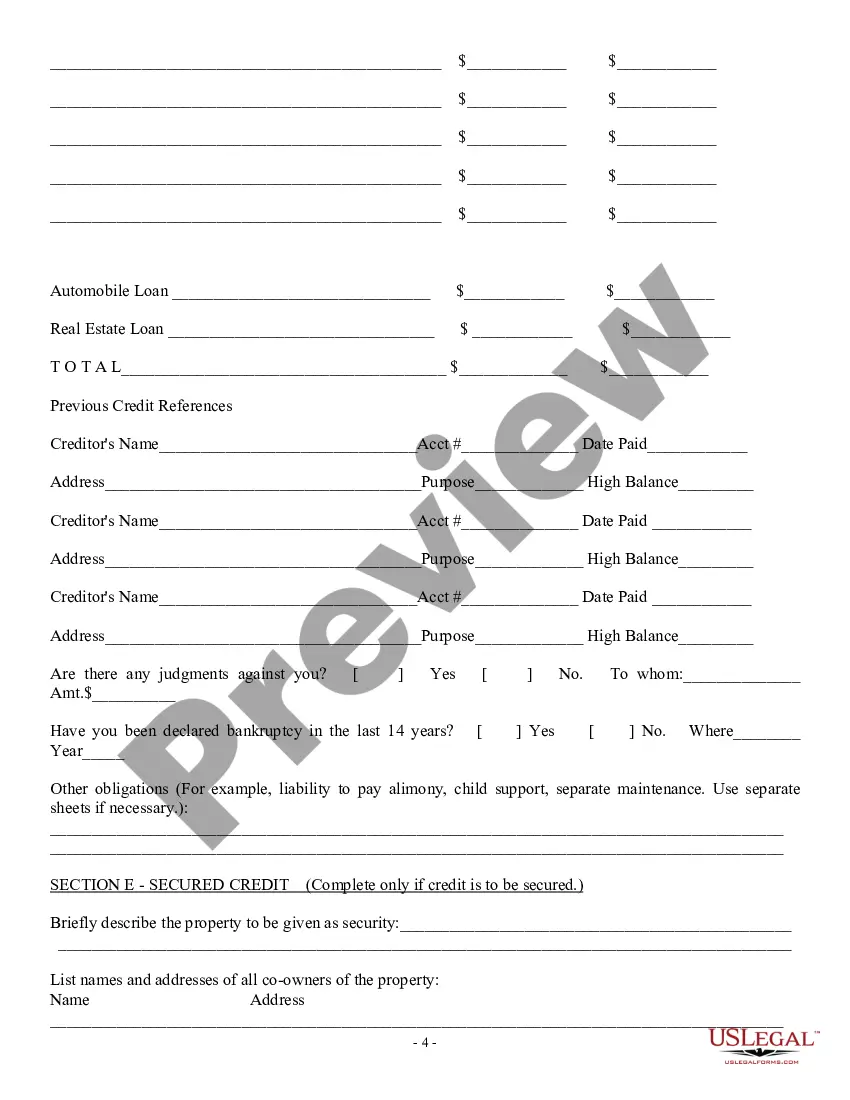

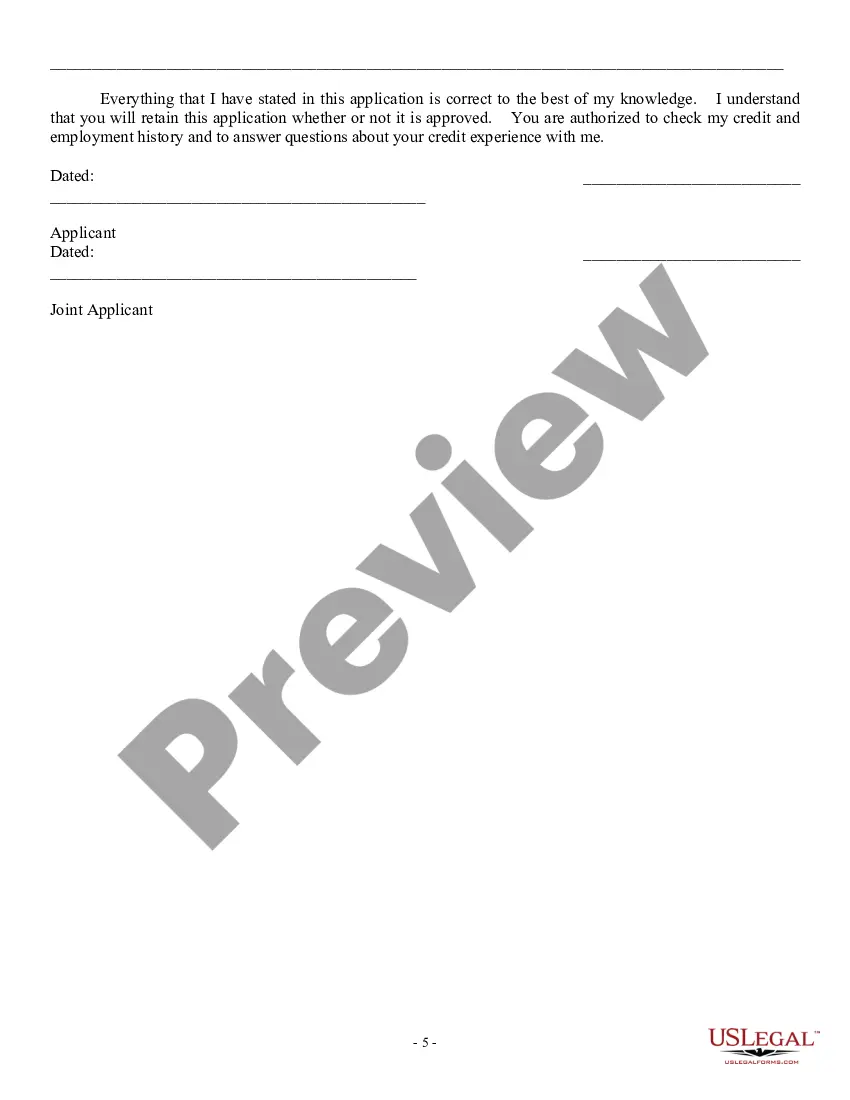

The Pennsylvania Consumer Loan Application — Personal Loan Agreement is a legal document that outlines the terms and conditions of a personal loan between a lender and a consumer residing in the state of Pennsylvania. It is an essential agreement that helps protect both parties involved in the loan transaction and ensures transparency and clarity throughout the lending process. The Pennsylvania Consumer Loan Application — Personal Loan Agreement typically includes various key components. First, it contains detailed information about the borrower, including their name, address, contact details, and other relevant personal information. It may also require the borrower to provide details regarding their employment status, income, and credit history, helping the lender assess their creditworthiness. Furthermore, the agreement outlines the terms of the loan, such as the loan amount, interest rate, repayment schedule, and any additional fees or charges associated with the loan. It is crucial for borrowers to carefully review these terms and ensure they understand their financial obligations during the repayment period. The agreement may also include provisions regarding late payment penalties, prepayment options, and default consequences. In Pennsylvania, consumer loan applications and personal loan agreements can vary depending on the lender and the type of loan being offered. Different types of loans that may require a personal loan agreement include: 1. Unsecured Personal Loans: These loans do not require collateral and are based solely on the borrower's credit history and income. The personal loan agreement for an unsecured loan would include the specific terms for repayment and any applicable interest rates. 2. Secured Personal Loans: These loans require borrowers to provide collateral, such as a vehicle or property, to secure the loan. The personal loan agreement would outline the terms of the loan, including the collateral details and the consequences of defaulting on the loan. 3. Payday Loans: These short-term loans typically require borrowers to repay the loan on their next payday. Since payday loans can have high-interest rates, the personal loan agreement would highlight the specific terms and conditions, including the total loan amount, fees, and repayment date. 4. Installment Loans: These loans allow borrowers to repay the loan amount and interest over a set period in regular installments. The personal loan agreement would outline the repayment schedule, interest rates, and any penalties for late payments or early repayments. In conclusion, the Pennsylvania Consumer Loan Application — Personal Loan Agreement is a vital document for borrowers and lenders involved in personal loan transactions. It includes essential information about the terms and conditions of the loan, ensuring that both parties are fully aware of their rights and obligations. Different types of personal loans may require specific loan agreements, tailored to their unique terms and conditions. It is crucial for borrowers to carefully review and understand the agreement before signing it to protect their financial interests.

Pennsylvania Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Pennsylvania Consumer Loan Application - Personal Loan Agreement?

If you want to full, download, or print legal document layouts, use US Legal Forms, the largest selection of legal varieties, that can be found on-line. Make use of the site`s basic and convenient search to discover the files you require. Different layouts for business and person purposes are sorted by classes and states, or search phrases. Use US Legal Forms to discover the Pennsylvania Consumer Loan Application - Personal Loan Agreement within a couple of clicks.

Should you be previously a US Legal Forms customer, log in to the bank account and click the Download button to find the Pennsylvania Consumer Loan Application - Personal Loan Agreement. Also you can gain access to varieties you previously saved in the My Forms tab of the bank account.

Should you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that proper metropolis/country.

- Step 2. Take advantage of the Preview choice to look through the form`s content material. Never neglect to read the description.

- Step 3. Should you be unsatisfied together with the type, make use of the Look for industry towards the top of the screen to get other types of your legal type design.

- Step 4. When you have discovered the form you require, select the Purchase now button. Choose the pricing strategy you prefer and include your credentials to register for an bank account.

- Step 5. Process the deal. You can use your charge card or PayPal bank account to accomplish the deal.

- Step 6. Choose the formatting of your legal type and download it on your product.

- Step 7. Complete, modify and print or sign the Pennsylvania Consumer Loan Application - Personal Loan Agreement.

Every legal document design you get is your own property permanently. You have acces to every type you saved within your acccount. Select the My Forms section and pick a type to print or download yet again.

Contend and download, and print the Pennsylvania Consumer Loan Application - Personal Loan Agreement with US Legal Forms. There are millions of expert and state-specific varieties you can use for your business or person requires.

Form popularity

FAQ

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

How to Draft a Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).

A consumer credit contract is a formal written agreement to borrow money, or pay something off over time, for personal use. You pay interest and fees for the use of the bank or finance company's money. One or more of your assets might secure the loan. Examples include: vehicle finance to buy a car, van, or boat.

In general, a personal loan contract is just as legally binding between friends or family as it would be with a bank. However, a contract between friends or family might be simpler or have fewer terms. Each agreement, though, is likely to have the same main provisions.

Here's a step-by-step on writing a simple Loan Agreement with a free Loan Agreement template. Step 1 ? Name the Parties. ... Step 2 ? Write Down the Loan Amount. ... Step 3 ? Specify Repayment Details. ... Step 4 ? Choose How the Loan Will Be Secured (Optional) ... Step 5 ? Provide a Guarantor (Optional) ... Step 6 ? Specify an Interest Rate.